🚀 Bitcoin Shatters ATH as Trump Demands Fed Rate Cuts—Again

Bitcoin just bulldozed through its previous all-time high—and Washington's drama might be fueling the rally. President Trump's latest pressure campaign on the Fed sends shockwaves through traditional markets, while crypto traders shrug and buy the dip.

The Fed vs. The Orange Swan

Another day, another presidential tweetstorm demanding rate cuts. This time, Bitcoin's price action seems to be front-running the monetary policy chaos—classic crypto.

Digital Gold 2.0

While fiat currencies play musical chairs with interest rates, BTC's hard cap looks increasingly attractive. Who needs yield when you've got 10x volatility and a president live-tweeting your macro strategy?

Wall Street analysts scramble to update their 'Bitcoin is dead' PowerPoints—right after finishing their third margarita of the afternoon.

Bitcoin soared to $113,788 on Thursday, according to BNC data, cementing a fresh all-time high and continuing a remarkable rally that has seen the world’s largest cryptocurrency break out of its recent sideways trading range. The price is now up 3.5% on the day. Now is the time to buy Bitcoin and crypto as the bull run begins.

Bitcoin has entered price discovery mode with new all-time highs on Thursday, Source: BNC Bitcoin Liquid Index

The surge coincides with a vocal push from President Trump, who took to his platform Truth Social to trumpet the performance of digital assets and equities and call for the Federal Reserve to lower interest rates.

“Tech Stocks, Industrial Stocks, & NASDAQ, HIT ALL-TIME, RECORD HIGHS!” the President posted on Truth Social.

Trump’s comments are part of a broader and sustained campaign against Fed Chair Jerome Powell, whom he has previously derided as a “loser” and “stupid.” On Thursday, TRUMP escalated his criticism, saying Powell’s firing “cannot come fast enough.”

While no U.S. president has ever successfully fired a Fed chair mid-term, the mere suggestion has rattled markets and drawn scrutiny from legal scholars and economists.

Despite market turbulence earlier this year, triggered in part by Trump’s aggressive tariff policies, crypto and stocks have since staged a robust comeback. The resilience is partly attributed to the growing institutional appetite for digital assets, particularly bitcoin ETFs.

Spot Bitcoin ETFs Attract Big Inflows

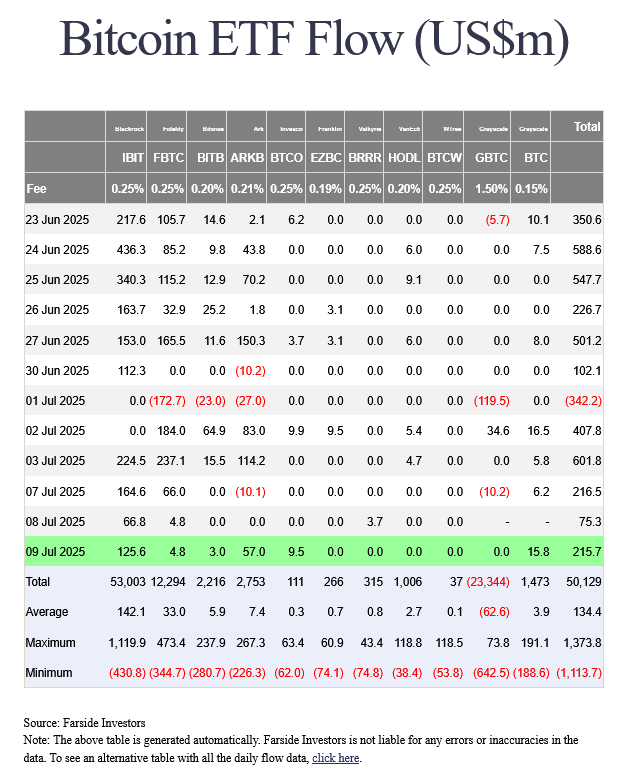

On that front, U.S. spot Bitcoin ETFs have now passed $50 billion in cumulative net inflows, just 18 months after their launch in January 2024. The BlackRock iShares Bitcoin Trust ETF (IBIT) leads the pack, pulling in a staggering $53 billion. Fidelity’s Wise Origin Bitcoin Fund (FBTC) follows with $12.29 billion.

By contrast, Grayscale’s Bitcoin Trust ETF (GBTC) experienced a sharp reversal, recording $23.34 billion in outflows, according to data from Farside Investors.

Meanwhile, IBIT has made ETF history, becoming the first Bitcoin fund to hold over 700,000 BTC, representing more than 55% of all BTC in spot Bitcoin ETFs. The fund’s explosive growth has been so pronounced that BlackRock is now reportedly earning more annual revenue from IBIT than from its flagship S&P 500 fund, the iShares Core S&P 500 ETF.

Huge inflows continue for the Bitcoin ETFs, Source Farside

While the Federal Reserve began hiking rates in 2022 to combat the highest inflation in four decades—putting downward pressure on both equities and crypto—the central bank has since shifted gears. It enacted some cuts in 2024 but has been reluctant to go further, citing macroeconomic uncertainty.

Trump’s latest pressure campaign could shift that stance—or further entrench Powell’s resistance. Either way, markets are betting on volatility, and Bitcoin, true to form, is loving the chaos. If you’ve been asking if now is the right time to buy Bitcoin and crypto, it is clear that a new bull market is underway. Bitcoin tends to lead, altcoin season tends to follow. New Bitcoin price predictions suggest price targets up to $200,000 in 2025.