BTCC Crypto Daily (8.4) | France Plans to Mine Bitcoin with Nuclear Power? BTC ETF Sees First Weekly Outflow After 7 Weeks of Inflows

1.Overview

- French right-wing party “Rassemblement National” proposes bill to support nuclear-powered Bitcoin mining

- Probability of a 25bps Fed rate cut in September rises to 89.1%

- Bitcoin spot ETFs saw a net outflow of $643 million last week, ending a seven-week streak of net inflows

2.Macro & Policy Outlook

Key Events Today

- Eurozone August Sentix Investor Confidence Index (previous: 4.5)

- U.S. June Factory Orders MoM (previous: 8.2%)

Global Macro Developments

1.Trump Raises $274 Million Ahead of Midterm Elections

According to Bloomberg (Aug 4), Donald Trump raised $236 million in political funds during H1 2025, including donations from Elon Musk, Jeff Yass, and crypto industry players. Documents submitted to the FEC show Trump holds $274 million in cash, which can be used to support GOP candidates in the midterms. Trump also hinted at nominating a new Fed governor in the coming days.

2.South Korea’s Major Banks Accelerate Crypto Business Deployment

Shinhan, Woori, and KB Kookmin Bank have formed dedicated digital asset task forces. Woori Bank has created a 9-member team focused on stablecoin and digital wallet services. KB Financial Group has launched a steering committee to coordinate among subsidiaries. Regional banks like KEB Hana and Busan Bank have also started blockchain research projects. The National Assembly is reviewing reform bills to allow financial institutions to issue stablecoins. To date, 81 stablecoin trademarks have been filed.

3.USTR: New Tariffs on Multiple Countries “Largely Finalized”

U.S. Trade Representative Grier said President Trump’s newly announced tariffs on imports are “largely finalized,” including 35% on Canadian goods, 50% on Brazilian imports, 25% on Indian goods, and 39% on Swiss imports. Grier noted that the tariffs reflect bilateral trade surpluses and deficits and are unlikely to change in the current negotiations.

4.French Party Proposes Bill to Support Nuclear-Powered BTC Mining

According to Le Monde, the right-wing Rassemblement National party plans to propose a bill using surplus nuclear power for BTC mining. MP Aurélien Lopez-Liguori began drafting in July. The bill aims to deploy high-performance computing equipment at EDF nuclear power plants to perform complex blockchain calculations and earn newly minted Bitcoin as rewards.

5.Hassett Denies Interest in BLS Role, Trump Seeks New Fed Chair

Following the dismissal of BLS Director Erika McEntarfer due to disappointing jobs data, William Wiatrowski was appointed acting director. NEC Director Hassett said he has no intention of leading the BLS, despite the weak labor report, and emphasized that the economy remains “on track.” He also confirmed Trump is working with Treasury Secretary Besant on selecting the next Fed Chair.

6.Probability of Fed Rate Cut in September Hits 89.1%

According to CME “FedWatch”:10.9% chance of no rate change in September;89.1% chance of 25bps rate cut;October: 3.4% chance of no change, 35.6% chance of cumulative 25bps cut, and 60.9% for 50bps cut

Traditional Asset Correlation

- U.S. equity markets closed for the weekend; index updates unavailable

- Spot gold fell 0.3% to $3,354/oz;WTI crude oil (USOIL) rose 0.01% to $67.22/barrel

