Wendy’s Stock (WEN) Takes a Hit as Store Closure Strategy Sparks Investor Jitters

Fast-food chain Wendy’s sees its stock (WEN) dip after announcing plans to shutter underperforming locations—because nothing says 'growth strategy' like retreating.

Wall Street reacts with predictable panic, proving once again that traders have the attention span of a TikTok scroll.

Will this be a temporary setback or the start of a 'flipping burgers to flipping tables' trend? Only time—and next quarter’s earnings—will tell.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

According to Cook, the decision to close Wendy’s stores in the U.S. is due to economic factors, including a drop in same-store sales in the company’s latest earnings report. This has sparked a strategic evaluation of the business, which will target underperforming locations. The CEO expects this to boost same-store sales and profits, as customers will MOVE to other locations within the same markets.

Wendy’s plans to start these store closures in the fourth quarter of 2025. It also intends to continue them into 2026. What’s unclear is how many layoffs will result from these changes. While some staff may be moved to other locations, not all staff will, resulting in layoffs that could hit hundreds of employees, if not more.

Wendy’s Stock Movement Today

Wendy’s stock was down 4.01% on Monday, extending a 44.91% year-to-date drop. The stock has also fallen 52.26% over the past 12 months. These drops came alongside increased competition in the burger market, as traditional restaurant chains have targeted this space with budget offerings.

Is Wendy’s Stock a Buy, Sell, or Hold?

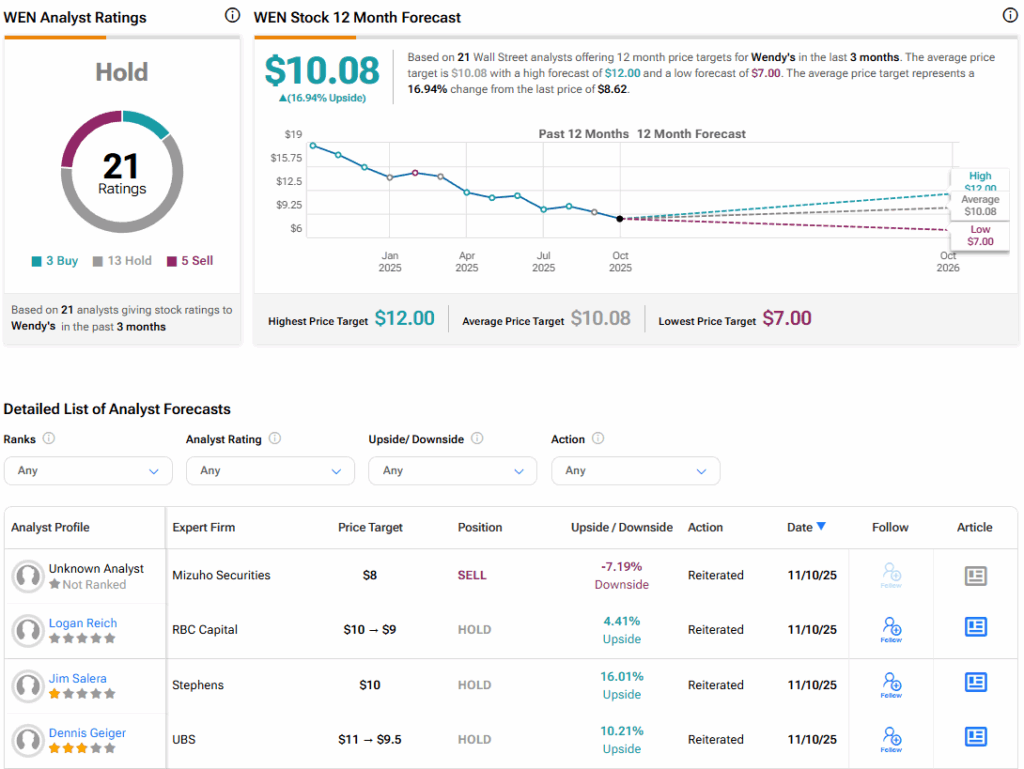

Turning to Wall Street, the analysts’ consensus rating for Wendy’s is Hold, based on three Buy, 13 Hold, and five Sell ratings over the past three months. With that comes an average WEN stock price target of $10.08, representing a potential 16.84% upside for the shares. These ratings and price targets will likely change as analysts update their coverage after today’s earnings report.