US Treasury Buyback Plan: How Markets and Crypto Are Redrawing the Financial Map

The Treasury just hit the 'buy' button. Its new buyback program isn't just a liquidity tweak—it's a seismic shift in how government debt moves, and the aftershocks are rippling straight into digital assets.

The Mechanics: More Than Just a Bond Swap

Forget dry auctions. This is about modernizing a creaking system. The Treasury's plan to repurchase older, less-liquid debt with fresh issuances aims to grease the wheels of the multi-trillion-dollar Treasury market. It's a bid for stability, but in finance, every solution breeds a new set of reactions.

Crypto's Asymmetric Reaction

Watch the correlation charts break. While traditional markets parse the implications for yield curves and bank reserves, crypto markets are reading a different script. Increased liquidity operations historically cast a long shadow over fiat credibility. For Bitcoin and its peers, that's not a risk—it's a foundational thesis. The narrative of 'digital gold' versus monetary debasement gets a fresh coat of paint with every government balance sheet maneuver.

The Bigger Picture: A System Under Stress

This isn't happening in a vacuum. It's a response to the underlying fragility exposed in recent years—a patch for a plumbing system everyone knows is outdated. When the official solution is to make the core debt market more 'functional,' alternative systems built for a digital age suddenly look less like speculation and more like sensible contingency plans. It's the ultimate backhanded compliment from the old guard to the new.

The Bottom Line: Watch the Signal, Not Just the Noise

The direct market impact might be nuanced, but the signal is crystal clear. The financial architecture is being retrofitted in real-time. For crypto, that's pure jet fuel. Every institutional foray, every new ETF wrapper, and every volatility spike that doesn't end in zero proves the asset class isn't just surviving—it's capitalizing on the old world's complexity. One trader's liquidity management is another's billion-dollar thesis for a parallel financial system. After all, on Wall Street, if you're not at the table, you're probably on the menu.

US Treasury Buy Back: What the Current Plan Involves

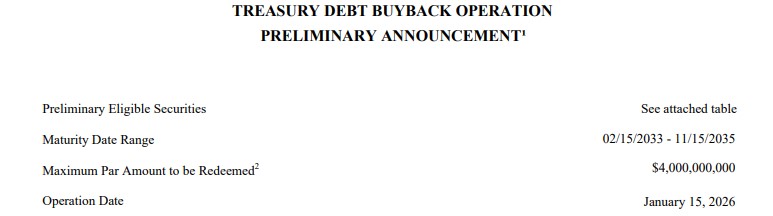

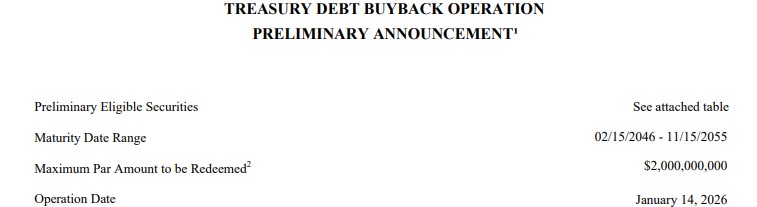

The latest US Treasury $4 billion buy back took place on January 15, 2026, following $2 billion a day earlier. In these two separate operations, the Finance Department repurchased a total of $6 billion of its own bonds mainly with long term-term maturities between 20 and 30 years.

The recent purchases are part of a broader plan unveiled in 2025-end, where the organization schedules several small buybacks each quarter. The strategy aims to enhance liquidity in less active and old bonds while managing the government's debt profile efficiently.

Importantly, the existing cash is used for purchases, which means no new money was printed for operation, keeping Federal Reserve policies unlinked. Settlements, one day after, will give primary dealers cash in exchange for the bonds they sold.

Economic Backdrop Behind the US Treasury Buy Back

The US Treasury buyback comes as the country's economic conditions are showing mixed reactions. Growth indicators hold positive with GDP for 2026 forecasts at the range of 1.8%-2.2%, supported by consumer spending along with investment in AI sectors and fiscal programs.

On the other side, the labor market is cooling with a mid-4% unemployment range and slower hiring. Inflation also hovering around 2.7%, slightly but higher than target, pressured by tariffs.

In this scenario the buy-back operations work as a tool to stabilize and improve the market with smoother liquidity flows, to avoid overstimulating the economy.

Why the US Treasury Buy Back Matters for Crypto Markets

For cryptocurrency investors, the action matters because liquidity supply affects risk assets like Bitcoin. When traders receive cash, they slightly improve pressures in financial markets, even if it’s in small amounts.

However, size is important. A $6 billion buyback is small compared to Federal Reserve quantitative tightening, which often removes tens of billions of dollars from the system each month. In crypto terms, this move alone cannot drive prices higher.

Still, perception plays a role. Some market analysts noted the buybacks as a mild positive signal, specially when bitcoin is again surging, holding near $96K and overall market is 0.49% up today, following yesterday's same scenario.

Beyond this, the crypto regulations in the US entering 2026, influencing the markets significantly. But delays and uncertainties keep traders hesitant as they hope for clarity over short-term liquidity moves.

Conclusion: A Small Move in a Much Bigger Picture

The US Treasury buy back is generally seen as routine maintenance of the marketplace, not any hyped move. It surely boosts capitalization and mild confidence, but does not directly affect the traditional markets.

For virtual assets, bigger actions, interest rates, demand from institutions, regulated laws, and worldwide liquidity, matters far more than this. These operations add a small contribution, while broader ones decide where the market will go next.