BTCC Crypto Daily (7.24) | Bitcoin’s Range Volatility Intensifies, Multiple Macro Events Amplify Fluctuations

1.Overview

- Trump: To impose 15%-50% flat tariffs on most countries

- 7 new wallets have accumulated 466,253 ETH in total recently

- The 90-day correlation coefficient between Bitcoin Volatility Index and S&P 500 VIX hits a record high

2.Macro & Policy Outlook

Key Events Today

- Eurozone July Manufacturing PMI will be released today, previous value: 49.5

- Eurozone ECB Deposit Facility Rate will be released today, previous value: 2.0%

- US Initial Jobless Claims for the week ending July 19 (in 10,000) will be released today, previous value: 22.1

- US President Trump will visit the Federal Reserve on Thursday

Global Macro Developments

1.Trump: To impose 15%-50% flat tariffs on most countries

At the AI summit held in Washington, US President Trump stated that the US will impose 15%-50% flat tariffs on most other countries worldwide. He noted, “There are a few countries – we set the tariff rate at 50% because we don’t get along well with them.” Additionally, Trump mentioned that the US is engaged in serious negotiations with the EU, and if the EU agrees to open up to US enterprises, the US will allow them to pay lower tariffs.

2.Third Russia-Ukraine talks yield no results; Trump’s 50-day ultimatum fails to improve the situation

The third round of direct talks between Russian and Ukrainian officials in Istanbul ended with almost no progress, lasting less than an hour. A senior Ukrainian official, Rustem Umerov, stated that there has been no progress on halting hostilities or a ceasefire. Months of efforts and multiple meetings have not brought the conflict closer to an end, and Ukraine’s proposal for a meeting between President Zelenskyy and Putin was rejected by Russia. This deadlock indicates that Trump’s ultimatum last week to Putin – “If no peace agreement is reached within 50 days, 100% tariffs will be imposed on Russia’s major trading partners” – has had no effect.

3.US and EU near a 15% tariff agreement to avoid a sharp tariff hike

According to the Financial Times, the EU and the US are close to reaching a trade agreement that would impose a 15% tariff on European imports, similar to the deal Trump struck with Japan. The agreement will exempt some products from tariffs, such as aircraft, spirits, and medical equipment, and reduce car tariffs from 27.5% to 15%. If no agreement is reached by August 1, the EU will prepare retaliatory tariff measures worth up to 93 billion euros, with a maximum tariff rate of 30%.

4.US Treasury Secretary Yellen: 1-2 rate cuts likely this year

US Treasury Secretary Yellen revealed that the Federal Reserve is expected to cut interest rates 1-2 times this year. Previously, in July, Yellen stated that the Fed is expected to cut rates by September.

5.Goldman Sachs and BNY Mellon launch tokenized money market funds

Goldman Sachs and BNY Mellon have partnered to offer institutional investors access to tokenized money market funds. The project records ownership of money market funds in the form of digital tokens, attracting participation from major fund companies such as BlackRock and Fidelity Investments. The two Wall Street giants believe that tokenization of money market funds will be a significant breakthrough in the digital asset sector, driving the digitization of $7.1 trillion in money market funds. Unlike stablecoins, tokenized money market funds provide returns to holders, making them an ideal tool for cash management.

Traditional Asset Correlation

- The three major US stock indices: Nasdaq +0.61%, S&P 500 +0.78%, Dow Jones +1.14%

- Spot gold: -0.32% to $3,376.61 per ounce

- WTI crude oil (USOIL): +0.53% to $65.72 per barrel

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(As of 14:00 HKT on July 24, 2025)

