BTCC Crypto Daily (8.1)|Trump Postpones Reciprocal Tariffs, SEC Launches Crypto Regulatory Reform, Market Sentiment Remains Cautious

Why Trust BTCC

1.Overview

- Trump delays “reciprocal tariffs” to August 7

- SEC Chair announces launch of crypto regulatory reform

- AguilaTrades’ $400M BTC long position got liquidated

2.Macro & Policy Outlook

Key Events Today

- U.S. July seasonally adjusted nonfarm payrolls (in 10,000s) to be released today, prior: 14.7

- U.S. July unemployment rate to be released today, prior: 4.10%

Global Macro Developments

1.Trump signs executive order for 10%–41% “reciprocal tariffs,” delays enforcement to August 7

U.S. President Donald Trump signed an executive order to impose “reciprocal tariffs” ranging from 10% to 41% on imports from 67 trade partners. Originally set to take effect on August 1, the implementation was postponed to August 7 to allow further negotiation efforts. The tariff rates vary by country and region: Syria is subject to 41%, Myanmar and Laos 40%, Brazil and the UK 10% (lowest), Japan and South Korea 15%, and Vietnam 20%. In addition, goods from EU countries currently subject to tariffs below 15% will be adjusted to 15%, while unspecified countries will face a unified 10% tariff. Goods in transit will be subject to a 40% transit duty. Trump called the action a “historic” deal and highlighted the significance of the “Trump Round negotiations.”

2.SEC Chair Paul Atkins launches “Project Crypto” to integrate crypto and traditional finance

SEC Chair Paul Atkins announced the launch of “Project Crypto” at the “U.S. Leads the Digital Financial Revolution” summit, aiming to shift the securities market from an off-chain to an on-chain environment. He instructed SEC staff to revise outdated regulations to unlock the potential of blockchain technology. Emphasizing that the U.S. must lead the global digital asset revolution, Atkins called for “clear and concise rules” governing the issuance, trading, and custody of crypto assets, while reducing bureaucratic hurdles to encourage innovation.Atkins further stated that most crypto assets are not securities and urged the SEC to establish a tailored disclosure framework for non-security crypto assets. He also pledged to work with the White House’s Crypto Task Force to implement reform recommendations. He described the initiative as “a new beginning for the SEC,” with the goal of making the U.S. the safest market in the world for digital asset investment.

3.Trump: U.S.–Mexico tariff agreement extended by 90 days

On July 31, Trump announced via social media that he had spoken with the Mexican President and agreed to extend the tariff agreement for 90 days. During this period, Mexico will continue to pay a 25% fentanyl tariff, a 25% auto tariff, and a 50% steel tariff, while removing several non-tariff barriers. The two countries will aim to sign a formal trade agreement within the 90-day window and continue cooperation on border security.

4.South Korea to release virtual asset lending guidelines in August

On July 31, the Financial Services Commission (FSC) and the Financial Supervisory Service (FSS) of South Korea formed a joint task force with the Digital Asset Exchange Association (DAXA) and five crypto exchanges. The goal is to develop “virtual asset lending service guidelines,” expected to be released in August. The guidelines will cover regulations on leverage usage, eligible user groups, allowable lending assets, and risk disclosures. Regulators also asked exchanges to re-evaluate services that may pose legal or investor loss risks.

5.Trump criticizes Powell again: “He cost America trillions”

President Trump once again slammed Federal Reserve Chair Jerome Powell, referring to him as “Mr. Too Late” and stating that Powell made another mistake and is unfit to lead the Fed. Trump accused Powell of causing “trillions of dollars” in losses to the U.S., and also ridiculed the ongoing Fed building renovation as the “most incompetent and corrupt” project in architectural history. This comes after the Fed announced it would keep rates unchanged following its July FOMC meeting, with Powell’s comments dampening expectations for a September rate cut.

6.Fed rate cut probability for September drops to 41.3%

According to CME’s FedWatch tool, the probability of the Fed keeping rates unchanged in September stands at 60.8%, while the likelihood of a 25bps rate cut has declined to 39.2%. For October, the probability of no change is 38.7%, a 25bps cut is 47.0%, and a 50bps cut is 14.2%.

