BTCC Crypto Daily (7.30)|SEC Approves Physical Crypto ETF Subscriptions; Ethereum Becomes Institutional Favorite

Why Trust BTCC

1.Overview

- The U.S. SEC has approved physical creation and redemption for Bitcoin and Ethereum ETFs

- Fed Governor Kugler to miss this week’s FOMC; voting members reduced to 11

- SCB: Institutional demand for Ethereum has surpassed that of Bitcoin

2.Macro & Policy Outlook

Key Events Today

- The White House will release its first official crypto policy report today

- Australia Q2 CPI YoY to be released today (previous: 2.40%, current: 2.10%)

- Eurozone July Economic Sentiment Index to be released (previous: 94)

- U.S. July ADP Employment Change (in 10,000s) to be released (previous: -3.3)

- U.S. Q2 real GDP annualized QoQ advance estimate to be released (previous: -0.5%)

Global Macro Developments

1.Two Fed Governors May Dissent at This Week’s FOMC, Support Rate Cuts

Fed “mouthpiece” Nick Timiraos reported that Governors Waller and Bowman may dissent at this week’s FOMC meeting by supporting rate cuts, while Powell and others are expected to remain on hold. Both were appointed by Donald Trump, who has recently called for rate cuts. If the Fed holds rates steady, it would mark the first time in over 30 years that two Governors vote against the consensus. If cuts are made, it may draw opposition from hawkish members.

2.SEC Approves Physical Creation and Redemption for Spot Bitcoin and Ethereum ETFs

The U.S. Securities and Exchange Commission (SEC) has approved the use of physical creation and redemption mechanisms for spot Bitcoin and Ethereum ETFs. This applies to products from BlackRock, Ark21, Fidelity, and others. The move is expected to improve fund efficiency and lower costs. The SEC also approved combination ETFs for BTC and ETH, options on Bitcoin ETFs, and relaxed position limits on crypto options. SEC Chairman Paul Atkins called it “part of building a more rational regulatory framework” that may enhance U.S. crypto market depth and liquidity.

3.Fed Governor Kugler Absent from July FOMC, Voting Members Temporarily Reduced to 11

Federal Reserve Governor Kugler will miss the July policy meeting due to personal matters, temporarily reducing the FOMC voting panel from 12 to 11. According to Fed rules, a missing regional Fed president may be replaced by another, but there is no replacement for Board Governors.

4.Bank of Korea Establishes Virtual Asset Department to Lead Stablecoin Discussions

The Bank of Korea has established a new virtual asset department within its Financial Settlement Bureau, which will lead internal discussions on a Korean won–based stablecoin. Additionally, the bank renamed its “Digital Currency Research Team” to “Digital Currency Team,” signaling a shift from theoretical research to active digital currency projects.

5.Hong Kong Monetary Authority Publishes Stablecoin Regulatory Framework Documents

The Hong Kong Monetary Authority (HKMA) has published documentation for the stablecoin issuer regulatory regime to take effect on August 1. The materials include consultation conclusions, licensing guidelines, and transitional arrangements. Both guidance documents were gazetted on the same day. As the regime is implemented, market participants must comply with the Stablecoin Ordinance and relevant guidelines. The HKMA also announced a six-month transition arrangement for entities that were already conducting stablecoin issuance in Hong Kong.

6.Indonesia Raises Crypto Trading Tax Rates

According to Reuters, Indonesia’s Ministry of Finance will increase taxes on crypto trading starting August 1:Domestic exchange seller tax rises from 0.1% to 0.21%;Foreign exchange seller tax rises from 0.2% to 1%;Buyers remain exempt from VAT;Mining VAT increases from 1.1% to 2.2%.

