BTCC Crypto Daily (8.6)|Trump’s Interview Triggers Policy Storm Again, Eased Crypto Regulations May Spark a Rally

Why Trust BTCC

1.Overview

- Trump to announce tariffs on pharmaceuticals and chips next week, up to 250%

- U.S. CFTC proposes allowing futures exchanges to offer spot crypto trading

- White House crypto report suggests taxing Bitcoin mining gains upon sale

2.Macro & Policy Outlook

Key Events Today

- Eurozone June retail sales YoY to be released today, previous: 1.8%

- U.S. EIA crude oil inventories (weekly ending August 1) to be released today, previous: 7.698 million barrels

Global Macro Developments

1.Trump signals multiple policy shifts in CNBC interview

During a live interview on CNBC’s “Squawk Box,” President Donald Trump released several policy signals: a sharp tariff hike on India will be announced within 24 hours; tariffs on pharmaceuticals and chips will be introduced next week, reaching up to 250%; criticized Powell for cutting rates too late and may soon name a new Fed Chair, mentioning candidates like Waller and Hassett; claimed labor statistics are politicized and manipulated; expressed interest in running for president again, but might not; said J.D. Vance is the most likely next presidential candidate.

2.SEC guidance: Liquid staking falls outside securities regulations

The U.S. Securities and Exchange Commission (SEC) clarified in its latest guidance that “liquid staking activities” related to protocol staking do not constitute securities offerings or sales. Participants are not required to register with the SEC or meet exemption requirements. This applies especially to staking via software protocols or service providers. Liquid staking entities possibly not subject to securities law include Lido, Marinade Finance, JitoSOL, and Stakewise.

3.Trump to appoint new Fed Governor this week

President Trump said he will decide this week on the replacement for outgoing Fed Governor Adriana Kugler. Kugler will resign before her term ends in January 2026, giving Trump an earlier opportunity to install a rate-cut-supporting ally at the Fed. His appointee may become a contender to succeed Jerome Powell when his term ends in May next year and could align with the Trump administration’s monetary policy stance

4.Digital asset reserve firms now hold $93 billion in BTC

Galaxy Research reported that digital asset reserve firms currently hold $93 billion in Bitcoin, accounting for nearly 4% of total circulating supply. ETH holdings reached $4.1 billion (1%). Newly added assets on balance sheets include SOL, XRP, BNB, and other emerging tokens. Strategy leads with $71.8 billion in BTC holdings.

5.Japan’s tariff negotiator arrives in the U.S. to push for auto tariff reduction

Ryosei Akazawa, Japan’s Minister for Economic Revitalization, arrived in Washington on Tuesday evening to urge U.S. officials to implement the agreement on reducing tariffs on Japanese cars and auto parts. Two weeks ago, Akazawa reached a trade deal with President Trump, who promised to lower reciprocal tariffs on Japanese goods from 25% to 15%, and to reduce auto tariffs in exchange for Japanese investment commitments. However, the Trump administration has yet to specify when the reduced tariffs will take effect.

6.CFTC proposes allowing futures exchanges to offer spot crypto trading

The U.S. Commodity Futures Trading Commission (CFTC) is considering allowing registered futures exchanges to list spot crypto assets for trading. The agency is seeking stakeholder feedback to support Trump’s digital asset policy goals. The Acting CFTC Chair called for clarity around spot crypto listing rules on regulated exchanges. This is the first response to the Trump administration’s Digital Asset Market Task Force report and part of the SEC’s “Project Crypto.”

