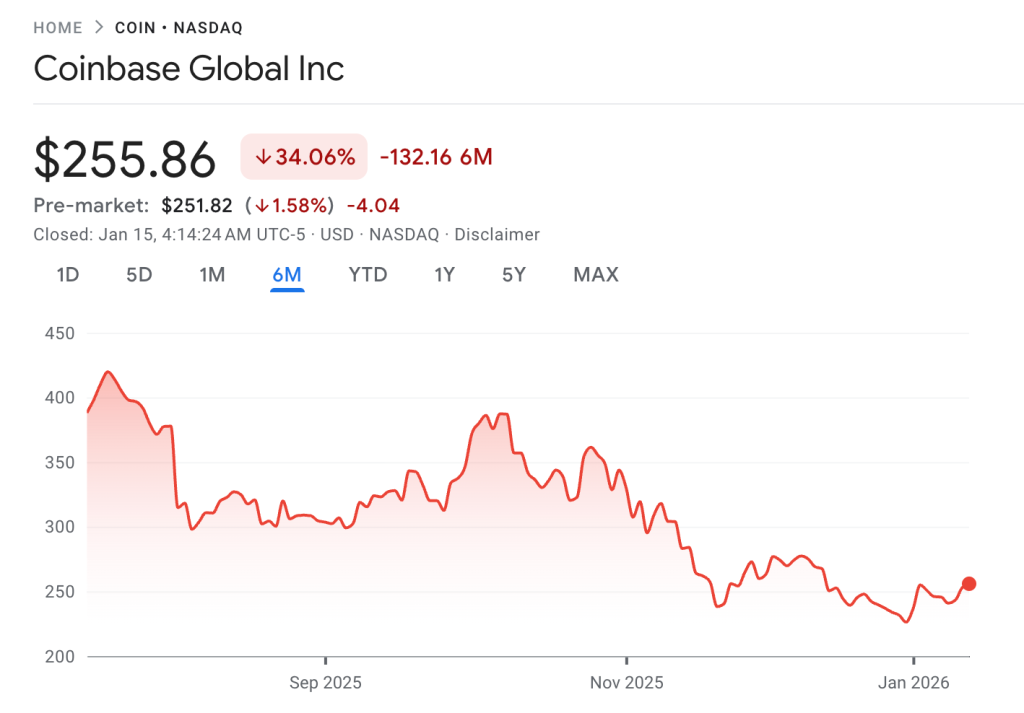

ARK Invest’s Flagship Funds Stumble as Coinbase Drags Performance in Q4 Crypto Slump

ARK's crypto-heavy bets hit a brutal Q4 wall—Coinbase's slide yanked flagship funds into the red just as the broader market bled.

The Contagion Effect

One major holding tanking can unravel an entire portfolio strategy. When a cornerstone position like Coinbase stumbles, it doesn't just dip—it pulls everything down with it. That's concentrated risk in a volatile sector, and last quarter, it played out in painful detail for Cathie Wood's funds.

Portfolio Physics in a Downturn

High conviction cuts both ways. The same concentrated bets that fuel outrageous bull-run returns become anchors in a slump. There's no elegant diversification hedge when your top picks are all swimming in the same crypto-adjacent pool. It's a lesson in correlation that traditional finance types love to cluck about over their stale coffee.

The crypto winter reminder: even the smartest thematic investors aren't immune to gravity. Sometimes, a 'disruptive innovation' is just a stock that goes down.

Source: Google Finance

Source: Google Finance

Coinbase’s struggles came despite hosting a product event showcasing long-term strategic ambitions, including plans for on-chain equities, prediction markets, and an AI-powered portfolio advisor.

Market conditions remained challenging following an October 10th liquidation event that wiped out $21 billion in Leveraged positions across the crypto sector.

ARK Funds Weather Crypto Downturn

The damage extended beyond Coinbase across ARK’s portfolios.

Roblox joined the exchange as another major weight after reporting third-quarter bookings growth of 51% year over year but guiding toward declining operating margins in 2026 due to higher infrastructure and safety costs.

