BTCC Crypto Daily (7.31)|Fed Holds Rates Steady, Crypto Market Resilience Stands Out Amid Policy-Heavy Period

1.Overview

- U.S. interest rate ceiling remains unchanged at 4.25%

- U.S. employment and GDP data exceed expectations

- CryptoQuant: Institutional demand supports continued crypto market growth

2.Macro & Policy Outlook

Key Events Today

- U.S. interest rate ceiling remains unchanged at 4.50%

- Eurozone June unemployment rate to be released today (previous: 6.3%)

- U.S. Core PCE Price Index for June to be released today (previous: 2.70%)

- U.S. Initial Jobless Claims for the week ending July 26 to be released today (previous: 217,000)

- Bank of Japan keeps interest rate unchanged at 0.5%

Global Macro Developments

1.Fed Holds Rates in July, Powell Downplays September Rate Cut Expectations

The Federal Reserve announced it will maintain the federal funds rate at 4.25%-4.50%, marking the fifth consecutive pause. Board members Michelle Bowman and Christopher Waller voted against the decision, advocating for a 25 basis point rate cut—marking the first instance since 1993 where two board members opposed the decision, believed to be linked to sustained pressure from the Trump administration. Fed Chair Jerome Powell downplayed expectations for a September rate cut, stating the need to observe the inflationary impact of tariffs and affirming the current rate level as “moderately restrictive.”

2.U.S.–South Korea Trade Deal: 15% Tariff + $350 Billion Investment

President Donald Trump announced via social media that the U.S. and South Korea have reached a comprehensive trade agreement. Under the deal, South Korea will invest $350 billion in projects owned and controlled by the U.S. government and personally selected by Trump. Additionally, South Korea will purchase $100 billion worth of LNG and energy products, and will allocate additional funds for its own investment purposes to be disclosed during President Lee Jae-myung’s visit to the U.S. in two weeks. South Korea will open its market to U.S. automobiles, trucks, and agricultural products. In return, the U.S. will impose a 15% tariff on South Korean imports, while South Korean exports to the U.S. will remain tariff-free.

3.Powell: Tariff-Driven Inflation Viewed as Temporary

Fed Chair Jerome Powell stated post-FOMC meeting that the U.S. economy remains robust, though inflation slightly exceeds the target and the labor market shows signs of weakening. He noted that tariffs have increased some goods prices and, while generally considered to have a short-term inflationary impact, they may persist longer. The Core Personal Consumption Expenditures (PCE) index is expected to rise 2.7% YoY in June. While inflation has eased from 2022 levels, it remains elevated, but most long-term inflation expectations remain aligned with the Fed’s target.

4.White House Releases Digital Asset Strategy, Omits BTC Reserve Plans

The White House released a widely anticipated report outlining a national digital asset strategy aimed at establishing U.S. leadership in blockchain, crypto, and tokenized finance. While the report covered multiple policy areas, it provided no concrete update on any government plan to hold Bitcoin. It merely reiterated the executive order signed by President Trump in January without offering a timeline or further steps.

5.U.S. Employment and GDP Data Beat Estimates

U.S. ADP private-sector jobs increased by 104,000 in July, far exceeding market expectations of 76,000. The previous reading was revised from a decrease of 33,000 to 23,000. This marked the largest increase since March, driven by a rebound in services—especially leisure, hospitality, and finance. Preliminary data from the U.S. Bureau of Economic Analysis showed Q2 real GDP growing at a 3% annualized rate, well above the 2.4% forecast and rebounding strongly from Q1’s 0.5% contraction. The surge was largely due to a shrinking trade deficit from plummeting imports and moderate consumer spending growth.

6.White House Rolls Out Multiple Tariff Measures Covering Copper and Low-Value Goods

The White House announced several tariff measures:Starting August 1, a 50% universal tariff will be imposed on imported semi-finished copper products (pipes, wires, rods) and copper-intensive derivatives (cable assemblies, electrical components). Raw copper, cathode, and scrap materials are excluded.;Starting August 29, de minimis tax exemption for low-value goods (≤$800) will be suspended, requiring full duty payments;Tariffs on Brazilian imports will increase by 40%, raising the total tariff rate to 50%, with exclusions for certain goods such as energy products, pig iron, and precious metals.

Traditional Asset Correlation

- Nasdaq +0.15%, S&P 500 -0.12%, Dow Jones -0.38%

- Spot gold +0.81% at $3,301.52/oz

- WTI crude oil (USOIL) -0.44% at $69.98/barrel

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(as of July 30, 2025, 14:00 HKT)

2.Futures Capital Flow Analysis

According to Coinglass on July 31, contract trading for BTC, ETH,, XRP,BNB,SOL and DOGE recorded net outflows over the past 24 hours, suggesting potential trading opportunities.