Traditional Asset Correlation

- Nasdaq +1.95%, S&P 500+1.47%, Dow Jones+1.34%

- Spot gold: -0.15% at $3,368.36/oz

- WTI crude oil: +0.12% at $66.33/barrel

3.Crypto Market Snapshot

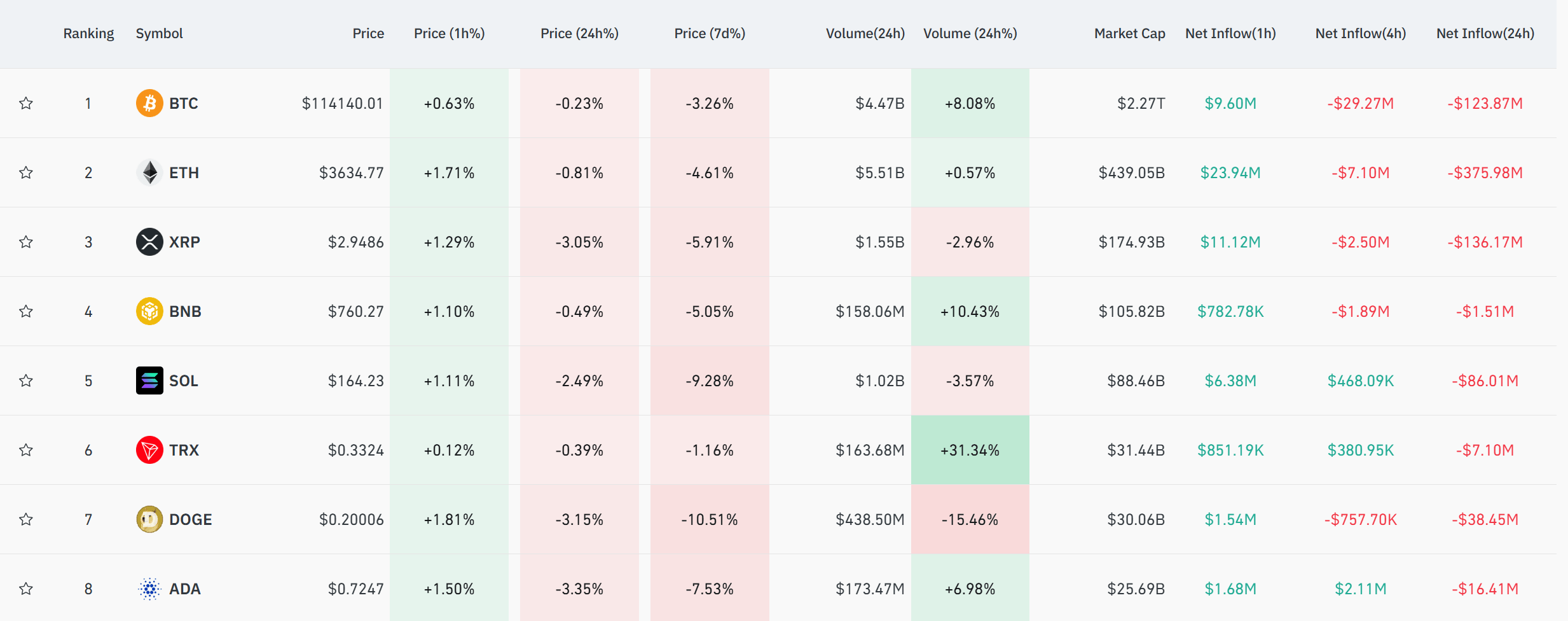

1. Spot Performance of Major Cryptocurrencies

(as of August 6, 2025, 14:00 HKT)

