Papa John’s Stock (PZZA) Surges 12% Amid Take-Private Buzz – Wall Street Bites Into Pizza Drama

Wall Street’s latest craving? A slice of Papa John’s—served private. Shares of PZZA rocketed 12% on rumors of a buyout offer, proving even pizza chains aren’t safe from Wall Street’s hunger for deals.

M&A Fever Hits Fast Food

Another day, another leveraged buyout target. This time it’s the pizza giant catching heat from investors betting on a premium exit. Because nothing says ‘market efficiency’ like hedge funds playing musical chairs with pepperoni.

The Numbers Don’t Lie

That 12% pop puts PZZA at year-to-date highs—turns out financial engineering still beats actual oven temperatures for cooking up shareholder value. Bon appétit, bulls.

Closing Thought: Maybe they’ll rename it ‘Private Equity John’s’ after the deal closes. Just don’t ask about the debt topping.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Media reports say a group of investors, led by private-equity company TriArtisan Capital Advisors, has made a new offer to buyout Papa John’s shareholders and take the pizza Maker private. Neither TriArtisan Capital or Papa John’s have commented publicly on the media reports.

If true, the new bid to take Papa John’s private WOULD be welcome relief to shareholders, who saw PZZA stock plunge last week after another private equity firm, Apollo Global Management (APO), backed away from a plan to acquire the restaurant chain and take it private, delisting its shares from the Nasdaq (NDAQ) exchange on which it trades.

Offer Details

TriArtisan Capital has reportedly offered $65 a share for Papa John’s. That’s a 58% premium over the closing price of PZZA stock on Nov. 7. The all-cash offer values the U.S. pizza chain at about $2.7 billion, according to estimates.

TriArtisan already has ownership stakes in several well-known restaurant chains, including privately held P.F. Chang’s and Hooters. The company recently struck a deal to acquire restaurant chain Denny’s (DENN) for $620 million, which further grows its footprint in the restaurant sector. Analysts have been quick to say that Papa John’s would fit with TriArtisan Capital’s portfolio.

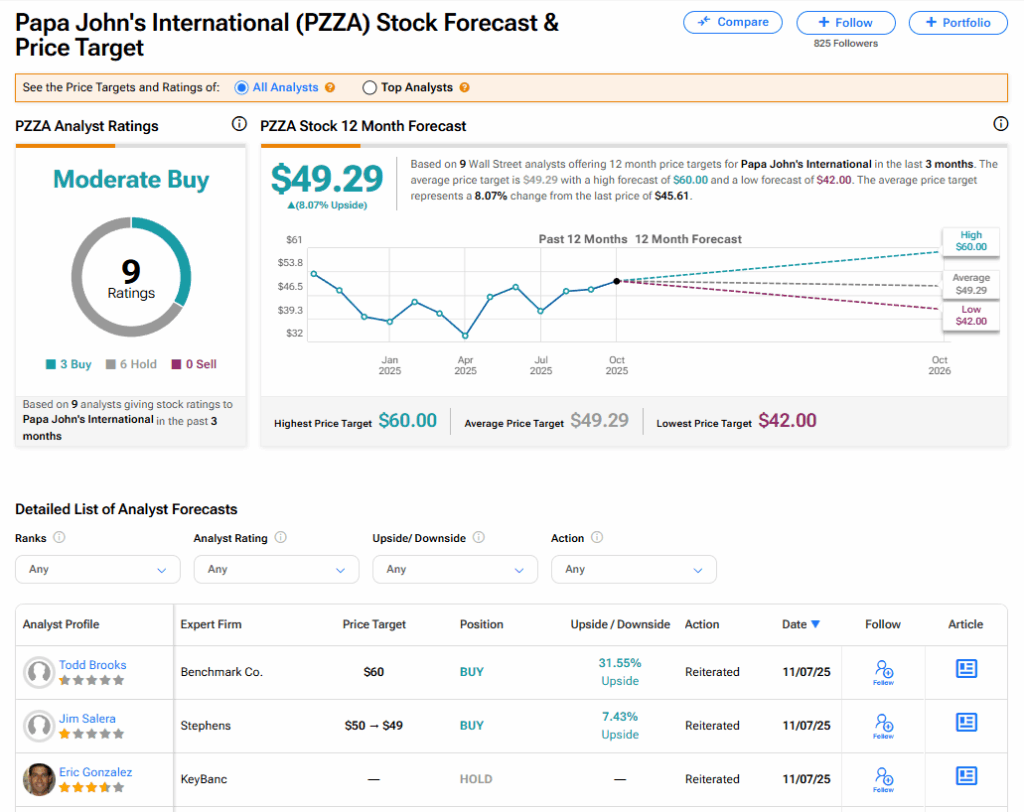

Is PZZA Stock a Buy?

The stock of Papa John’s has a consensus Moderate Buy rating among nine Wall Street analysts. That rating is based on three Buy and six Hold recommendations issued in the last three months. The average PZZA price target of $49.29 implies 8.07% upside from current levels.