Russia’s ban on Roblox over child safety concerns removed roughly 8% of the platform’s total daily active users, though the region accounted for less than 1% of total revenue.

Advanced Micro Devices emerged as the quarter’s strongest contributor after announcing significant AI partnerships, including a multiyear deal with OpenAI and a collaboration with Oracle for a public AI supercluster.

AMD’s third-quarter earnings reflected 36% year-over-year revenue growth driven by robust demand in the Data Center and Gaming segments.

Shopify rallied on news of its integration with OpenAI, which enables instant in-chat checkout for ChatGPT users, and reported strong third-quarter earnings, with 32% year-over-year growth in both gross merchandise value and revenue.

Rocket Lab shares surged following multiple launch agreements and the largest contract in company history, an $816 million agreement to provide 18 missile warning, tracking, and defense satellites in low Earth orbit.

During Q4 2025, four of ARK’s actively managed ETFs underperformed broad-based global equity indexes, while two outperformed or delivered mixed results.

ARK Chief Investment Officer Cathie Wood said “the innovation space is recovering and being revalued,” noting that “headwinds that once pressured disruptive technologies are shifting into structural tailwinds.“

The crypto-heavy portfolios faced particular pressure asdropped from October highs NEAR $126,000 to trade below $88,000 by year-end.

Coinbase Pursues “Everything Exchange” Expansion

Earlier this month, Coinbase CEO Brian Armstrong announced the exchange will pursue an “everything exchange” strategy in 2026, combining crypto, equities, prediction markets, and commodities across spot, futures, and options products.

The plan positions Coinbase to compete directly with traditional brokerages while expanding beyond its Core digital asset business into tokenized securities and event-based markets that attracted billions in recent trading volume.

“,” he wrote, adding the company is making major investments in product quality and automation to support the expansion.

![]() Coinbase announces plans to launch "everything exchange" in 2026, combining crypto, stocks, prediction markets, and commodities as the platform expands beyond digital assets.https://t.co/WidMyeQhwP

Coinbase announces plans to launch "everything exchange" in 2026, combining crypto, stocks, prediction markets, and commodities as the platform expands beyond digital assets.https://t.co/WidMyeQhwP

The exchange also moved aggressively into prediction markets in late 2025, partnering with Kalshi, a federally regulated platform approved by the U.S. Commodity Futures Trading Commission.

Leaked screenshots in November revealed a Coinbase-branded prediction interface supporting USDC or USD trading across economics, politics, sports, and technology categories.

The product operates through Coinbase Financial Markets, the exchange’s derivatives arm, using Kalshi’s regulatory framework to offer event contracts structured as simple yes-or-no questions.

Tokenized Assets and Regulatory Tailwinds Drive Optimism

Beyond those, Coinbase also plans to issue tokenized equities in-house rather than through external partners, marking a departure from rivals like Robinhood and Kraken that rely on third-party providers for stock tokens.

Seeing all these significant 2026 preparations, Goldman Sachs upgraded Coinbase from neutral to buy on January 6, raising its 12-month price target to $303 and citing growing confidence in the company’s diversification strategy.

![]() @Coinbase shares jumped 8% after Goldman Sachs upgraded COIN to “buy” and raised its 12-month price target to $303.#Coinbase #Cryptohttps://t.co/M8TT7GaJFe

@Coinbase shares jumped 8% after Goldman Sachs upgraded COIN to “buy” and raised its 12-month price target to $303.#Coinbase #Cryptohttps://t.co/M8TT7GaJFe

Analyst James Yaro particularly highlighted Coinbase’s efforts to expand beyond spot crypto trading, citing initiatives in infrastructure, tokenization, and prediction markets as potential growth drivers.

Coinbase shares surged 8% following the upgrade, closing at $254.92.

David Duong, the exchange’s head of investment research, also reaffirmed that the exchange expects broader crypto adoption in 2026, driven by increased participation from both retail and institutional investors as regulatory clarity improves.

Notably, Coinbase has threatened to withdraw support for the ongoing draft Crypto Market Structure Bill, facing bipartisan clashes and banking industry pressure, following last-minute changes the industry claims WOULD effectively end DeFi.