BTCC Crypto Daily (8.5)|White House Considers Executive Order to Back Crypto Firms; Fed Rate Cut Odds Hit 94%

Why Trust BTCC

1.Overview

- The White House is preparing an executive order to penalize banks that discriminate against crypto firms

- Market odds for a Fed rate cut in September rise to 94.4%

- Forbes: Crypto equity IPO season likely to begin in the coming months

2.Macro & Policy Outlook

Key Events Today

- U.S. July ISM Non-Manufacturing Index to be released today (prior: 50.8)

- U.S. June import and export data due today

- Donald Trump to appear on CNBC for a live interview today

Global Macro Developments

1.White House Prepares Executive Order Targeting Anti-Crypto Bank Bias

According to The Wall Street Journal, the White House is planning to increase pressure on major banks accused of discriminating against conservatives and crypto firms. A draft executive order would direct regulators to investigate whether financial institutions have violated the Equal Credit Opportunity Act, antitrust laws, or consumer protection regulations when terminating client relationships for political reasons.

2.U.S. SEC: Certain Stablecoins May Be Treated as Cash Equivalents

The U.S. Securities and Exchange Commission (SEC) has issued updated staff guidance on crypto accounting. Stablecoins pegged to the U.S. dollar with guaranteed redemption rights may now be classified as cash equivalents if their value is anchored to other assets.

3.India Responds to Trump Tariff Threats: Will Protect National Interests

In response to Donald Trump’s call for steep tariffs on India and U.S.-EU criticism over India’s oil trade with Russia, Indian Foreign Ministry spokesman Randhir Jaiswal stated that the accusations are unfair. He emphasized that India will take necessary actions to safeguard national economic security. He also noted that India’s Russian oil imports are a necessity due to global supply disruptions.

4.Fed’s Mary Daly: Rate Cuts Approaching, Likely More Than Twice This Year

San Francisco Fed President Mary Daly said that signs of a weakening labor market and fading tariff-driven inflation indicate that a rate cut is nearing. While not guaranteed in September, policy adjustments could occur at any meeting. She stated that two 25 bps cuts remain appropriate, with a higher likelihood if labor conditions worsen and inflation remains tame.

5.CME FedWatch Tool: September Rate Cut Odds Surge to 94.4%

CME’s FedWatch Tool shows a 94.4% probability that the Fed will cut rates by 25 bps in September, and only a 5.6% chance of holding steady. For October, the market prices in a 67.6% chance of a cumulative 50 bps cut and a 30.8% chance of a 25 bps cut.