Traditional Asset Correlation

- Nasdaq -0.03%, S&P 500 -0.37%, Dow Jones -0.74%

- Spot gold +0.19%, at $3,296.48 per ounce

- WTI crude (USOIL) +0.10%, at $69.42 per barrel

3.Crypto Market Snapshot

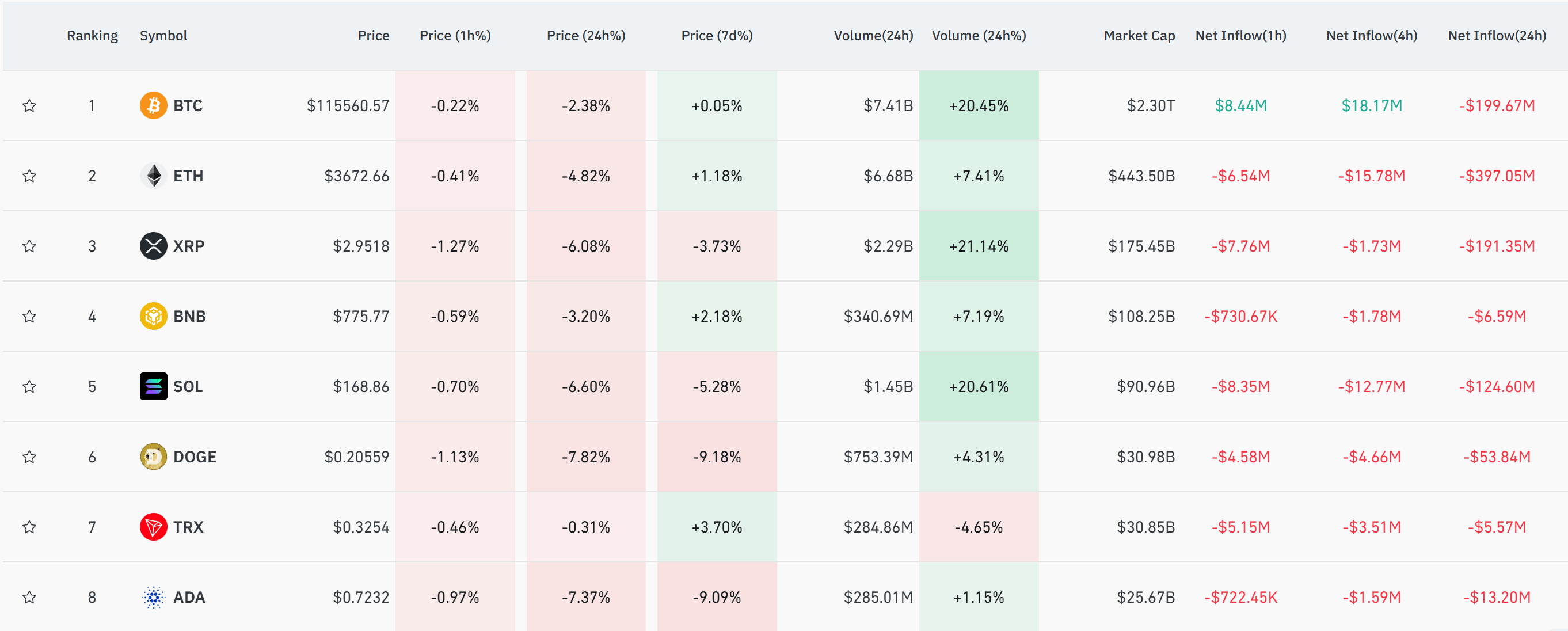

1. Spot Performance of Major Cryptocurrencies

(as of August 1, 2025, 14:00 HKT)

