BTCC Crypto Daily (7.29)|PayPal Bets on Crypto Payments; Bitcoin Awaits Breakout from Range

Why Trust BTCC

1.Overview

- Donald Trump: Global tariffs expected to range around 15-20%

- PayPal launches cryptocurrency payment service

- Ray Dalio: Investors should allocate 15% of their portfolios to Bitcoin and gold

2.Macro & Policy Outlook

Key Events Today

- U.S. July Conference Board Consumer Confidence Index due today (previous: 96)

- U.S. June JOLTs Job Openings (in 10,000s) due today (previous: 776.9)

Global Macro Developments

1.Donald Trump: Global tariffs expected around 15-20%

U.S. President Donald Trump stated after meeting with U.K. Prime Minister Keir Starmer that the U.S. is likely to impose tariffs of 15% to 20% on countries that have not reached a trade agreement with Washington. “I think it will be somewhere in the 15% to 20% range, probably one of those numbers,” Trump noted. He also announced that the U.S. would soon notify around 200 countries of the expected tariff rates on their exports to the U.S. Since April, the U.S. has already imposed an additional 10% tariff on most countries, and further hikes are expected starting August 1.

2.PayPal launches crypto payment service, supporting over 100 digital currencies for U.S. merchants

PayPal has launched a new crypto payment solution for U.S. small and medium-sized merchants, enabling them to accept payments in over 100 cryptocurrencies, including Bitcoin and Ethereum. The service is provided via PayPal’s online payment platform, with a 0.99% transaction fee for the first year, rising to 1.5% thereafter. During checkout, users can link their existing crypto wallets to the payment interface, and the system will convert the crypto into PayPal’s stablecoin PYUSD via Binance or a decentralized exchange, which is then settled to the merchant in USD.

3.Fed ‘mouthpiece’: Fed not ready to cut rates this week

Nick Timiraos, the so-called Fed “mouthpiece,” stated that while Federal Reserve officials anticipate eventual rate cuts, they are not yet ready to take action this week. Officials are currently split into three camps on whether to resume rate cuts, with focus on whether Chair Jerome Powell will signal a possible September cut during the press conference, and whether other Fed members will begin to pave the way for easing in the next meeting.

4.Donald Trump: Fed must cut rates in July

On July 28 local time, President Trump commented that the Fed “must” cut interest rates when asked about this week’s FOMC decision.

5.South Korea’s ruling and opposition parties clash over stablecoin regulation

South Korea’s ruling and opposition parties submitted separate stablecoin regulation bills on Monday, with a major divergence over whether to ban interest payments to users. The Democratic Party’s proposal explicitly bans interest and mandates 100% reserve backing with a minimum capital of 5 billion KRW. In contrast, the ruling party’s version does not restrict interest payments, instead emphasizing innovation and enhanced disclosure. Both versions assign oversight authority to the Bank of Korea.