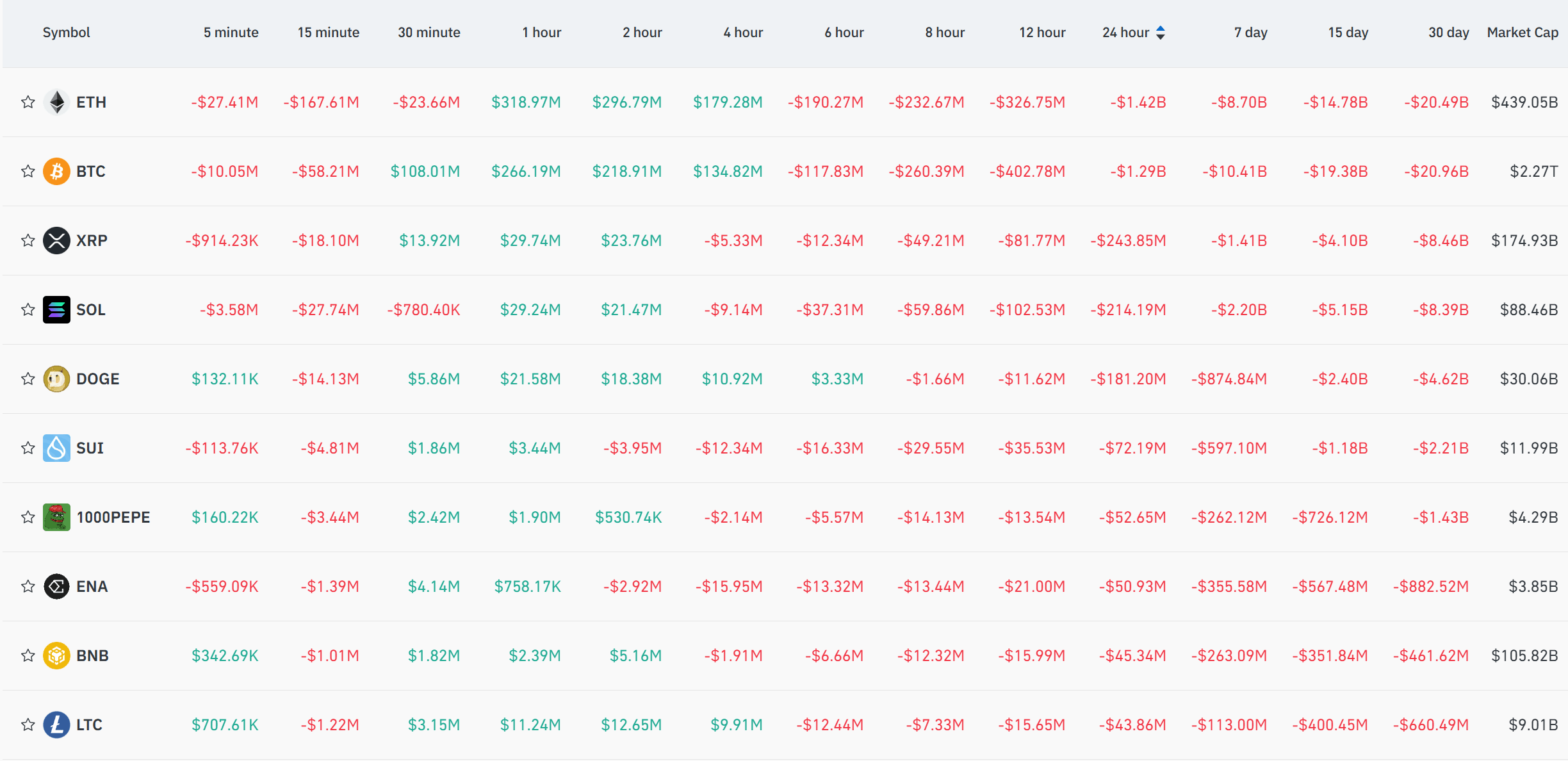

2.Futures Capital Flow Analysis

As of August 6, Coinglass data shows net outflows in futures trading for ETH, BTC, XRP, SOL, DOGE, etc., over the past 24 hours, potentially indicating trading opportunities.

