Nvidia (NVDA) Primed for a ’Beat and Raise’ Q3 Surge—Top Analyst Boosts Price Target

Nvidia’s Q3 earnings are shaping up to be another blockbuster—analysts bet big on another 'beat and raise' performance.

Why the hype? The chip giant keeps defying gravity—while the rest of the market sweats over valuations.

Key drivers: AI demand stays white-hot, data centers keep guzzling GPUs, and gaming isn’t slowing down. No wonder Wall Street’s scrambling to hike targets.

The cynical take? Another quarter, another chance for NVDA bulls to ignore pesky things like 'valuation' and 'mean reversion.' But hey—momentum trades wait for no one.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street expects Nvidia to report a 54.3% year-over-year rise in Q3 FY26 earnings per share (EPS) to $1.25. Revenue is estimated to grow by 56% to $54.62 billion.

Citi Analyst Is Bullish on Nvidia’s Q3 Earnings

Malik expects Nvidia to report Q3 FY26 revenue of $56.8 billion, above the consensus estimate of about $54.6 billion. He expects the company to issue Q4 revenue guidance of $62.6 billion compared to the Street’s expectation of $61.5 billion.

The analyst added that he revised his October-quarter estimates by 11% following Nvidia’s announcement that it has already shipped 6 million units of its Blackwell chips.

Additionally, Malik expects Nvidia to benefit from the continued momentum in B300. He projects NVDA’s data center revenue to grow by 24% and 12% quarter over quarter in Q3 and Q4 FY26, respectively. Also, Malik expects Nvidia to report a 3% and 1% upside to Q3 and Q4 FY26 EPS estimates, respectively, compared to the Street’s expectations.

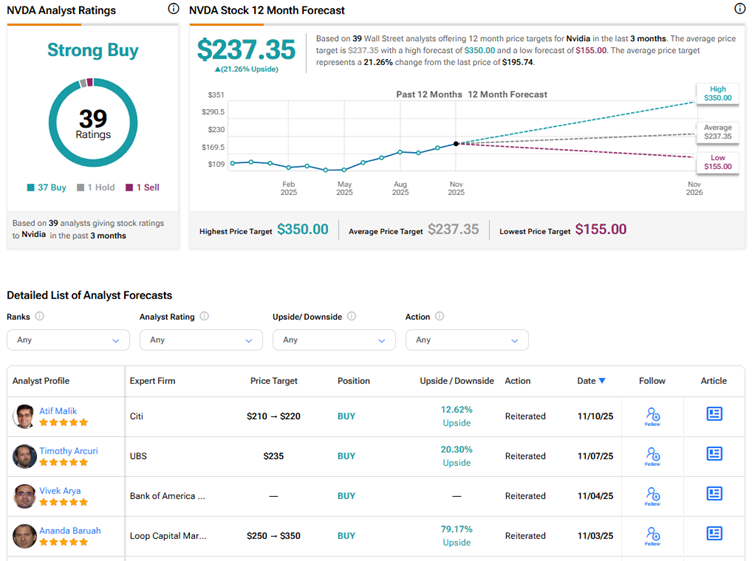

Is NVDA Stock a Buy, Sell, or Hold?

Currently, Wall Street has a Strong Buy consensus rating on Nvidia stock based on 37 Buys, one Hold, and one Sell recommendation. The average NVDA stock price target of $237.35 indicates 21.3% upside potential.