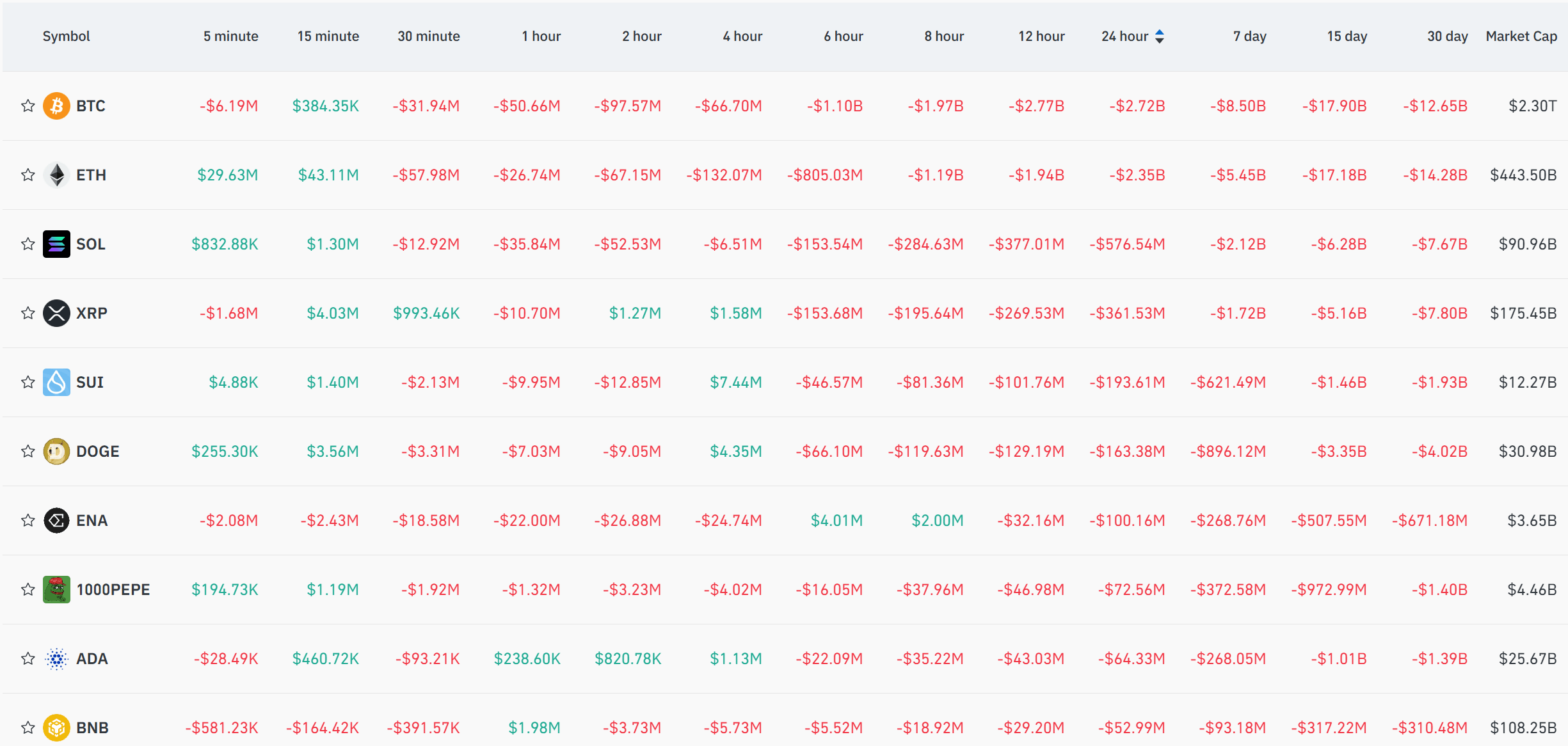

2.Futures Capital Flow Analysis

According to Coinglass on August 1, over the past 24 hours, futures capital net outflows were recorded in BTC, ETH, SOL, XRP, SUI, DOGE, and other major tokens. This may signal potential trading opportunities.

