Take-Two Stock (TTWO) Soars as Red Dead Redemption 2 Smashes Records in 2025

Gaming giant Take-Two Interactive rides high as its cowboy epic hits a staggering new milestone.

Wall Street bulls cheer—while skeptics whisper 'pump-and-ranch' tactics.

Red Dead Redemption 2's relentless momentum proves single-player isn't dead—it's printing money.

Analysts scramble to update price targets as TTWO stock defies gaming sector headwinds.

Another win for old-school narrative gaming in an era of microtransaction fatigue.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This saw Red Dead Redemption 2 surpass Nintendo’s (NTDOF) Mario Kart 8 Deluxe, which has sold 78.02 million units. Still above it are Nintendo’s Wii Sports at number three with 82.9 million units sold, Take-Two’s Grand Theft Auto V at number two with 220 million units sold, and Microsoft’s (MSFT) Minecraft at number one with 350 million units sold.

Red Dead Redemption 2’s rise to the number four spot of highest-selling games is worth noting, as the game originally came out on October 26, 2018. Reaching such a milestone more than seven years after its release shows the staying power of the game. The same can be said about Grand Theft Auto V and its number two position on the list. This also means investors can likely expect similar long-term success from Grand Theft Auto VI, which was recently delayed to November 19, 2026.

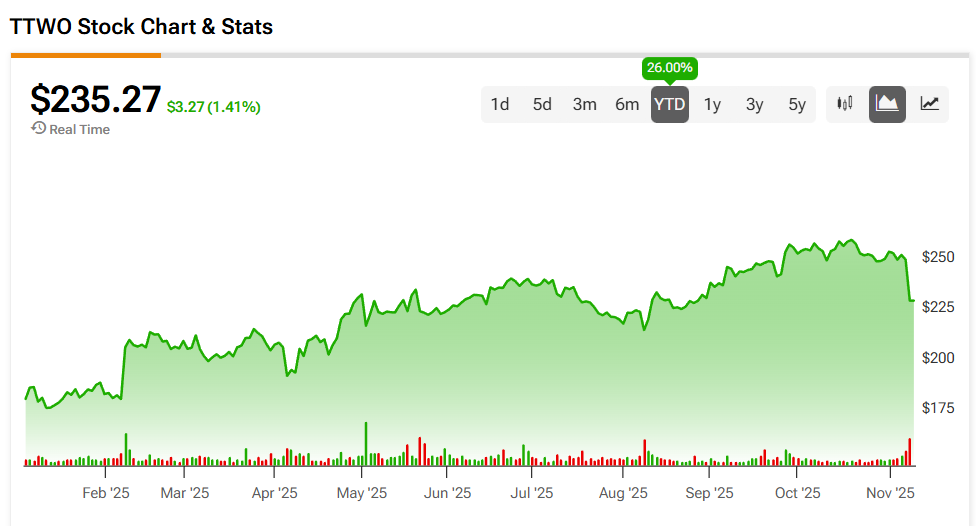

Take-Two Stock Movement Today

Take-Two stock was up 1.41% on Monday, extending a 26% year-to-date gain. The shares have also rallied 29.33% over the past 12 months.

Trading volume today is fairly normal, with some 600,000 shares exchanged as of this writing. For comparison, the stock’s three-month daily average trading volume is about 1.63 million units.

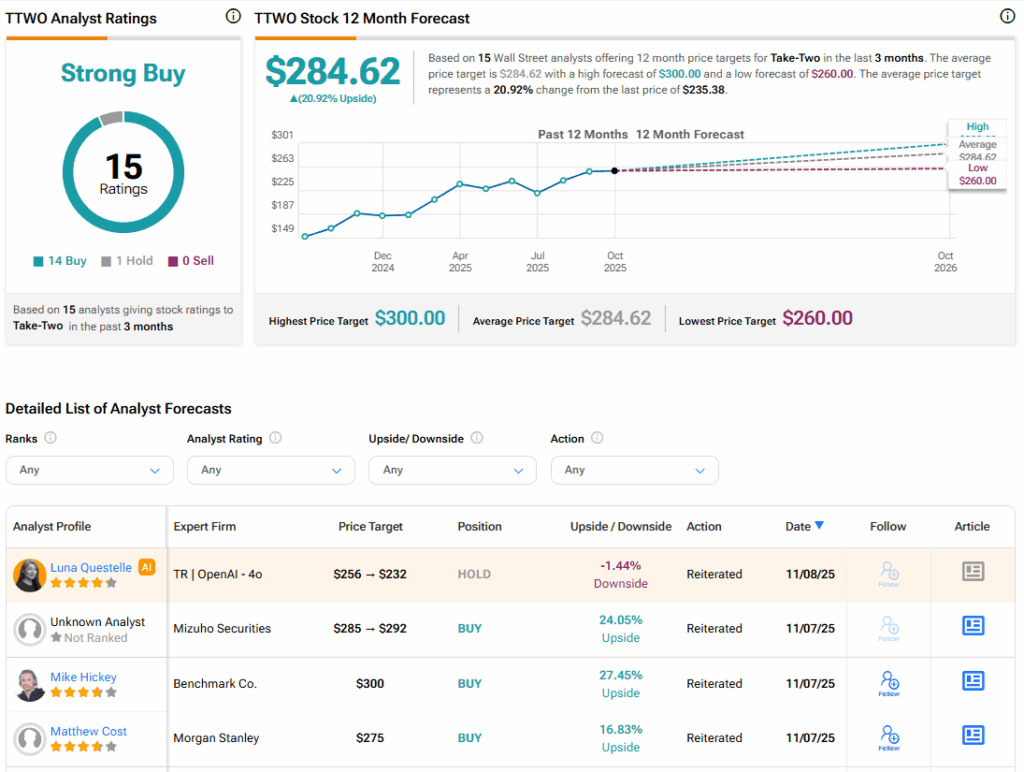

Is Take-Two Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Take-Two is Strong Buy, based on 14 Buy ratings and a single Sell rating over the past three months. With that comes an average TTWO stock price target of $284.62, representing a potential 20.92% upside for the shares.