Traditional Asset Correlation

- Nasdaq -0.38%, S&P 500 -0.30%, Dow Jones -0.46%

- Spot gold -0.04% at $3,325.09/oz

- WTI crude oil (USOIL) -0.16% at $69.10/barrel

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(as of July 30, 2025, 14:00 HKT)

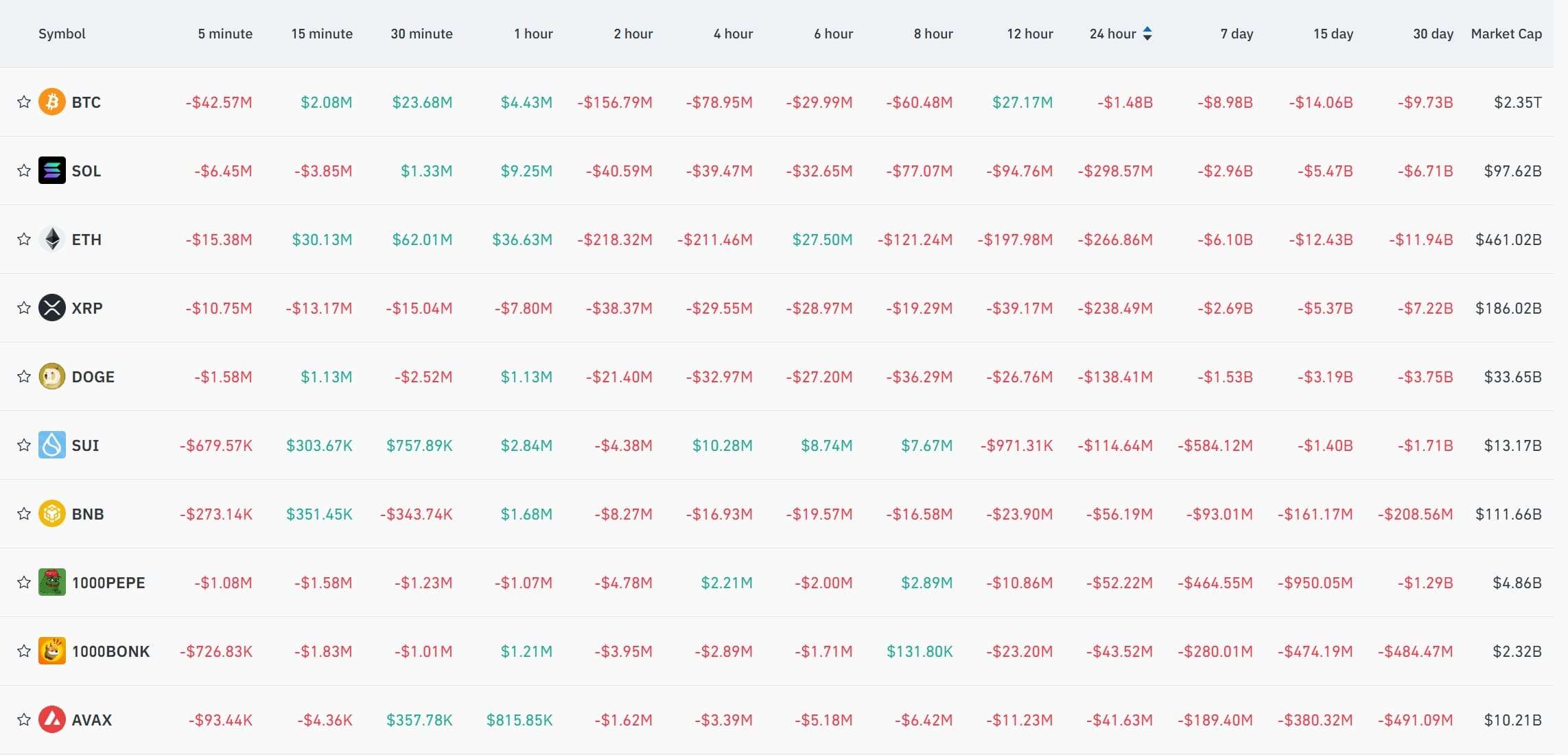

2.Futures Capital Flow Analysis

According to Coinglass on July 30, contract trading for BTC, SOL, ETH, XRP, DOGE, and SUI recorded net outflows over the past 24 hours, suggesting potential trading opportunities.