Traditional Asset Correlation

- Nasdaq +1.95%, S&P 500+1.47%, Dow Jones+1.34%

- Spot gold: -0.15% at $3,368.36/oz

- WTI crude oil: +0.12% at $66.33/barrel

3.Crypto Market Snapshot

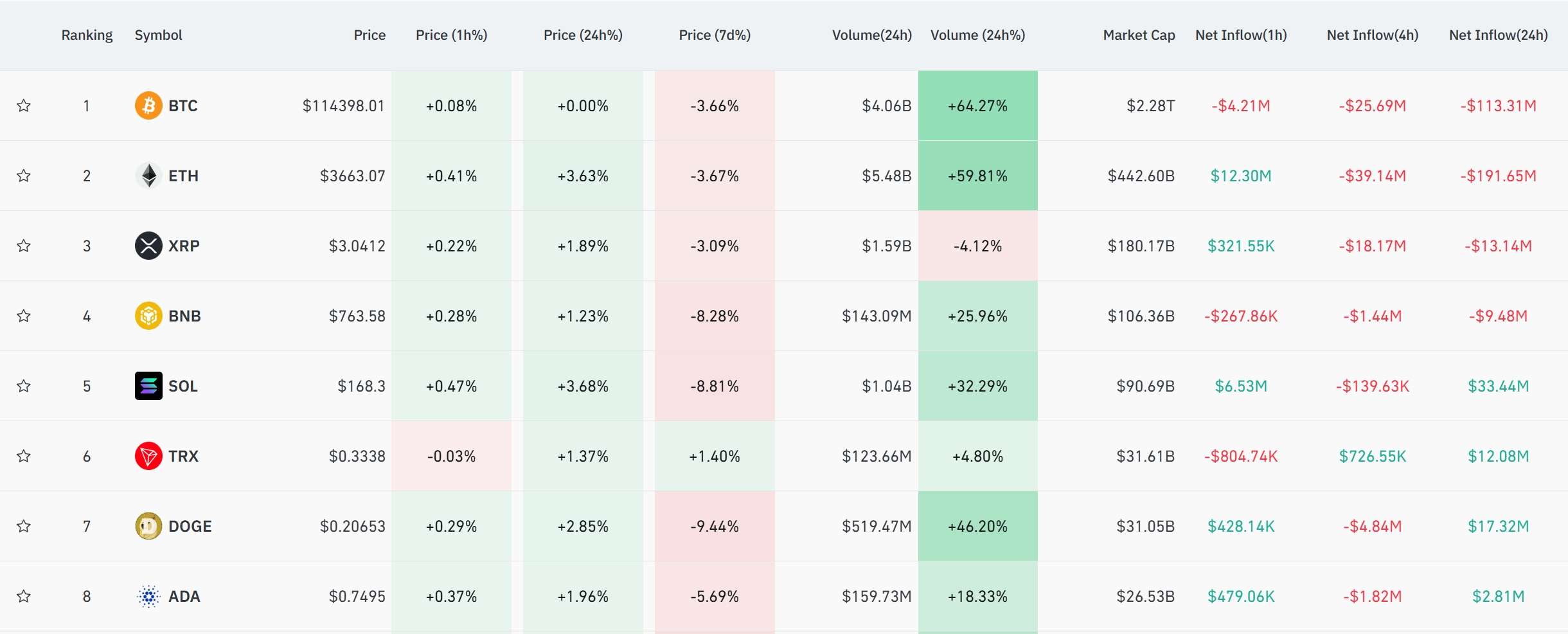

1. Spot Performance of Major Cryptocurrencies

(as of August 5, 2025, 14:00 HKT)