3.Crypto Market Snapshot

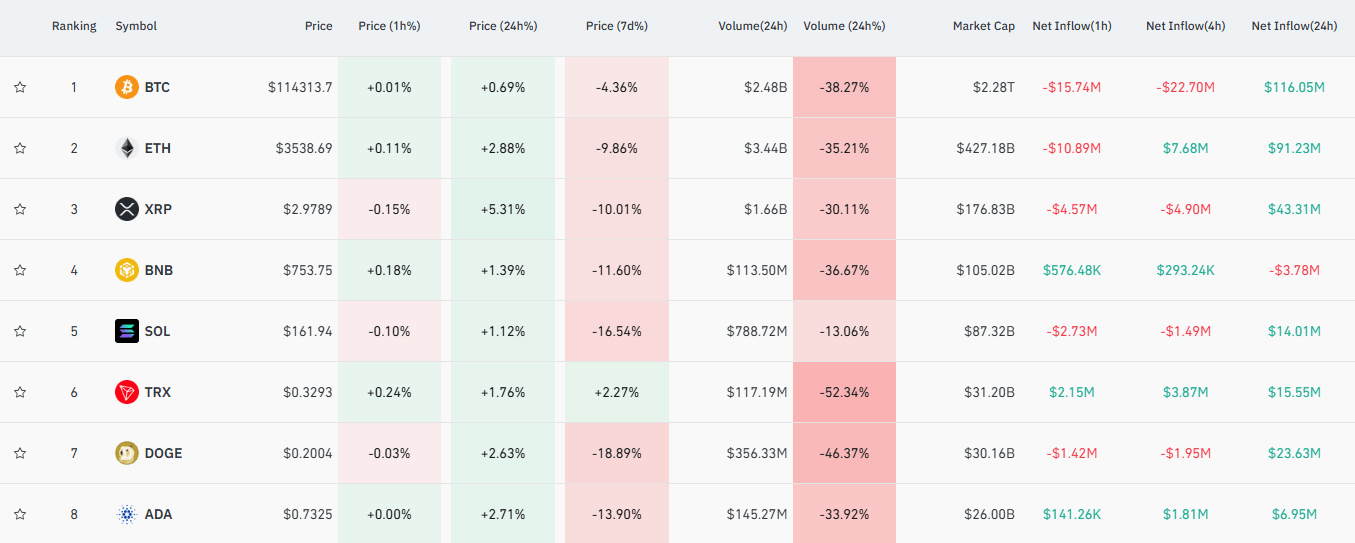

1. Spot Performance of Major Cryptocurrencies

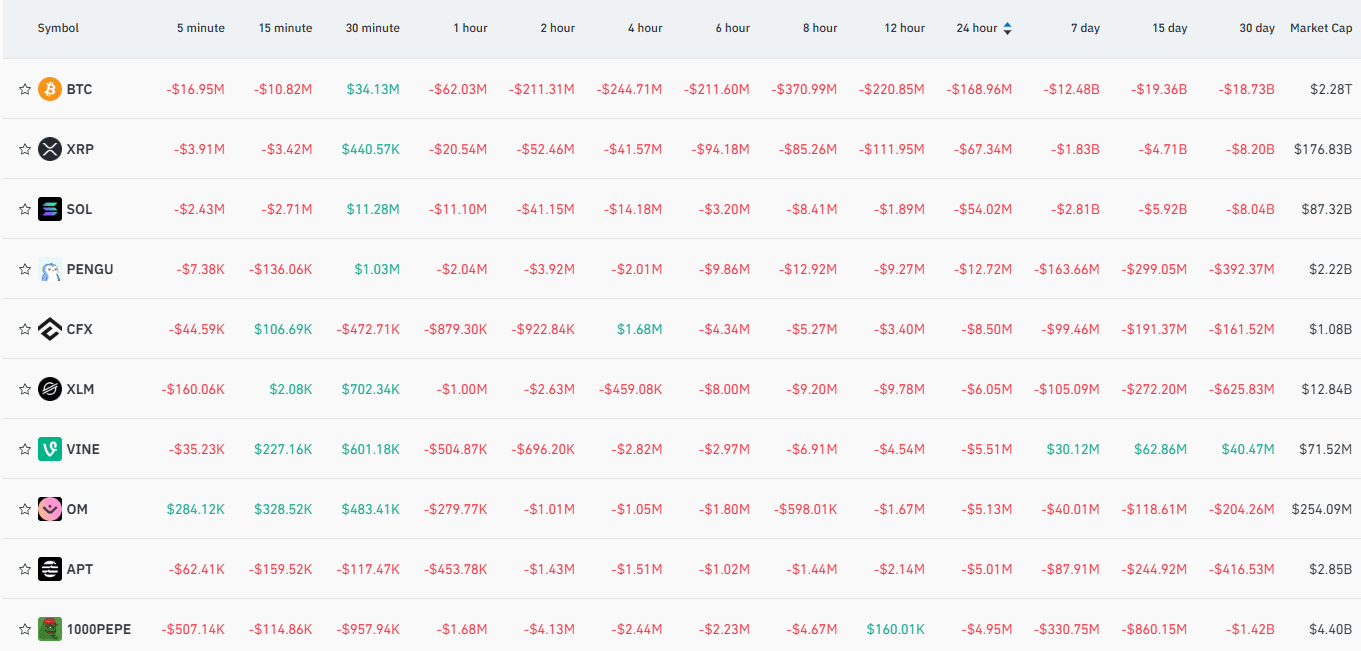

2.Futures Capital Flow Analysis

According to Coinglass (Aug 4), BTC, XRP, SOL, PENGU, and CFX saw the largest net outflows in derivatives trading over the past 24 hours, indicating potential trading opportunities.

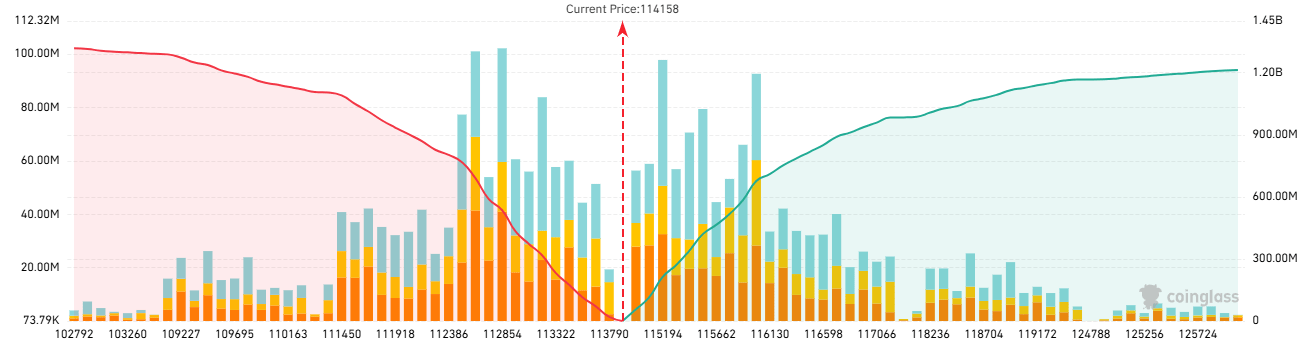

3. Bitcoin Liquidation Map