Traditional Asset Correlation

- Nasdaq +0.33%, S&P 500 +0.02%, Dow Jones -0.14%

- Spot gold +0.15% at $3,319.74/oz

- WTI crude (USOIL) -0.33% at $66.69/barrel

3.Crypto Market Snapshot

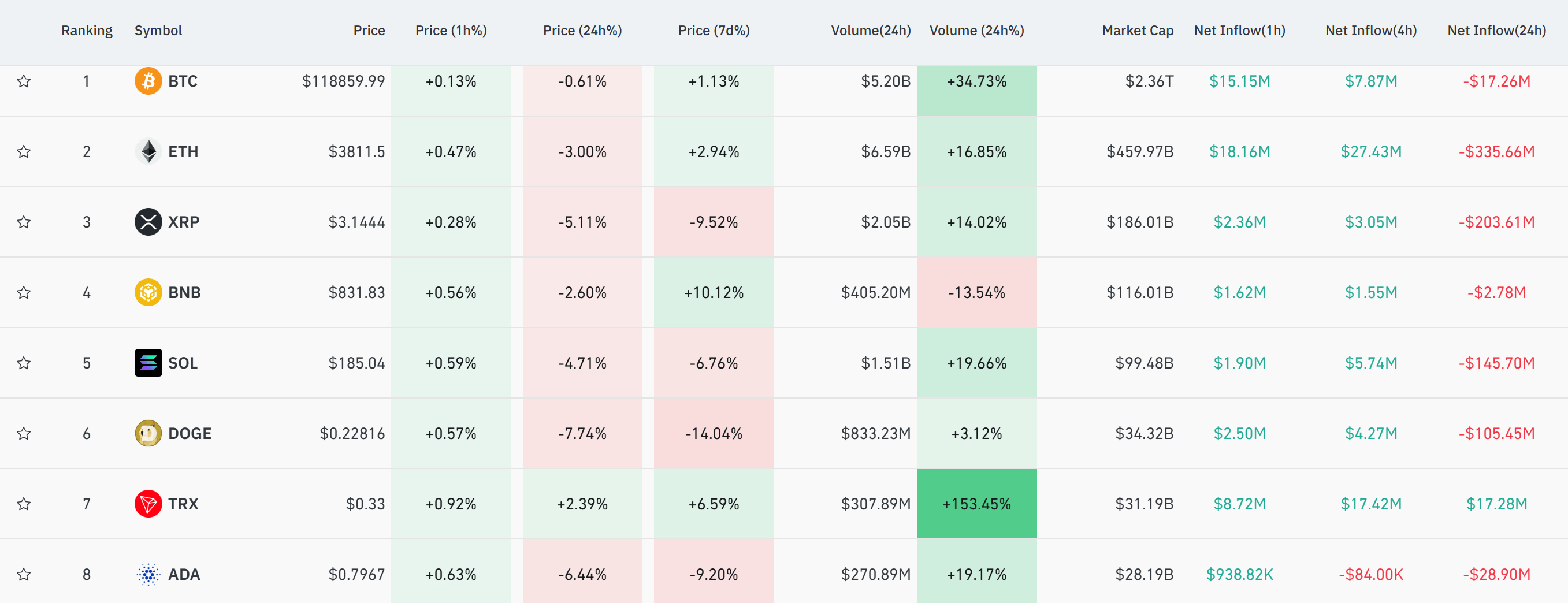

1. Spot Performance of Major Cryptocurrencies

(As of 14:00 HKT on July 29, 2025)

2.Futures Capital Flow Analysis

According to Coinglass on July 29, ETH, BTC, SOL, XRP, DOGE, and SUI showed leading net outflows in derivatives markets over the past 24 hours, potentially indicating trading opportunities.