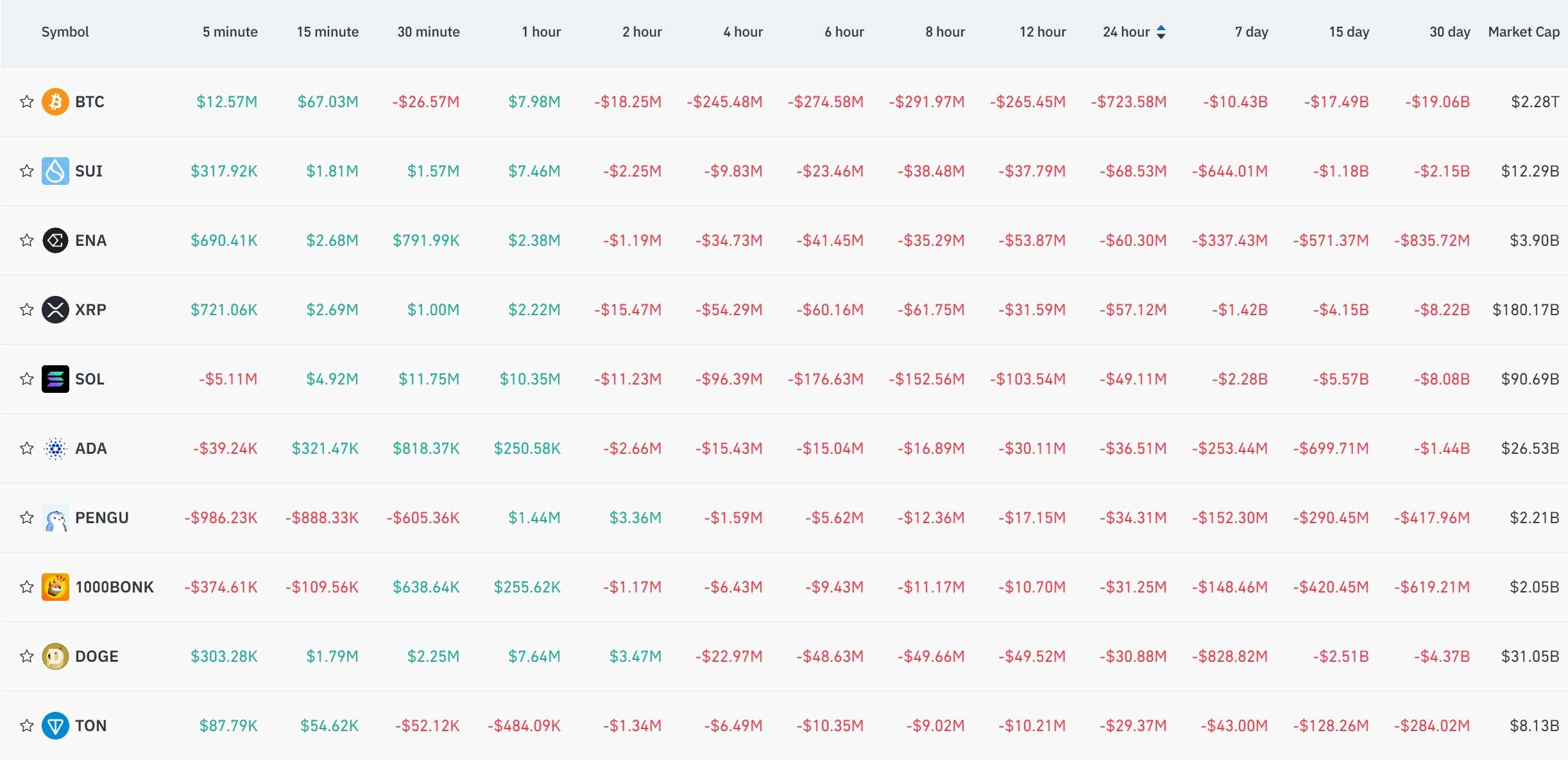

2.Futures Capital Flow Analysis

According to Coinglass data on August 5, BTC, SUI, ENA, XRP, and SOL led in net futures outflows over the past 24 hours, suggesting potential trading opportunities.

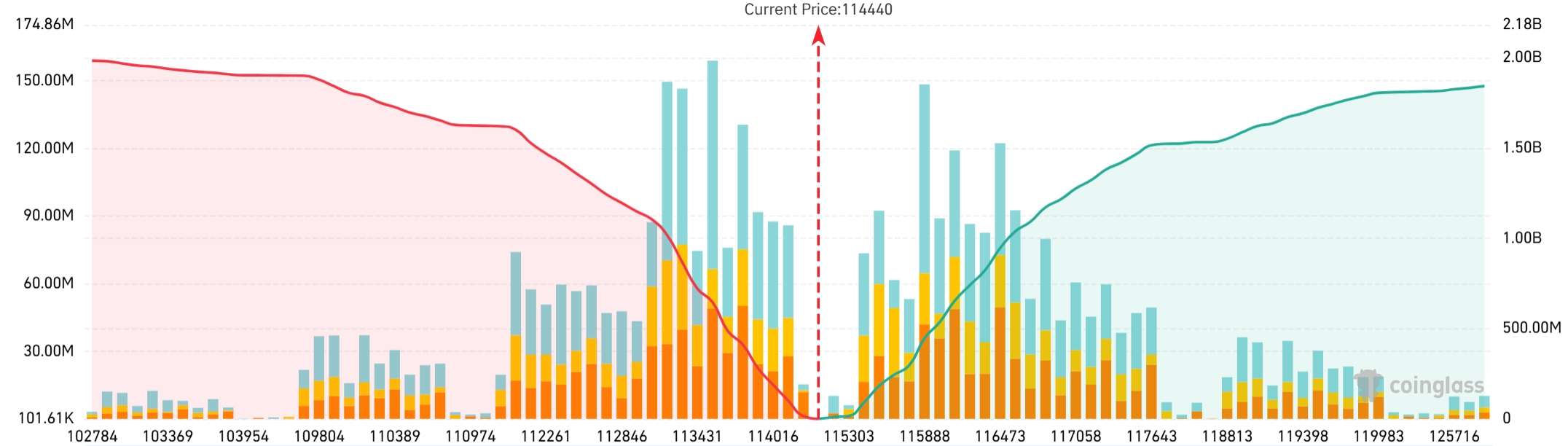

3. Bitcoin Liquidation Map

As per Coinglass, if BTC drops below $112,000, long liquidations on major CEXs could total $1.611 billion. Conversely, a breakout above $117,000 could trigger $1.264 billion in short liquidations. Traders are advised to manage leverage prudently.

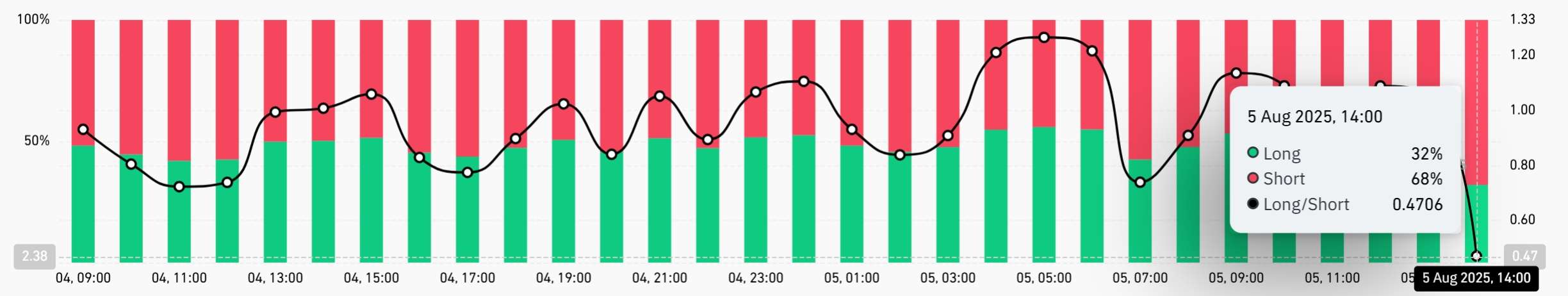

4. Bitcoin Long/Short Ratio

As of 14:00 HKT on August 5, Coinglass data shows a BTC long/short ratio of 0.4706, with 32% long vs. 68% short positions.