As per Coinglass (Aug 4), if BTC drops below $112,000, total long liquidations on major CEXs could reach $902 million. Conversely, a breakout above $116,000 could trigger $676 million in short liquidations. Traders are advised to manage leverage carefully to avoid mass liquidation during volatility.

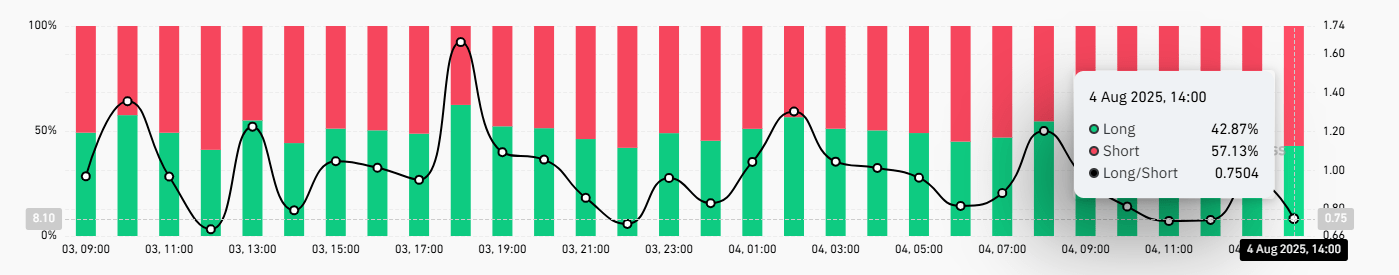

4. Bitcoin Long/Short Ratio

As of 14:00 HKT on Aug 4, Coinglass data shows the BTC long/short ratio at 0.7504, with longs accounting for 42.87% and shorts at 57.13%.