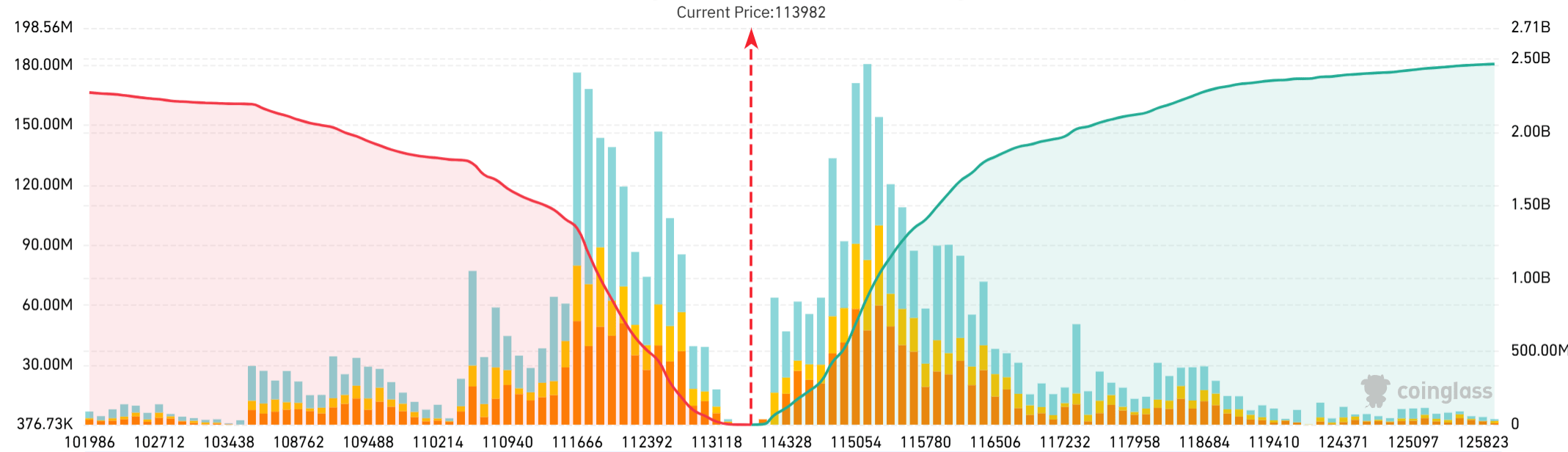

3. Bitcoin Liquidation Map

According to Coinglass on August 6, if BTC falls below $110,000 from the current price of $113,982, total long liquidations on major CEXs could reach $1.846 billion. Conversely, a breakout above $117,000 could trigger $1.953 billion in short liquidations. Leverage control is advised to avoid large-scale liquidations during price swings.

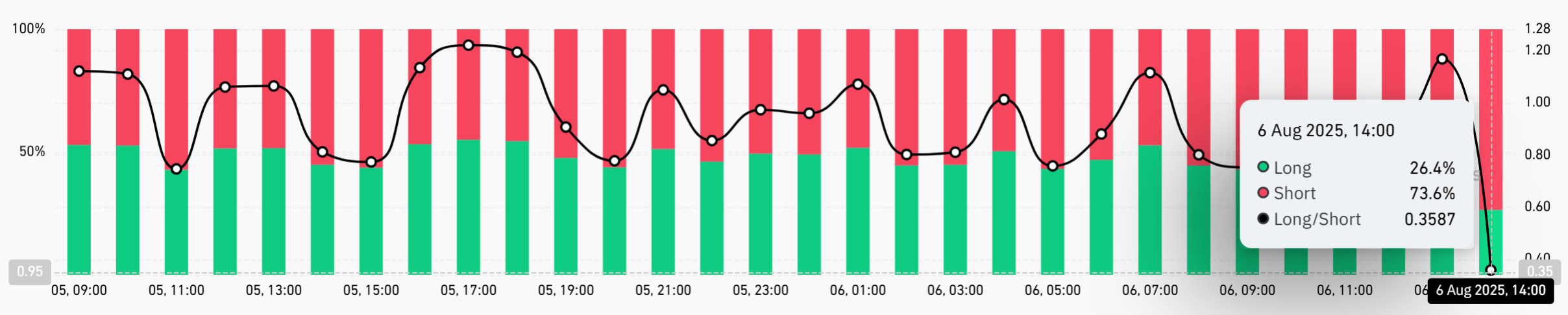

4. Bitcoin Long/Short Ratio

As of August 6, 14:00 HKT, Coinglass reports a BTC long/short ratio of 0.3587, with 26.4% long and 73.6% short.

5. On-Chain Monitoring

- According to analyst @EmberCN, a whale known for “ETH 4 Battles, 75% Win Rate” continued adding to short ETH positions, now holding 70,000 ETH shorts worth approx. $252 million, with 15x leverage, entry at $3,618, and liquidation at $3,686.