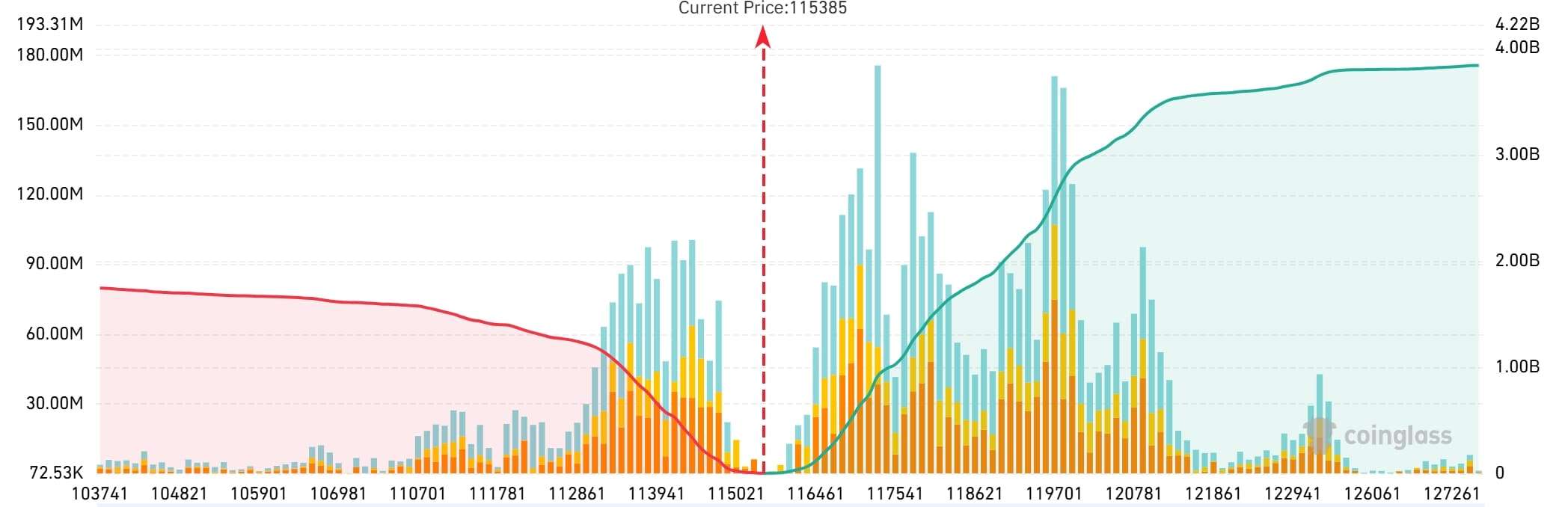

3. Bitcoin Liquidation Map

As per Coinglass data on August 1, with the current BTC price at $115,385, a drop below $113,000 could trigger cumulative long liquidations totaling $1.221 billion across major centralized exchanges (CEXs). Conversely, if BTC breaks above $119,000, cumulative short liquidations could reach $2.063 billion. Traders are advised to manage leverage carefully to avoid mass liquidation during market swings.

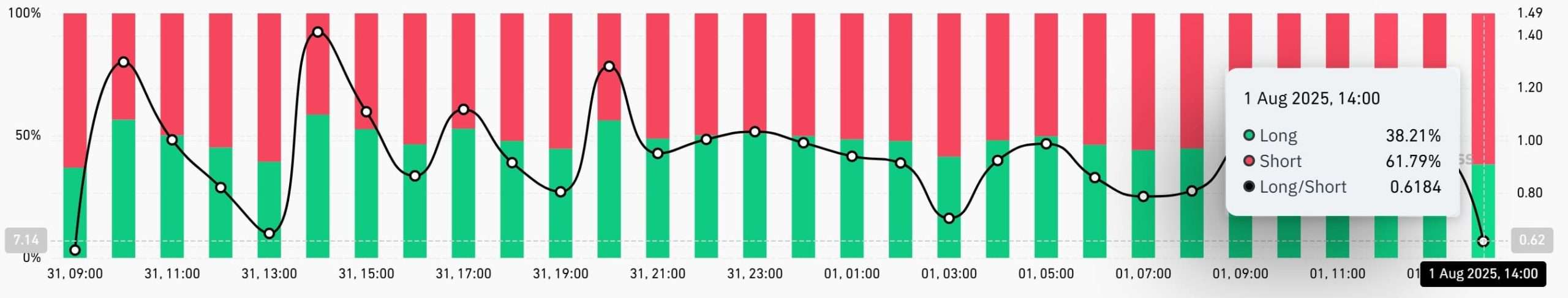

4. Bitcoin Long/Short Ratio

As of 14:00 HKT on August 1, Coinglass data shows the BTC long/short ratio across all exchanges at 0.6184, with long positions at 38.21% and short positions at 61.79%.