5. On-Chain Monitoring

- According to Lookonchain, whale address 0xab15 added to long BTC positions, holding 752 BTC ($86 million) with $774,000 in unrealized gains. The new take-profit target is set at $120,000.

- @mlmabc estimates Paradigm holds 19,134,900.46 HYPE tokens (~$765.4 million) at an average cost of $16.46, for a total cost of ~$315 million and unrealized gain of ~$450 million.

4.Blockchain Headlines

- Linea-based DEX Etherex to launch native token REX on Aug 6

- Whale AguilaTrades suffers $12,000 floating loss on 40x BTC long, total loss ~$40 million

- Large token unlocks coming for ENA, IMX, MOVE; ENA unlock valued at ~$95.8 million

- JD.com & Ant Group may not be in Hong Kong’s initial list of stablecoin license applicants

- Michael Saylor: BTC is a short-term trading asset, long-term treasury reserve

- SEC v. Ripple: Legal experts say SEC must file response by Aug 15, 2025

- Lido co-founder Vasiliy Shapovalov to downsize contributor team, ~15% layoffs

- Capital B to raise ~€11.5 million for Bitcoin reserve strategy

- Public firm The Smarter Web Company raises £8.1 million with BTC holdings

- H100 Group plans to raise ~$2.2 million to buy more BTC

- Suiscan: AI project DeAgentAI is fastest-growing Infra project on Sui in last 30 days

- Former UK Finance Minister: UK is falling behind in crypto sector

- SlowMist: APT37 hacker group embedded malware in JPEG images

- Ethereum spot ETFs saw $154 million net inflow last week, 12th consecutive week

- Bitcoin spot ETFs had $643 million net outflow, ending 7-week inflow streak

- USDe market cap rises to $9.293 billion, up 75%+ over past month

- Cardano community approves “IOE roadmap” proposal

5.Institutional Insights · Daily Picks

- NYDIG Research: SEC’s approval of higher position limits on BTC ETF options may reduce BTC volatility and boost spot demand

- Ripple, CB Insights & UK CBT joint report: Digital assets are going mainstream; since 2020, traditional banks have invested over $100 billion in blockchain infrastructure

6.BTCC Exclusive Market Analysis

As of August 4, BTC trades at $114,654. BTC found support near the lower Bollinger Band and rebounded technically from oversold levels on the 4-hour chart, now testing the MA20. Although MACD lines remain in a bearish crossover, the histogram is expanding, and momentum is turning positive. CCI has recovered from oversold territory, suggesting selling pressure has eased short-term.

If BTC breaks above and stabilizes above MA20 and $116,000 mid-band, a short-term second-leg rally structure may form. Otherwise, if it fails to hold and drops below $114,000, a return to the downtrend is likely—watch for deeper downside risk.

The 89.1% probability of a Fed rate cut in September appears priced in, but recession concerns persist. Trump’s $274 million in campaign cash and the pending Fed governor nomination add uncertainty to monetary policy. Meanwhile, South Korea and France continue to push forward with legislation supporting stablecoins, blockchain, and mining, signaling long-term positive sentiment.

If BTC breaks and holds above $116,000, small long positions can target the $119,500 resistance zone. If it falls back below $114,000, stop-losses should be triggered to guard against further downside. With the new round of tariffs set to take effect on Aug 7, short-term market sentiment may remain unstable. Defensive positioning is advised, with trend-following entries delayed until after key data validation.

Risk Warning: The above content is for informational purposes only and does not constitute investment advice. Please exercise caution and conduct your own risk management when trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download