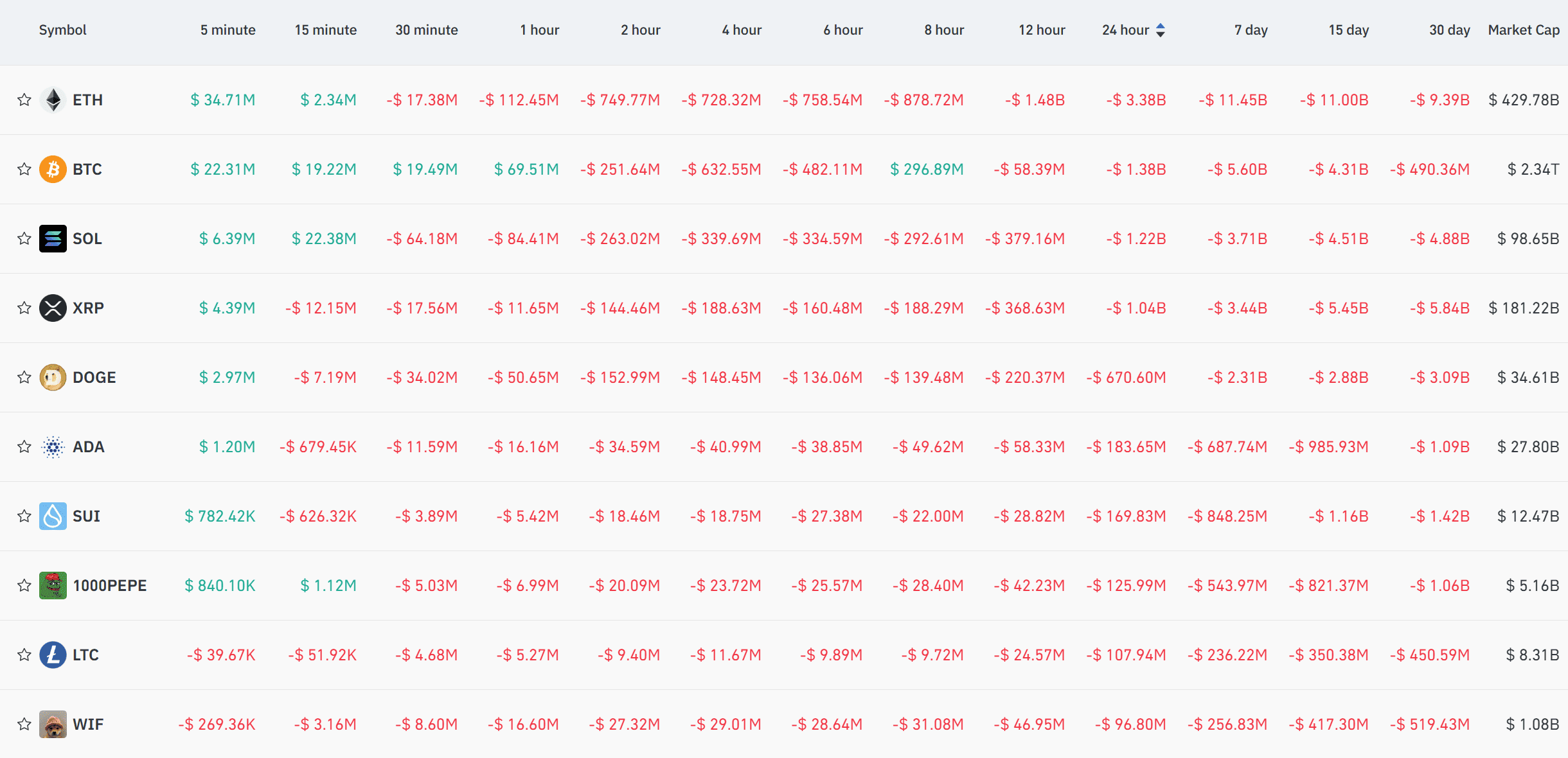

2.Futures Capital Flow Analysis

On July 24, data from Coinglass shows that in the past 24 hours, futures for ETH, BTC, SOL, XRP, DOGE, ADA, and other cryptocurrencies led net outflows, potentially presenting trading opportunities.