5. On-Chain Monitoring

- According to Onchain lens, the whale trader AguilaTrades, holding a 40x leveraged BTC long position, faced another round of partial liquidation, incurring a $2.78 million loss. Their total losses now stand at $39.8 million, with only $200,000 of the original $40.05 million USDC remaining.

- On-chain analyst @ai_9684xtpa reported that a 14.5-year dormant crypto whale holding 3,963 BTC has sold another 180 BTC (approx. $21.25 million). Over the past week, the address has reportedly offloaded 330 BTC ($29.57 million) at a cost basis as low as $0.37.

- According to @EmberCN, a whale/institution that sold 113,600 ETH in July for a $73.96 million profit re-entered the market during the recent downturn, buying 20,000 ETH ($74.06 million). They now hold 40,000 ETH at an average entry of $3,121.

4.Blockchain Headlines

- Riot Platforms’ Q2 report shows Bitcoin mining costs nearly doubled YoY

- Crypto hacks in July 2025 caused losses exceeding $142 million

- July saw record monthly net inflows into U.S. Ethereum spot ETFs; Bitcoin spot ETFs saw the third-highest monthly inflows in history

- Bitcoin’s historical average return in August: 1.75%; Ethereum: 5.5%

- ETH treasury reserves across 64 entities now exceed $10 billion

- Hong Kong’s “Stablecoin Ordinance” takes effect today; Citi estimates local stablecoin market to reach $16 billion

- Ethereum Foundation releases “lean Ethereum” 10-year vision focusing on performance and security

- Coinbase posts $1.43 billion net income in Q2, beating last year’s figure, but trading revenue falls 39% QoQ

- Over 780,000 “Torch” NFTs minted for Ethereum’s 10th anniversary event

- Ethereum spot ETFs see 20 consecutive days of net inflows; Bitcoin spot ETFs turn negative for the first time in 5 days

- The Ether Machine becomes the third-largest ETH holder, surpassing the Ethereum Foundation

- AguilaTrades’ $400M BTC long liquidation results in total realized losses of $40M

- Several ETF issuers file S-1 amendments for SOL spot ETFs to advance listing process

- Bitcoin whales have accumulated 1% of total circulating supply over the past 4 months

5.Institutional Insights · Daily Picks

- CryptoQuant: At the end of July, Bitcoin experienced its third major wave of profit-taking. The main sellers above $120,000 appear to be newly entered whales.

- SharpLink: Since launching its ETH treasury strategy, the firm’s “ETH concentration” (amount of ETH per 1,000 shares) has risen from approximately 2 to 3.4—a 70% increase.

- Bernstein: The current crypto bull cycle is still in its early stage. Trading platforms are likely to benefit from rising trading volumes and broader mainstream adoption.

6.BTCC Exclusive Market Analysis

As of 14:00 HKT on August 1, Bitcoin is quoted at $115,385, showing signs of a downward breakout on the hourly chart. After breaching the lower band of the Bollinger Bands, the price attempted a brief rebound but failed to reclaim key support, with the candlestick body continuing to move lower. Technically, the MACD lines have formed a bearish crossover, with growing red histogram bars; CCI has entered the oversold zone, indicating that selling pressure has been heavily released in the short term—but this also implies potential for a technical rebound.

The postponement of Trump’s “reciprocal tariffs” to August 7 signals that global trade tensions will persist, and tonight’s U.S. nonfarm payroll data may serve as a key factor in determining whether the Fed begins a rate-cutting cycle. Overall, policy and macroeconomic uncertainties continue to exert complex influence on the crypto market. In the short term, it’s advisable to control positions and leverage to avoid excessive exposure to volatility. From a mid- to long-term perspective, investors may consider scaling into positions during market corrections—while closely monitoring how macro trends impact risk assets.

Short-term traders can watch for potential oversold rebounds. If BTC recovers above $115,700, a small long position may be considered, with stop-loss set at the Bollinger lower band ($114,909). If the price continues to fall below that level, it’s safer to stay sidelined until signs of stabilization emerge.

Mid-term traders should closely monitor the $114K–$117K range. A breakout from this zone could justify initiating a trend-following position. Strict position and leverage control is advised to guard against extreme volatility.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download