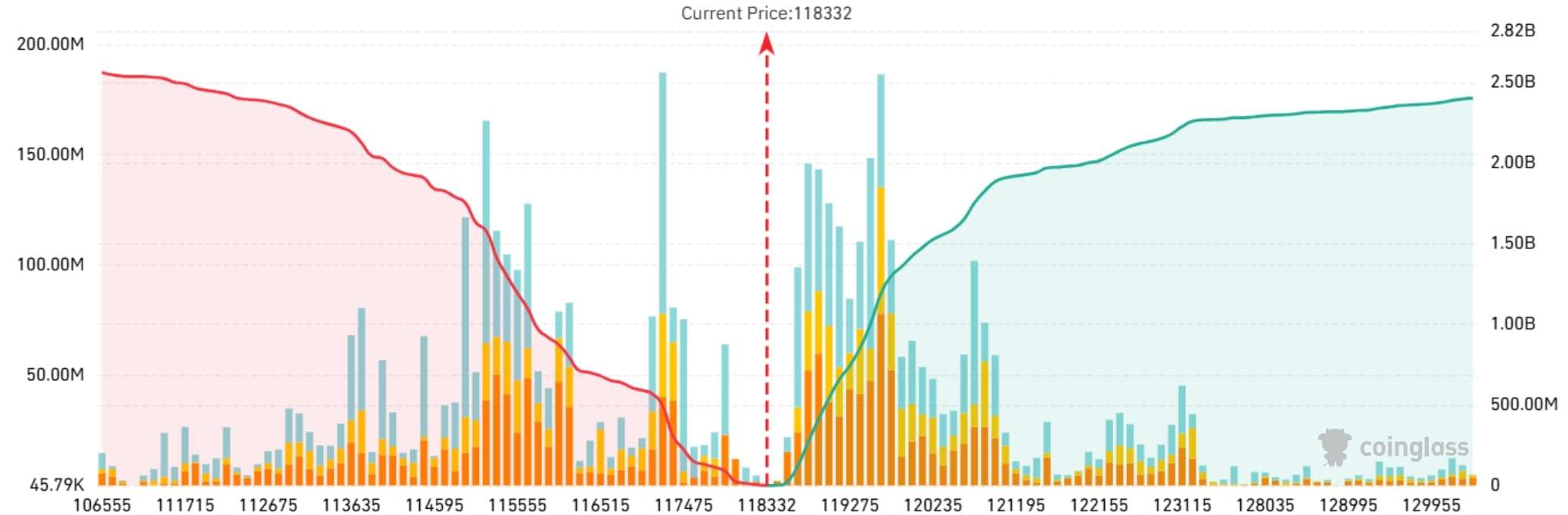

3. Bitcoin Liquidation Map

On July 31, according to data from Coinglass, based on the current price of $118,332, if Bitcoin falls below $115,000, the cumulative long liquidation volume across major centralized exchanges (CEXs) will reach $1.754 billion. Conversely, if Bitcoin breaks above $121,000, the cumulative short liquidation volume will reach $1.901 billion. It is advised to manage leverage ratios prudently to avoid triggering large-scale liquidations amid market fluctuations.

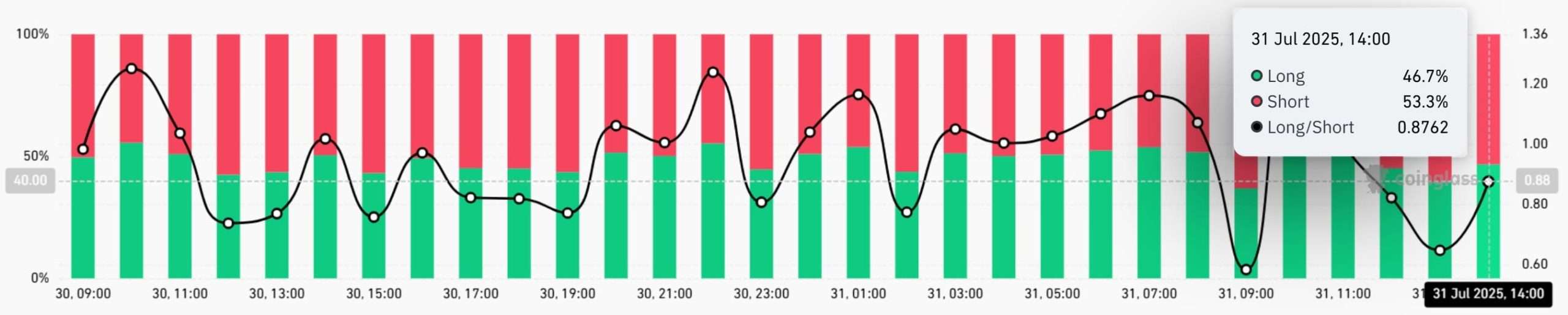

4. Bitcoin Long/Short Ratio

According to Coinglass, as of July 31 at 14:00 HKT, the long/short ratio for BTC stands at 0.7733, with 43.62% long and 56.38% short positions. Market sentiment leans cautiously bearish.

