Walmart (WMT) Stock Surge: Top Analyst Raises Price Target to $120 Before Q3 Earnings Drop

Wall Street's favorite discount prophet just slapped a fat $120 target on Walmart shares—right as the retail giant preps its Q3 numbers.

Why the bullish bet? Either analysts found a crystal ball in the clearance aisle, or they're betting Main Street will keep panic-buying toilet paper.

Remember: Price targets are like Black Friday sale signs—shiny until you realize everything's 'limited quantity.'

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Why Cowen Is Optimistic About Walmart Stock

Chen expects Walmart to beat Wall Street’s Q3 earnings forecast, supported by growth in advertising and membership income, both of which carry higher profit margins. He slightly lifted his earnings estimate to $0.62 per share, one cent above consensus, and noted that stronger operating margins should help the company outperform expectations.

However, Chen cautioned that valuation remains high, with the stock trading around 35 times forward earnings after a 14% gain this year. He noted that even with strong results, the stock may not MOVE much higher unless Walmart raises its full-year guidance.

Nevertheless, the analyst pointed to Walmart’s growing income from advertising and memberships, which earn higher profits. He said these areas are helping the company handle rising costs and keep earnings steady.

Chen added that Walmart is in a strong position, supported by steady sales, a growing online business, and new income streams that can lift future profits.

Is WMT Stock a Buy or Sell Ahead of Q3?

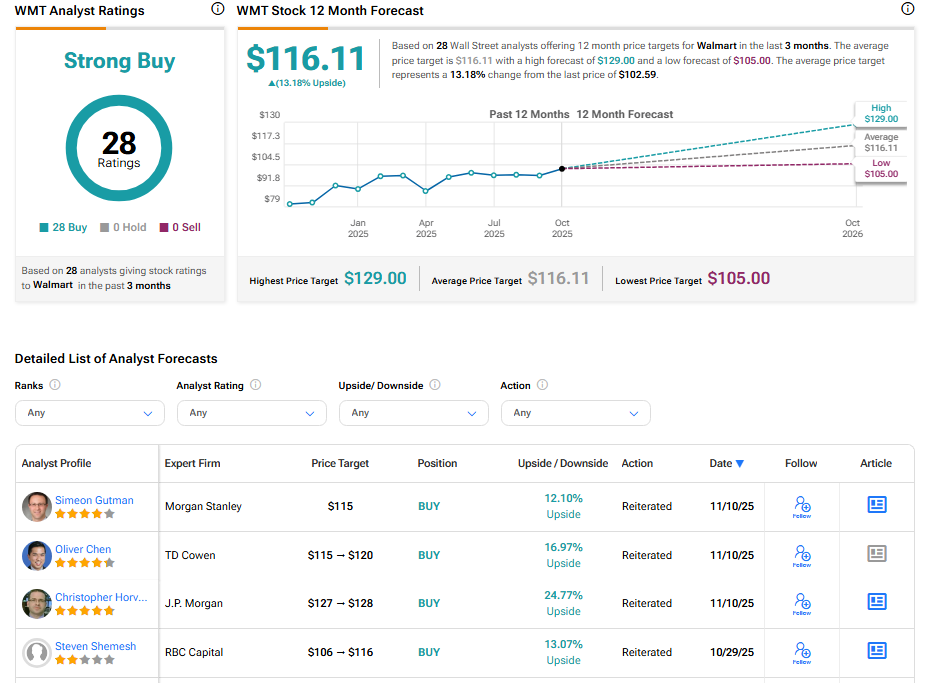

Currently, Wall Street has a Strong Buy consensus rating on Walmart stock based on 28 Buys. The average WMT stock price target of $116.11 indicates 13.18% upside potential from current levels.