AI Analyst Picks: 3 Must-Buy ETFs Before 2025 Ends

Wall Street's silicon oracles have spoken—these ETFs are crushing it.

1. The Disruptor's ETF

Tech stacks the odds—this fund bets on AI infrastructure plays most humans haven't even heard of yet.

2. The Inflation Slayer

While the Fed waffles, this basket of commodities and crypto-correlated assets laughs at 8% CPI prints.

3. The Zombie Index Killer

Actively managed algorithms gut underperforming S&P 500 relics—because who needs deadweight in a digital age?

Remember: Past performance may indicate future results, but your broker's fees are guaranteed.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The TipRanks AI analyst has done the legwork, and below we identify three ETFs the analyst ranks with an Outperform rating. These ETFs come with at least a 10% upside potential.

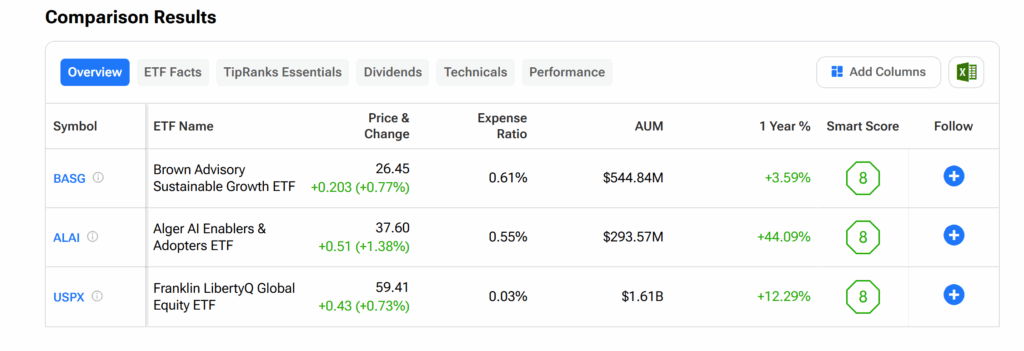

Take a look at the list and chart below to see how these funds stack up.

(BASG) – This ETF focuses on sustainability by emphasizing U.S. companies that have solid accounts and have environmental, social, and governance factors ingrained into their operations. The fund, which has significant exposure to the technology sector, was launched earlier this year and managed by Brown Advisory.

The ETF AI analyst currently has a $30 price target on BASG, suggesting more than 13% upside. The fund’s current Outperform rating is based on solid performance seen since the start of the year from its top holdings. These top holdings include companies such as Nvidia and American tech colossus Microsoft (MSFT).

(ALAI) — As the name suggests, this ETF focuses on companies invested in the development and adoption of technologies reliant on artificial intelligence. It is, therefore, not surprising that the fund — launched in April 2024 by investment firm Alger — heavily leans towards the tech and communication services industry, where the technology is critical.

The ETF AI analyst currently has a price target of $42 on ALAI, suggesting more than 12% upside. The fund’s current Outperform rating is supported by strong results from key holdings such as Nvidia and mobile tech firm AppLovin (APP).

(USPX) — This ETF is based on the LibertyQ U.S. Equity Index, a benchmark that selects and tracks large and mid-cap U.S. companies using qualities such as strong profitability, undervaluation, and solid recent performance. USPX is managed by Franklin Templeton and emphasizes low-cost and tax-friendly access to the U.S. stock market

The ETF AI analyst currently has a $66 price target on USPX, suggesting about 11% upside. The fund’s current Outperform rating is based on solid year-to-date performance from top tech companies in its portfolio, including chipmakers Nvidia (NVDA) and Broadcom (AVGO), and tech giant Alphabet (GOOGL).