Solana Soars: Short Squeeze Propels SOL Beyond Key Resistance, $164 Target in Play

Liquidation cascades trigger explosive rally—Solana bulls are back in control.

SOL just sliced through resistance like a hot knife through butter. The cause? A brutal short squeeze that left overleveraged traders choking on dust. Now, the path to $164 looks wide open.

Technical breakout or just another crypto pump? The charts don't lie—this rally has teeth. With funding rates normalizing and open interest rebuilding, Solana's proving it's more than just an NFT chain.

Wall Street analysts would call this 'price discovery.' Crypto natives know it's just Tuesday. Either way, the shorts got rekt—and isn't that what really matters?

Each day, Solana inches closer to joining the ranks of crypto’s Big Two, Bitcoin and Ethereum, as both price action and ecosystem momentum start aligning. The recent breakout above $152 has flipped a key resistance zone into support, with price now eyeing $164 as the next major level.

SOL Price Eyes $164 as Key Resistance Breaks

Solana just broke through a major technical resistance, and the chart from Ali Martinez lays it out clean. After consolidating inside a symmetrical triangle for over a week, SOL has now breached above the upper trendline. The breakout happened around the $152 zone, and so far, the price has held above it, confirming the structure shift.

Solana breaks out from a symmetrical triangle, flipping $152 into support as it eyes a MOVE toward $164. Source: Ali Martinez via X

The triangle breakout now opens up a path toward the next technical target at $164, which aligns with previous horizontal resistance levels. This kind of pattern often follows a measured move, and if volume continues to back the rally, SOL could test that target in the coming days. The key now is for the price to hold above $152 to $153, turning it into fresh support.

Solana Shorts Face $12.7M Liquidation as Bulls Regain Control

The crypto market just saw one of its biggest shakeouts in weeks, with over $460 million in short positions liquidated in 24 hours. Bitcoin led the bloodbath at $233M, followed by Ethereum’s $151M. But it wasn’t just the majors, Solana shorts took a $12.72M hit as price broke out from a key resistance zone. The scale of this liquidation shows how quickly sentiment flipped as prices climbed past critical technical levels.

Solana shorts face $12.7M in liquidations. Source: Coin Bureau via X

For Solana, the short squeeze came right as it confirmed a breakout from a months-long triangle pattern. With bears forced to cover and momentum building, SOL is now trading above $152 and eyeing the next resistance around $164.

SOL Solana Price Structure Starting to Flip Bullish

Following the sharp breakout above $152 and a major short squeeze, Solana’s price action is now drawing attention from both analysts and ecosystem watchers. As highlighted by 0xGumshoe, Solana price is now consolidating in the $150 to $160 range, a zone that’s now starting to look like a potential launchpad.

Solana consolidates between $150 to $160, setting up a potential launchpad for its next move. Source: 0xGumshoe via X

With attention shifting to ecosystem catalysts like the upcoming launch of PUMP, Solana’s ability to hold this zone could give bulls the confidence to step in with more aggression. For now, the base is forming, and if it holds, it could mark the foundation for the next push toward $180 and beyond.

SOL Staking Hits New All-Time High, Underscoring On-Chain Confidence

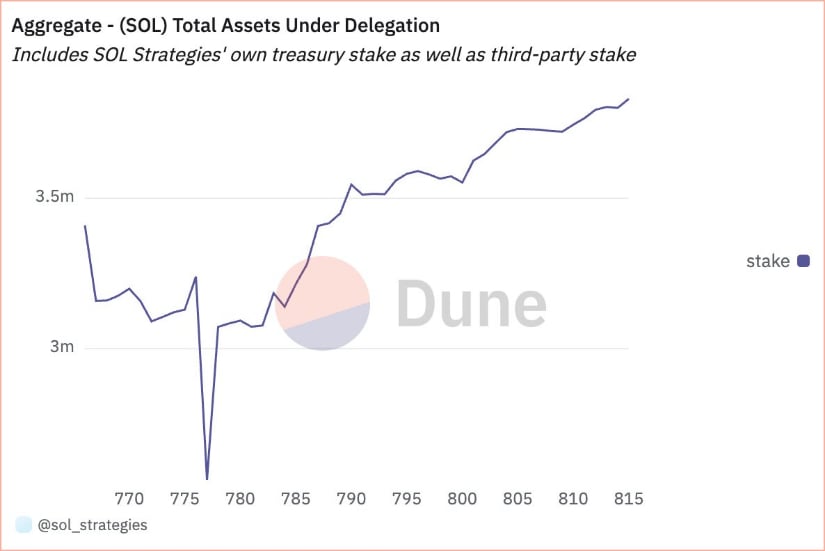

While Solana’s price structure continues to firm up above key resistance zones, the on-chain story is quietly strengthening as well. According to SOL Strategies, total delegated stake just hit an all-time high of 3.83 million SOL, up over 30,000 SOL from the previous count.

Solana staking hits a record 3.83 million SOL. Source: SOL Strategies via X

This aligns well with the recent technical setup, as more stake often reflects deeper conviction from both retail and institutional sides. When price is building a base and staking activity is climbing, it often means the network is entering a healthier phase.

Adding to the on-chain triggers, solana ETFs are also picking up. Famous ETF analyst Eric Balchunas pointed out that the newly launched $SSK fund alone absorbed $20 million in a single day, pushing its AUM over $40 million. Collectively, the three Solana-linked ETFs have brought in $80 million over the past month, doubling their total assets. While these numbers are still small compared to BTC or ETH funds, the steady inflows suggest growing institutional activity around Solana.

Solana-linked ETFs pull in $80M over the past month, with $SSK alone absorbing $20M in a single day. Source: Eric Balchunas via X

Final Thoughts

Solana’s recent breakout is more than just a chart pattern; it’s a sign of growing confidence across the board. From $12.7 million in short liquidations to record-breaking staking levels and rising ETF flows, the momentum is shifting. The price structure is tightening in a bullish way, and the ecosystem is showing real strength beneath the surface.

If SOL can continue holding the $152 to $153 zone as a new support, the path toward $164, and possibly even $180, starts looking a lot more realistic.