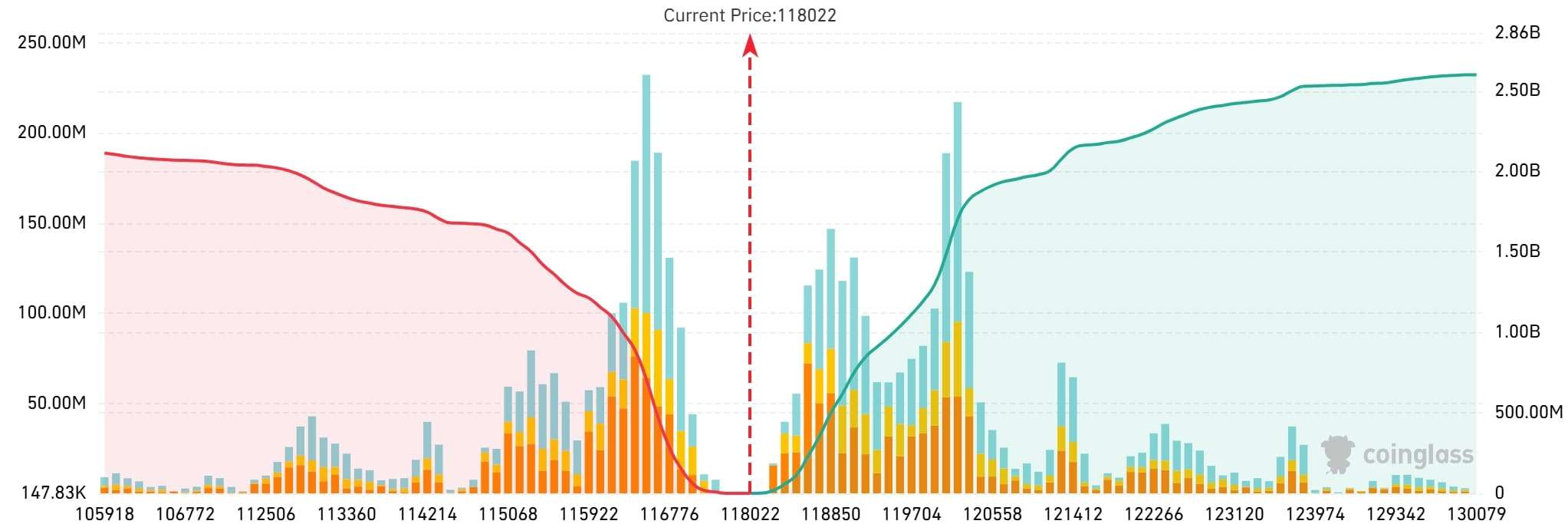

3. Bitcoin Liquidation Map

According to Coinglass on July 30, if Bitcoin falls below $115,000 from the current price of +, cumulative long liquidations across major CEXs may reach $1.642 billion. Conversely, a breakout above $120,000 could trigger $1.486 billion in cumulative short liquidations. Leverage should be managed carefully to avoid large-scale liquidation amid market swings.

4. Bitcoin Long/Short Ratio

As of 14:00 HKT on July 30, Coinglass reports the overall BTC long-short ratio at 1.3691, with 57.79% long positions and 42.21% short positions.

5. On-Chain Monitoring

- According to @EmberCN, since July 10, several addresses have accumulated 648,000 ETH worth approximately $2.44 billion, at an average price of $3,445. Address “0x3dF…E3E” alone added 12,000 ETH on July 30, holding a total of 112,972 ETH worth about $413 million at an average of $3,662.

- HyperInsight data shows multiple crypto whales actively adjusting derivatives positions, including frequent openings and closures of both long and short contracts on BTC and ETH. BTC liquidation ranges span from $45,000 to $214,000; ETH ranges from $3,380 to $4,786. Some whales are incurring losses, reflecting aggressive position shifts.