- Analyst @EmberCN also reported that insider whale @qwatio stopped losses on ETH shorts and now holds only BTC shorts worth approx. $115 million, with a liquidation price of $114,491—about $400 from the current level.

4.Blockchain Headlines

- White House crypto report recommends taxing Bitcoin mining profits upon sale

- Hong Kong explores stablecoin use in taxi markets

- Indonesia VP’s office studies Bitcoin as a national reserve asset

- Tether CEO: USDt transfers account for ~40% of blockchain fees

- Over 955,000 BTC held by top 100 listed companies globally

- Michigan pension fund increased holdings in ARK BTC ETF in Q2

- Superform Foundation established, tokenomics whitepaper due in coming months

- Bitcoin spot ETFs saw $196 million in net outflows yesterday, fourth straight day

- Cumberland & Abraxas_Capital withdrew over 46,000 ETH combined

- SBI Holdings filed two crypto ETF applications in Japan, one focused on XRP & BTC

- CEA Industries completed $500M private placement, will rebrand to “BNB Network Company”

- Fundamental Global raised $200M in private equity round, with Galaxy Digital participation

- BlackRock transferred 101,975 ETH and 2,544 BTC to Coinbase Prime

- Galaxy Digital Q2 report shows $30.7M net profit

- Coinbase plans to raise $2B via convertible bond issuance

- BitBridge to transform into a Bitcoin reserve company with BTC-backed loan products

5.Institutional Insights · Daily Picks

- Figment CEO: Regulatory changes in the U.S. are a positive sign for Ethereum and the crypto sector. Passage of the market structure bill helps clarify ETH’s use cases and role.

- Bitwise: SEC Chairman Paul Atkins’ remarks on “Project Crypto” highlight three investment opportunities: Ethereum & Layer 1s, super-apps like Coinbase, and DeFi protocols. These are not yet fully priced in.

- LD Capital: Under the influence of U.S. equities and tariff news, ETH may trade sideways for now. We expect a bullish rally to begin mid-August driven by September rate-cut expectations. Every dip is a buying opportunity in this ongoing bull cycle.

6.BTCC Exclusive Market Analysis

As of 14:00 HKT on August 6, BTC was trading at $113,982, consolidating around the midline of the 1H Bollinger Band. Price volatility is narrowing, indicating an ongoing tug-of-war between bulls and bears. MA10 and MA20 are intertwined, showing no clear short-term direction. The lower band at around $112,800 offers preliminary support. MACD lines are converging below zero, with decreasing bearish momentum. Initial red bars suggest a rebound may begin. CCI has risen to 38, exiting the oversold zone and signaling initial recovery momentum.

On the macro front, the White House is expected to issue an executive order prohibiting banking discrimination against crypto firms, interpreted as a regulatory easing. The SEC’s classification of compliant stablecoins as cash equivalents could further integrate traditional finance with crypto. Fed’s Daly sent dovish signals, and CME data shows a 94%+ chance of a September rate cut, boosting liquidity expectations. However, rising geopolitical uncertainty from Trump’s new tariffs and India’s tough stance is adding caution to the market sentiment.

In the short term, watch for a breakout of the $114,000–114,770 range. If BTC breaks above MA20, small-scale longs can be considered with stop-loss below $113,000. If price falls below $114K, staying on the sidelines is advised. Mid-term strategies should be guided by White House policy details and Fed’s rate cut timing. Volatility may be driven by shifting policy expectations and risk-off sentiment. Leverage should be controlled and positions adjusted flexibly.

Recommended Campaigns on BTCC

Earn USDT with Paper Trading

Claim 100,000 virtual funds now to test trading strategies with zero risk. Earn up to 35 USDT in real trading funds based on your simulated PnL.

How to Join

Log in to the BTCC mobile app → Go to the paper trading page → Navigate to the task center via “Contract Toolbox” (next to K-line button) on the USDT-margined Futures simulation page.

Risk Disclaimer: The above content is for reference only and does not constitute investment advice. The market involves risk. Please trade cautiously and manage your risks appropriately.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download