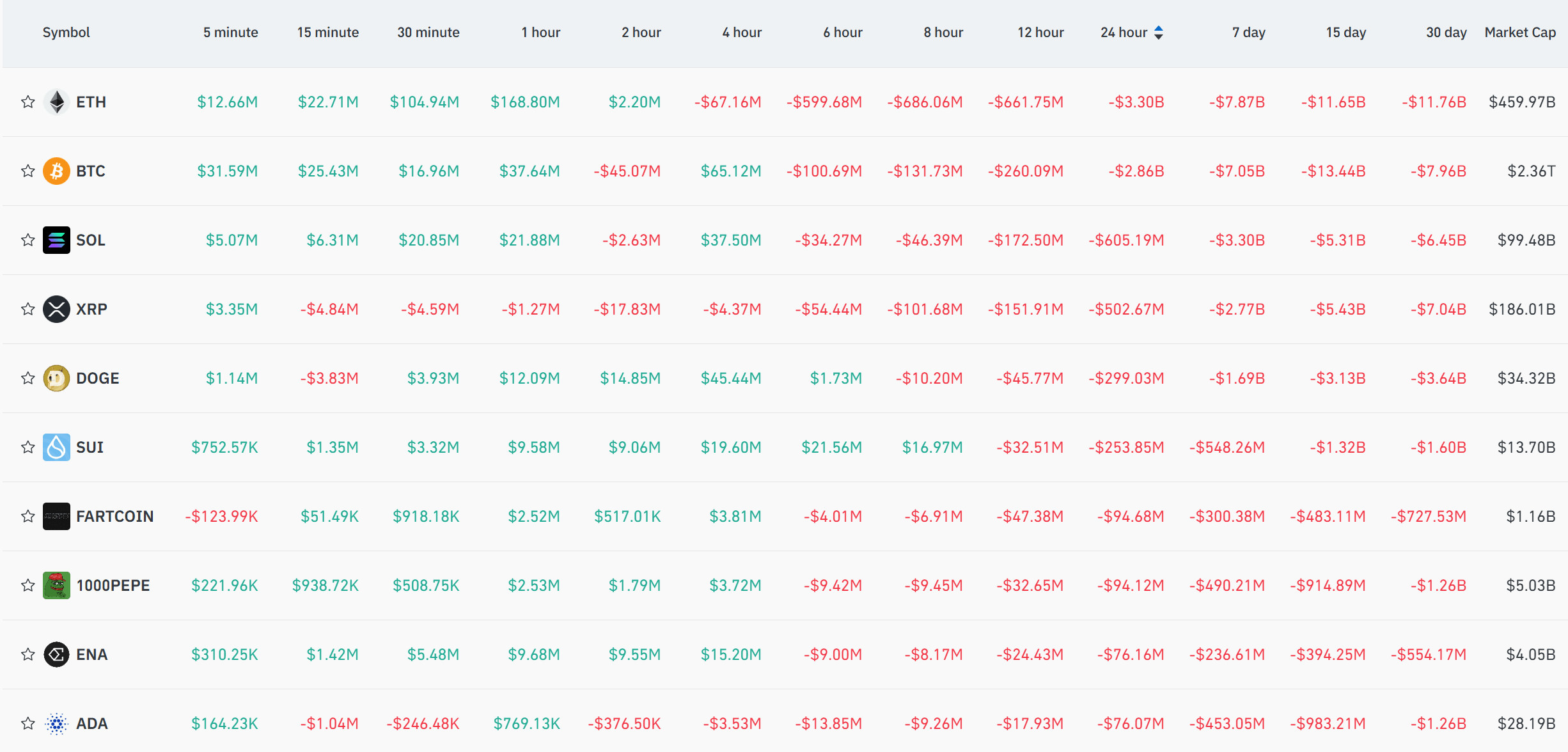

3. Bitcoin Liquidation Map

As of July 29, Coinglass data shows that if Bitcoin falls below $116,000 from the current level of $118,845, the cumulative long liquidation pressure across major CEXs could reach $1.413 billion. Conversely, if Bitcoin breaks above $121,000, the cumulative short liquidation pressure may surge to $1.765 billion. It is advised to manage leverage prudently and avoid large-scale forced liquidations during volatile swings.

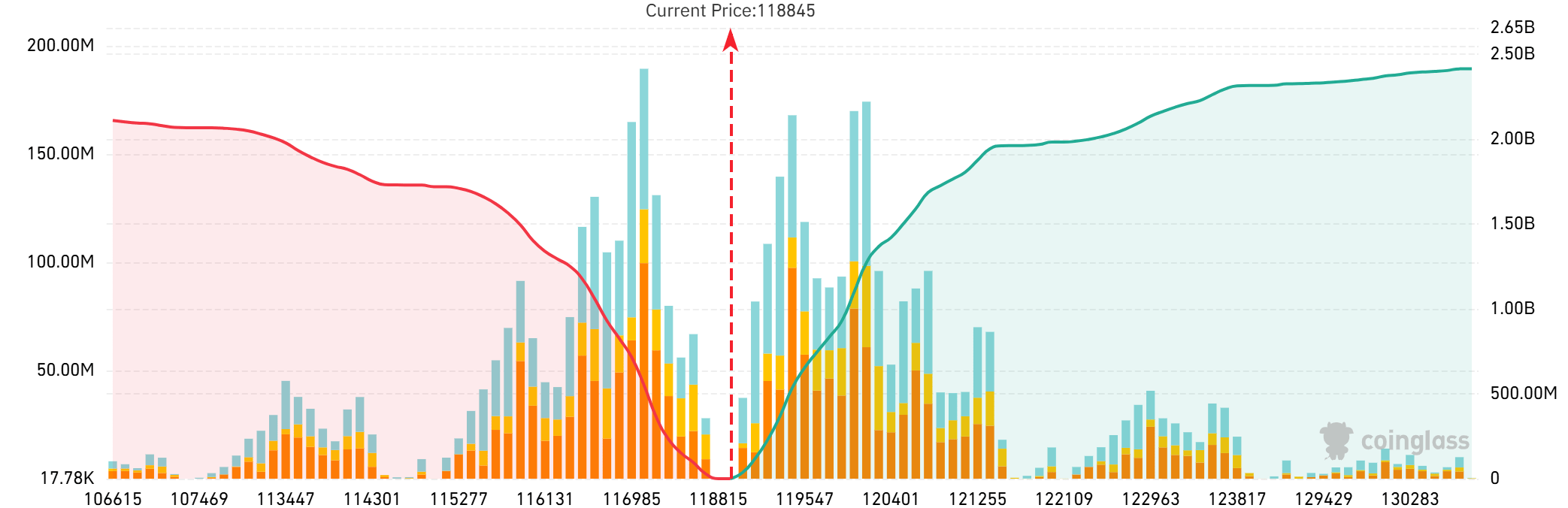

4. Bitcoin Long/Short Ratio

As of 14:00 HKT on July 29, the Bitcoin long-short ratio stands at 1.5088, with 60.14% of positions long and 39.86% short, according to Coinglass.