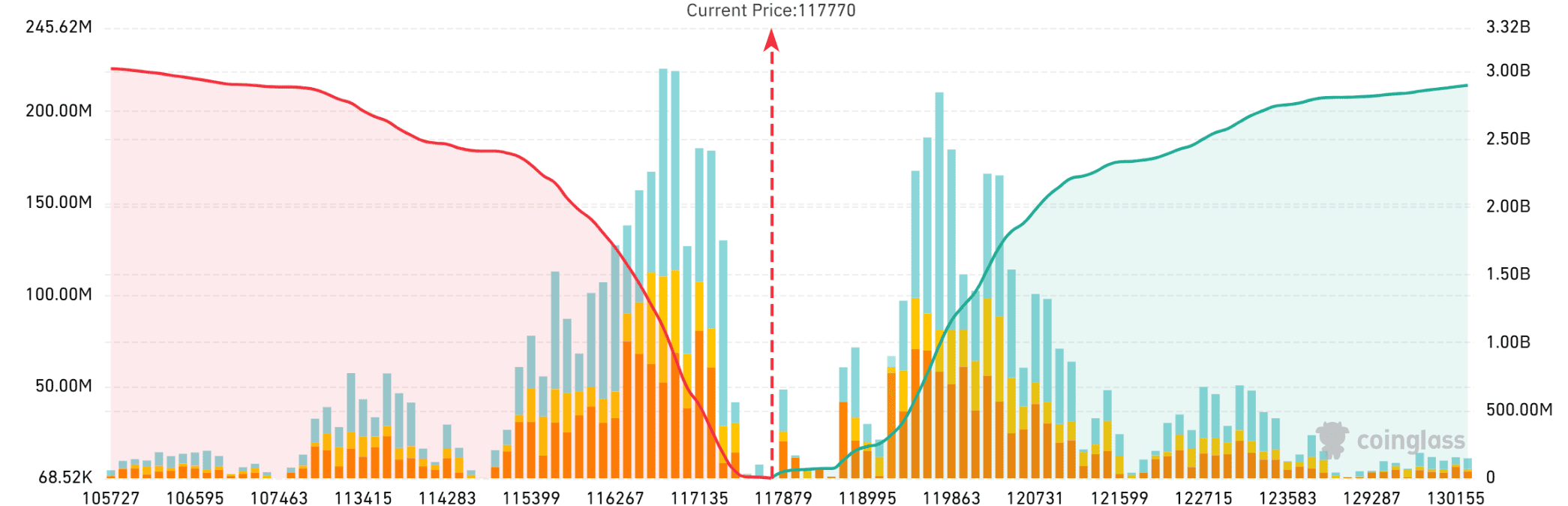

3. Bitcoin Liquidation Map

On July 24, according to Coinglass data, based on the current price of $117,770, if Bitcoin breaks below $116,000, the cumulative long liquidation intensity of major CEXs will reach 1.978 billion. Conversely, if Bitcoin breaks above $120,000, the cumulative short liquidation intensity of major CEXs will reach 1.851 billion. It is advisable to reasonably control leverage ratios to avoid triggering large-scale liquidations amid price fluctuations.

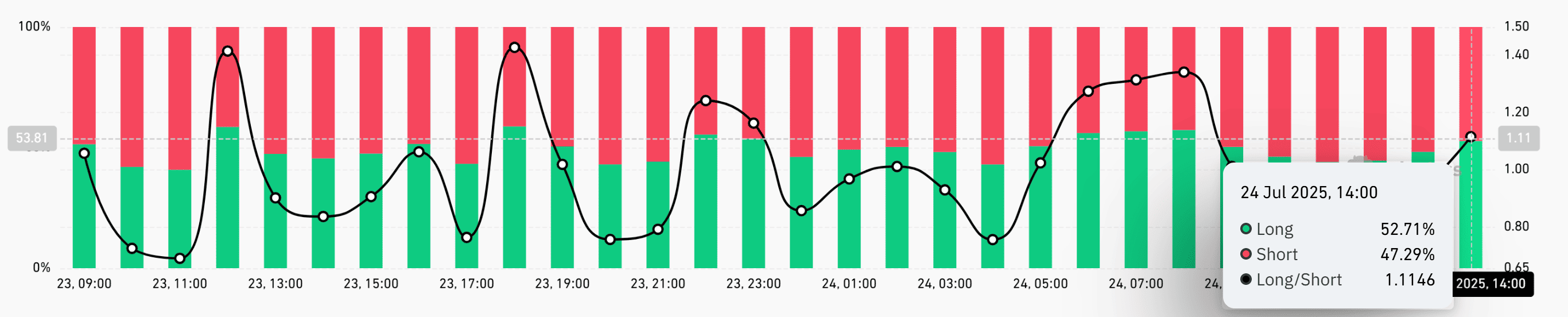

4. Bitcoin Long/Short Ratio

As of 14:00 HKT on July 24, data from Coinglass shows that the global Bitcoin long-short ratio is temporarily 1.1146, with 52.71% long positions and 47.29% short positions.

5. On-Chain Monitoring

- According to @EmberCN, in the past few hours, two addresses suspected of executing the ETH reserve plan have continued to purchase 43,591 ETH (valued at 145 million yuan). One address has accumulated 138,345 ETH since July 19 (valued at 503 million yuan, with an average price of $3,644), while the other has accumulated 58,156 ETH since July 14 (valued at 211 million yuan, with an average price of $3,564).

- According to on-chain analyst @ai_9684xtpa, the futures whale “Xian Ding 10 Ge Da Mu Biao” opened a short position of 5,444.155 ETH, valued at approximately $19.82 million, with an entry price of $3,528.85 and margin of $3.845 million.

