ICP Rocket Fuel: Why Internet Computer Is Surging Today & What’s Next

Internet Computer isn't just pumping—it's staging a full-scale breakout. The decentralized cloud protocol is ripping higher, leaving traditional crypto narratives in the dust.

The Catalyst: More Than Just Hype

Forget vague promises. ICP's surge ties directly to tangible on-chain growth. Developer activity is exploding, with smart contract deployments hitting new peaks. The network's unique architecture—which runs web-speed dApps directly on-chain—is finally getting its moment. No AWS, no intermediaries. Just code executing at the speed of the internet itself.

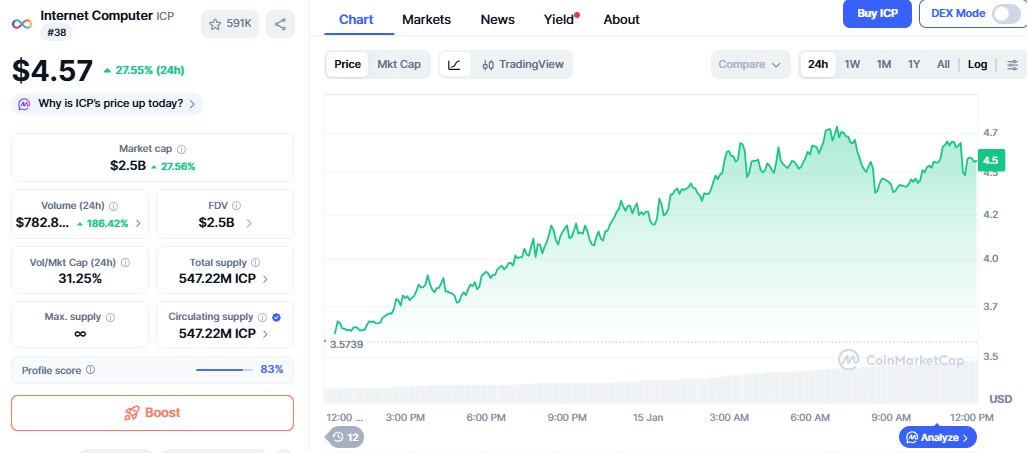

What The Charts Scream Next

Technical structure suggests this isn't a fleeting pump. Key resistance levels have vaporized. Trading volume confirms institutional fingers are in the pie—a classic sign the 'smart money' sees something retail might have missed. The next targets? Analysts point to zones last visited before the last major market correction. A reclaim there would signal a full trend reversal, not just a bounce.

The Cynic's Corner

Let's be real—half of Wall Street still thinks DeFi is a typo. Their loss. While traditional finance wrestles with legacy systems and quarterly reports, protocols like ICP are rebuilding the stack from the ground up. The surge isn't just about price; it's a vote for a different financial future. One that doesn't require begging a bank for permission.

The momentum is undeniable. ICP isn't just riding a wave; it's generating its own. The question now isn't *if* the landscape is changing, but how fast you adapt to it.

Why ICP is Pumping So: 3 Catalysts Driving the Breakout

If you’re searching why ICP is pumping so, the story is simple: tighter supply expectations, a new DeFi narrative, and stronger category positioning.

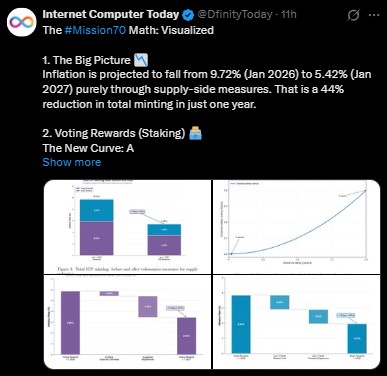

The biggest spark is DFINITY’s Mission70 whitepaper (Jan 13, 2026). It proposes dropping annual inflation from about 9.72% (Jan 2026) to about 5.42% (Jan 2027)—a 44% reduction in minting from supply-side changes alone. Voting rewards minting is modeled to fall from 5.88% to 3.45%, while node rewards drop from 3.84% to 1.97%, as per X (formerly Twitter) post. The plan also links network usage to token burns through compute cycles, raising the chance of a more scarcity-driven setup if adoption grows.

The second push came from the project and Liquidium partnership update (Jan 14). Liquidium highlights a smooth DeFi experience—instant wallet connections, a clear portfolio view, and tracking LTV, collateral health, and loans in one place. That “easy DeFi” narrative often attracts new users faster than technical claims alone.

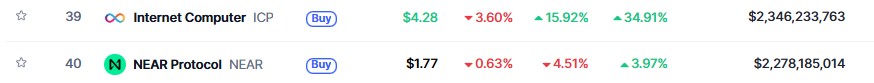

The third catalyst is positioning. It surpassed Near Protocol in CoinMarketCap’s AI & Big Data category ranking by market cap, taking the #2 spot while NEAR Protocol Price sits near $1.76 with about $2.26B market cap (as cited in your draft). That ranking shift matters because many traders rotate into “leaders” inside hot sectors.