4.Blockchain Headlines

- BlackRock ETF purchased over $1.2 billion in ETH last week, 4x more than in BTC

- UK-listed Hamak Gold bought 20 BTC and partnered with Archax

- Analysis: After the “80,000 BTC ancient whale” sold off, 97% of BTC supply remains in profit

- Twenty One Capital (linked to the U.S. Commerce Secretary’s son) now holds 43,514 BTC

- Over 145,000 addresses now hold Ethereum’s 10th Anniversary Torch NFT

- RD Technologies raised $40 million in Series A2 round, led by ZA International and others

- Opinion: ETH faces major resistance at $4,500, repeating March 2024 and previous cycle signals

- Base chain has surpassed Solana in daily token issuance for 3 consecutive days; Zora leads the trend

- JPMorgan: Coinbase gains significantly from its partnership with Circle and USDC economics

- Robinhood CEO’s net worth surged 6x in a year to $6.1 billion

- Pump.fun has spent over $21.5 million on token buybacks, reportedly using 100% daily revenue

- Stats: BlackRock ETF bought over $1.2 billion in ETH last week—four times more than BTC

- BTCS plans to raise $2 billion to boost crypto investments

- Strategy completes $2.521 billion STRC IPO, adds 21,021 BTC to its holdings

- Algeria bans all crypto-related activities; violators face jail and fines

- White House delays vote on CFTC Chair nominee due to ongoing Kalshi board role

- eToro to launch tokenized U.S. stocks on the Ethereum blockchain

- DEGEN Foundation considers phased burn of 32.5% of DEGEN token supply

- UAE’s Rakbank launches cryptocurrency trading services

5.Institutional Insights · Daily Picks

- 10x Research: The $140,000 BTC target is not easily achievable. The current bullish momentum may weaken as seasonal model signals fade and market structure shows signs of exhaustion. A new phase may emerge as we approach a critical inflection point.

- SCB: As crypto treasury companies continue buying Ethereum, ETH is expected to break above $4,000. Institutional buying power has already surpassed that of Bitcoin.

- ethdigitaloil: Based on global oil, gold, and fiat valuations, ETH’s market cap could reach $85 trillion, implying a potential price of $706,000 per ETH.

6.BTCC Exclusive Market Analysis

As of 14:00 HKT on July 30, Bitcoin is priced at $118,022. On the 4-hour chart, BTC is showing a range compression pattern: The Bollinger Bands continue to narrow, with price oscillating around the middle band. Candlestick volatility has been shrinking, and both bulls and bears appear locked in a critical balance. A breakout signal requires concentrated momentum.

MACD fast and slow lines are converging; bearish momentum is fading, but bulls have yet to take clear control. CCI remains in the neutral zone, reflecting a strong wait-and-see sentiment. The Bollinger Bands’ upper and lower bounds are fixed, and the middle band is acting as a short-term battleground—its eventual breach will define the trend’s next direction.

Short-term traders can focus on breakout levels within the range: If BTC breaks above $119,400, a light long position may be considered, with a stop loss below $118,400. If it falls below the middle Bollinger Band, a light short position may be tested, with stop loss near the upper band ($119,400). Mid-term traders should wait for a clear range breakout and closely watch resistance at $119,500 and support at $117,000. Until then, the preferred strategy is to “buy low and sell high within the range,” staying cautious and reactive.

The market is entering a 72-hour period of dense information. A series of economic events, corporate earnings, the White House’s upcoming crypto policy report, and the looming tariff deadline from Donald Trump could significantly affect crypto price action. Expect heightened volatility. High-leverage positions risk liquidation amid sharp swings. Traders are advised to control leverage, diversify risk, and adjust strategies based on real-time developments.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Register now to begin your crypto journey

Download the BTCC app via App Store or Google Play

Follow us

Scan to download