5. On-Chain Monitoring

- According to on-chain analyst @ai_9684xtpa, a newly created address 0x286…2aEa4, whose ownership remains unidentified, has been continuously accumulating ETH. Over the past six days, this address has withdrawn a total of 113,028.97 ETH. Based on an average price of $3,752, the total value is approximately $424 million, with an unrealized profit of around $12.044 million.

- According to Arkham, Ledger’s Ethereum spot ETF ETHA has purchased $375 million worth of ETH this week. ETHA currently holds ETH valued at $11.32 billion, accounting for 2.46% of the total ETH supply.

- According to Lookonchain, ‘Maji Dage’—Chinese-American singer Jeffrey Huang—has closed his PUMP long position at a loss. He still holds a 5x leveraged long position of 4.175 billion PUMP tokens (worth approximately $13.3 million), with an unrealized loss of $4.47 million.

4.Blockchain Headlines

- Ethena’s total value locked (TVL) has surged 50% over the past 30 days, reaching $8.5 billion.

- Five Satoshi-era wallets transferred BTC worth approximately $29.64 million.

- JPMorgan has partnered with Coinbase to facilitate easier cryptocurrency purchases for banking clients.

- Twenty One Capital is considering offering USD loans backed by Bitcoin collateral.

- The White House has proposed legislation requiring U.S. taxpayers to report and pay taxes on overseas crypto accounts.

- Whale addresses holding between 10,000 and 100,000 BTC have accumulated a total of 218,500 BTC since the end of March.

- Analysis: Bitcoin may rally toward $125,000 based on short-term holder cost basis.

- Bloomberg analysts: Only a dozen or so crypto assets meet the SEC’s standard listing criteria for crypto ETPs.

- The Ether Machine has acquired nearly 15,000 ETH, with $407 million in purchasing power remaining.

- USDC Treasury burned 60 million USDC on the Ethereum network.

- Cboe BZX and NYSE Arca have submitted proposals to the SEC to streamline the approval process for crypto ETFs.

- The widow of renowned U.S. country singer George Jones fell victim to an XRP scam, losing up to $17 million.

- The @crypto username on Telegram received a $25 million buyout offer, with its value surging 70-fold over two years.

- Bitwise executive: Crypto treasury companies help reshape Ethereum’s narrative and attract traditional capital.

5.Institutional Insights · Daily Picks

- Greeks.Live: Market sentiment remains divided, with traders debating whether the recent decline is a buying opportunity or the start of a deeper correction.

- Glassnode: The ratio of unrealized profits to Bitcoin market capitalization has exceeded the +2 standard deviation range. Historically, this level often corresponds to periods of market euphoria, indicating rising potential selling pressure.

- CryptoQuant: Large holders have locked in significant profits over the past year, but institutional demand continues to support market growth, with strong new capital inflows driving token demand

6.BTCC Exclusive Market Analysis

As of 14:00 HKT on July 31, Bitcoin was priced at $118,332, showing a mildly bullish consolidation pattern on the 1-hour chart. After repeatedly contesting the Bollinger Bands middle band ($117,853.88), the price recently tested the upper band ($118,992.70). Following the announcement of the Federal Reserve’s July interest rate decision, the candlestick briefly dipped to the lower Bollinger Band ($116,729) before swiftly rebounding. As the market digested the signal of “no rate change,” the candlestick gradually shifted upward, with bulls attempting to break the range equilibrium and a potential breakout energy forming beneath the volatility center.

From a technical perspective, the MACD fast and slow lines maintained a golden cross. The red histogram bars briefly contracted after the decision and then expanded slightly, indicating bulls are gathering momentum within the consolidation. RSI remains in a mildly bullish neutral range and has not deviated from normal despite short-term fluctuations, reflecting market participants’ wait-and-see stance toward a range breakout. The Bollinger Bands upper and lower limits are tightly constraining the short-term range. A breakout above the upper band would reinforce rebound expectations, while a breakdown below the lower band would raise correction risks.

In terms of strategy, short-term traders should closely watch the post-decision consolidation range: if the price breaks above the upper Bollinger Band ($118,992) and stabilizes, consider light long positions with a stop loss below the middle band ($117,853); if the price falls below the middle band, consider light short positions with a stop loss near the upper band. Position sizing should be strictly limited to within 30%.

Medium-term traders should focus on the resistance at $119,500 and support at $117,000, and determine breakout direction based on upcoming event catalysts. Current strategy favors buying low and selling high within the range, while remaining alert to extreme volatility triggered by policy and data interactions.

The Federal Reserve maintained its interest rate unchanged, downplaying expectations of a rate cut in September. Strong employment and GDP data supported market confidence. Meanwhile, the United States and South Korea reached a trade agreement and implemented new tariff policies. As key data points are released, the crypto market is gradually recovering amid global economic uncertainties. Overall market sentiment appears bullish, with Bitcoin and Ethereum showing firm support following the data release, potentially offering more risk appetite for investors.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]