- According to Lookonchain, multiple new wallets have cumulatively purchased 40,591 ETH today, valued at $148 million. Recently, 7 new wallets have accumulated 466,253 ETH in total, valued at $1.7 billion.

4.Blockchain Headlines

- The 90-day correlation coefficient between Bitcoin Volatility Index and S&P 500 VIX hits a record high

- Hong Kong Monetary Authority (HKMA): Promoting any unlicensed stablecoin to the public will be illegal starting August 1

- KeyCorp CEO: Will provide corresponding services if customers demand cryptocurrencies

- Grayscale Bitcoin Mini Trust ETF’s AUM exceeds $5 billion

- The Ether Machine holds approximately 170,000 ETH, surpassing Coinbase to rank 4th in Ethereum holdings

- Ethereum spot ETF sees total net inflows of $332 million yesterday, marking 14 consecutive days of net inflows

- Data: Only 12% of Ethereum protocols and 25% of Solana protocols currently generate revenue

- Data: Only 5.3% of Bitcoin’s total supply remains unmined, while over 7.5% has been permanently lost

- Ethereum PoS network exit queue rises to 644,300 ETH, setting the longest waiting time in nearly 1.5 years

- Founder of Asymmetric will lead Accelerate, a new Solana treasury company, aiming to raise up to $1.51 billion

- Asymmetric’s Liquid Alpha Fund closes due to massive losses this year

- Solana plans to increase block limit to 100 million CUs via SIMD-0286

- Appellate court rules NFTs are eligible for trademark protection; Yuga Labs case remanded for retrial

- Tesla’s Q2 earnings report shows its Bitcoin holdings value rising to $1.2 billion

- H100 Group increases Bitcoin holdings by 117.93, with total holdings reaching 628.22

- Co-founder of Pump.fun: No airdrop soon, will share timetable and details as soon as possible

- Block is officially included in the S&P 500 Index today, holding 8,584 Bitcoin

5.Institutional Insights · Daily Picks

- Cryptoquant: Investors are shifting funds from Bitcoin to Ethereum and altcoins; long-term holders are massively transferring their Bitcoin to the market for sale. This distribution is unlikely to completely halt the current uptrend but will only slightly slow its pace.

- Greeks.live: Traders have strong confidence in Bitcoin’s dominance, believing that “Bitcoin is irreplaceable, and others are junk”; opinions on Ethereum are divided, with some believing ETH is undervalued.

- 10x Research: Ethereum’s recent rebound is affected by the unwinding of DeFi leverage trading, facing resistance when technical indicators are overbought. With key long-term downtrends and technical reversal signals emerging, the market faces high correction risks.

6.BTCC Exclusive Market Analysis

Bitcoin is currently quoted at $117,600, with sharp intraday volatility between $170,000 and $190,000. The price continues to trade below the middle band of the Bollinger Bands, with the MA10 and MA20 diverging after a death cross. The K-line oscillates under pressure near the lower band, and bearish momentum is gradually releasing.

Technically, the MACD death cross deepens, and although the green energy 柱 shows signs of convergence, the bearish dominance remains unchanged, suggesting the adjustment period may extend. The CCI indicator hovers in the neutral-low range, failing to reach the oversold threshold, indicating further room for selling pressure. The Bollinger Bands channel has 收口 and tilted downward, with the lower band forming a key support; a valid breakdown will open further downside space.

Short-term traders can deploy shorts based on breakout trends: If a rebound tests $118,000 (near the middle band) and faces resistance, go short with light positions, setting a stop-loss above $118,500. If the price directly breaks below the Bollinger Bands’ lower band ($116,900) with volume, chase the short, with a stop-loss reference above $117,500 – strict position control is required in both cases. Medium-term traders should avoid bearish momentum, and consider long positions only after the price recovers and stabilizes above $118,000 and the moving average death cross is repaired; currently, it is advisable to wait and monitor key support levels.

Recent overlapping macro events have complex impacts on Bitcoin’s trend, including short-term easing of trade policies and long-term uncertainty from high tariffs, which have made capital allocation to risky assets more cautious. Overnight gains in US stocks also reflect institutional capital shifting to US tech stocks. Overall, Bitcoin’s trend is currently more dominated by technical factors, while macro events have amplified volatility – continued attention should be paid to the transmission effects of tariff agreement outcomes and capital flow changes.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]