5. On-Chain Monitoring

- Lookonchain: A smart money wallet bought 27.86 million TROLL tokens at $22,800 three and a half months ago. After realizing $16.2K profit on 1.28 million tokens sold, the address still holds $2.48M worth of tokens—an approximate 109x gain.

- EmberCN: A whale with a 75% win rate shorting ETH across four trades faced liquidations as ETH rebounded. The wallet now holds 30,000 ETH shorts. After injecting $3.32M in USDC margin, the whale reopened 27,000 ETH shorts (worth $100M) at an entry price of $3,637 and a liquidation price of $3,828.

4.Blockchain Headlines

- FinCEN warns financial institutions about crypto ATM-related criminal activity

- CFTC considers allowing certain registered futures exchanges to trade crypto spot markets

- Philippines SEC flags 10 exchanges violating new digital asset regulations

- Ethereum network rebounded in July, with monthly volume nearing $240B

- Bitcoin volatility in July dropped to its lowest in over a year

- Ethereum spot ETFs saw a record $465M net outflow yesterday

- Bitcoin spot ETF volatility has declined sharply, now less than 2x that of gold

- Mode Network’s TVL has dropped 99% from its May 2024 peak

- Pump.fun to announce major updates for “organic community tokens” this week

- Phantom acquires Solana-based meme coin platform Solsniper

- Solana begins selling Seeker mobile devices in over 50 countries

- Coinbase and PayPal continue stablecoin rewards despite GENIUS Act ban

- JD CoinChain preparing for a stablecoin license application

- Chaos Labs warns Aave’s $4.7B Ethena exposure could cause a liquidity crunch

- Billionaire Adam Weitsman buys 5,000+ NFTs from Yuga Labs

- Thomas Lee: ETH remains a key macro trend over the next 10–15 years

- Grayscale founder Barry Silbert returns as board chairman

- British IT man who lost a hard drive with 8,000 BTC plans to tokenize it into Ceiniog Coin (INI)

5.Institutional Insights · Daily Picks

- LD Capital: The world’s largest economies are building crypto reserves; those that don’t risk being left behind. A national-level race to adopt Bitcoin and other mainstream cryptocurrencies is expected.

- Forbes: A successful Circle IPO could inspire hesitant players. A wave of crypto equity IPOs is expected in coming months, with capital likely flowing into native crypto projects rather than meme coins.

- 10x Research: BTC could reach $142,000 by end-2025. With $206B already flowing in this year, an additional $140B could follow at the current pace.

6.BTCC Exclusive Market Analysis

As of 14:00 on August 5, Bitcoin trades at $114,440. On the 1H chart, BTC shows a range-bound consolidation pattern. Price fluctuates around the Bollinger Bands’ middle band, with support at the lower band. K-line range is narrowing; MAs are entangled, signaling a tight battle between bulls and bears. MACD lines are tightly aligned at the bottom, with bearish momentum fading. CCI has exited deep oversold territory, indicating potential short-term recovery.

On the macro side, a White House executive order against banking discrimination could be bullish for crypto. The SEC classifying some stablecoins as cash equivalents supports integration with TradFi. Fed’s Daly signals rate cuts are nearing, and CME shows 94% odds of a September cut—raising expectations for liquidity easing. However, Trump’s tariff threats and India’s defiant response add geopolitical risks.

BTC faces a tug-of-war between policy optimism and risk aversion.

In the short term, watch the $114,000–$114,770 range. A breakout above MA20 may justify light long positions, with stop-loss at lower support. If BTC breaks below $114K, wait and see.

Mid-term, watch the $113,000–$115,000 support range. Adjust strategies based on the implementation of White House policies and the Fed’s rate decisions to avoid extreme volatility.

Recommended Campaigns on BTCC

Earn USDT Through Demo Trading

Get 100,000 USDT in virtual trading funds instantly – completely free! Test your trading strategies with zero risk and no barriers to entry. Turn your demo trading profits into rewards – earn up to 35 USDT in actual trading capital.

How to Join

On the BTCC app and go to the demo trading section. Tap the “…” icon at the top right corner, then tap “Task Center” to find out more about the details.

Risk Disclaimer: The above content is for informational purposes only and does not constitute investment advice. Please assess your risk tolerance before trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download