🚀 Dogwifhat (WIF) Primed for Breakout: Bullish MACD & $517M Volume Fuel Rally Past $0.95

Dogwifhat (WIF) isn't just barking—it's biting into a bullish uptrend. Technical indicators scream green as trading volume hits $517 million, painting a target above $0.95.

The MACD Doesn't Lie

A golden cross on the Moving Average Convergence Divergence (MACD) chart signals growing momentum. Traders are piling in, betting against the skeptics who still think meme coins are just internet jokes.

Volume Talks, BS Walks

Half a billion in daily volume? That’s not retail FOMO—that’s smart money positioning. Whether it’s hedge funds or degens, someone’s loading up for the next leg up.

The Cynic’s Corner

Sure, traditional finance will clutch its pearls. Meanwhile, WIF holders might just laugh their way to the bank—again.

The token’s latest movement above $0.95 comes amid increasing volume and momentum, triggering renewed market focus. With bullish indicators emerging across multiple timeframes, traders are watching closely for confirmation above the key $1.00 level.

Analyst Chart Highlights Key Breakout Level at $1.04

According to the 4-hour chart analysis shared by a prominent crypto analyst, WIF/USDT has transitioned from a series of lower highs and lower lows into a more neutral trend structure, with signs of a potential reversal.

The most recent higher low (HL) has set the stage for a MOVE toward a higher high (HH), signaling that bearish pressure may be weakening. The chart identifies $1.04 as a key breakout level, where a successful breach followed by a retest could confirm a bullish continuation.

Source: Chart by @best_analysts

Volume has started to increase NEAR this resistance zone, suggesting rising interest among buyers. The analyst outlines a tiered take-profit strategy, with targets placed at $1.7731, $2.1319, and $2.6151, and an ultimate target near $2.9874.

A stop-loss level is defined at $0.8231, placed just below recent support, indicating a risk-managed setup. The setup reflects cautious optimism, with clear entry, exit, and validation points based on price behavior around $1.04.

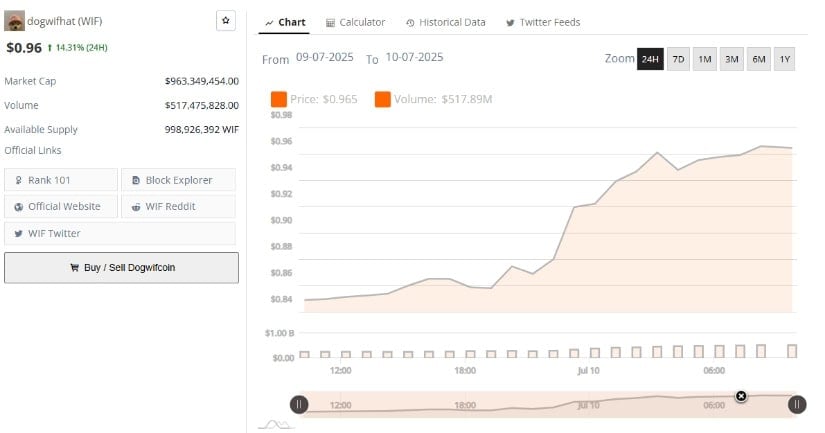

Brave New Coin Chart Shows 14% Daily Gain and Accumulation Zone

Additionally, BraveNewCoin’s 24-hour chart reveals a significant upward move in WIF, with the price rising by over 14% to reach $0.965. This rally started after a prolonged period of low volatility near the $0.84 mark and was supported by trading volume that peaked at $517.89 million. The volume surge began around the $0.88 level, which marked the initial breakout zone and was followed by sustained buying activity throughout the session.

Source: Chart by BraveNewCoin

The volume pattern suggests healthy accumulation rather than a brief speculative spike. Even as the price moved past $0.96, volume held steady, indicating that the rally was underpinned by consistent demand. Market participants appear to be positioning for a test of the $1.00 level, with $1.10 identified as the next resistance zone based on prior price action. The lack of major retracements during this rise supports a short-term bullish outlook.

TradingView Indicators Confirm Bullish Momentum at Key Resistance

On the other hand, the daily chart for WIF/USDT, as presented on TradingView, shows the price trading near $0.952 with interaction at the upper Bollinger Band at $0.982. The widening of the Bollinger Bands suggests an increase in volatility, and the price maintaining above the basis line at $0.838 reinforces bullish momentum. The most recent daily candles show minor hesitation near resistance, but no significant pullbacks have yet developed.

Source: Chart by TradingView

The MACD indicator supports the bullish narrative with a positive crossover; the MACD line at 0.015 has crossed above the signal line, which currently sits at 0.000. This crossover is accompanied by rising green histogram bars, suggesting that buying momentum is building.

WIF’s recent price movement also indicates a breakout from its previous consolidation range. A daily close above $0.98 with sustained volume could validate a continuation toward the $1.00 psychological level and possibly beyond to retest April’s highs near $1.50.