5. On-Chain Monitoring

- According to on-chain analyst @ai_9684xtpa, a 14.5-year dormant crypto whale holding 3,963 BTC moved 135 BTC (approx. $15.93 million) to a new address after three days of activity. Previously, 50 BTC were distributed to Coinbase and Wintermute, indicating possible continued selling.

- HyperInsight reports that a whale with a 75% win rate from four ETH trades is now shorting 20,000 ETH with 20x leverage. The position is valued at $75.76 million, with an entry price of $3,843 and liquidation at $3,999.

- On-chain data from @ai_9684xtpa shows a wallet suspected to belong to Amber Group has withdrawn 15,814 ETH (approx. $59.75 million) from multiple exchanges, now holding a total of 18,463 ETH worth about $70.05 million.

4.Blockchain Headlines

- Ethereum co-founder Joe Lubin says he hopes SharpLink becomes the fastest ETH-accumulating company

- Bitmine: Multiple institutions estimate ETH’s implied value to be $60,000 based on an alternative value model

- CoinDCX co-founder responds to acquisition rumors: “We remain focused on the Indian crypto market and are not considering a sale”

- Lido founder borrows $85 million USDT from Aave to buy ETH

- CryptoPunks floor price surpasses $200,000 for the first time in over a year

- Analyst Eugene: SUI’s recent surge may be due to early positioning; impact remains difficult to quantify

- CryptoPunks NFT trading volume hits highest level since March 2024

- FIS partners with Circle to offer stablecoin payment solutions for banks

- Analysis: Every $1 trillion in stablecoins may generate $100–$300 billion in net demand for U.S. Treasuries

- Analysis: Derivatives data suggests ETH may target $5,000 in the near term

- Analysis: A $1 billion ETH treasury strategy could generate up to $50 million in annual returns

- U.S. SEC delays approval of Truth Social’s spot Bitcoin ETF application

- Interactive Brokers reportedly exploring stablecoin products for clients

- Plasma’s public token offering exceeds $373 million, oversubscribed by 7x

- Donald Trump pushes to include crypto assets in U.S. retirement and mortgage systems, drawing criticism from Democrats

- Placeholder Ventures partner: Market sentiment around ETH has shifted significantly over the past month

- European Central Bank warns that the rise of stablecoins may disrupt eurozone monetary policy

5.Institutional Insights · Daily Picks

- Ray Dalio: “Investors should allocate 15% of their portfolios to Bitcoin and gold to hedge against rising U.S. debt and economic instability.”

- Matrixport: “While we maintain a bullish outlook for year-end, seasonal headwinds suggest the Bitcoin market may be entering a phase of strategic consolidation.”

- Greeks.Live: “Market sentiment remains extremely bullish, with traders anticipating new highs for Bitcoin. Watch for support at $119,000 and a mid-term target of $121,000.”

6.BTCC Exclusive Market Analysis

Bitcoin is currently trading at $118,760. On the 4-hour chart, it is showing a range compression pattern: Bollinger Bands are narrowing continuously, and price action is oscillating around the midline with decreasing volatility—now within 1.5% range. Market forces have entered a critical balance phase, and a breakout will require a strong momentum release.

From a technical perspective, the MACD lines are forming a preliminary bullish crossover, and bearish momentum is fading, although bulls have yet to take full control. The CCI indicator remains neutral, showing no overbought or oversold signals, reflecting market indecision. The upper and lower Bollinger Bands are tightly constraining the current range, with the midline acting as the short-term battleground.

Short-term strategy: Traders may consider range trading within the Bollinger Band limits.If price breaks above the upper band ($119,500), a light long position may be taken, with a stop-loss set below $118,000.If price breaks below the midline ($118,400), a light short position may be considered, with stop-loss near the upper band.

Mid-term strategy: Wait for a confirmed breakout from the range. A break above $119,500 or below $117,000 may signal the start of a new trend. Until then, continue with a buy-low, sell-high approach within the current range.

On the news front, PayPal’s rollout of a crypto payment service supporting over 100 digital assets—with a 0.99% fee in the first year—could spur demand among small businesses. With U.S. monetary policy and crypto innovation advancing in parallel, crypto assets may increasingly serve dual roles in reserve and circulation, driving broader market acceptance.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download