XRP Price Prediction 2025: Will the Rally Overcome Key Resistance to Reach $15?

- Technical Analysis: Bullish Signals vs. Resistance Walls

- Institutional Adoption: The $20M Vote of Confidence

- Regulatory Developments: The GENIUS Act Catalyst

- On-Chain Red Flags vs. Bullish Indicators

- Price Targets: Realistic or Overly Optimistic?

- Scam Alert: Rising Threats Amid Price Volatility

- Cloud Mining Innovation: GENIUS-Compliant Options

- XRP Price Prediction FAQs

XRP is showing fascinating technical signals as it trades above critical moving averages while facing stiff resistance levels. With institutional adoption growing (including a $20M corporate treasury plan) and regulatory developments looming, analysts are debating whether the remittance token can sustain its momentum toward ambitious $15 targets. This analysis combines on-chain data, technical indicators, and fundamental catalysts to assess XRP's near-term potential.

Technical Analysis: Bullish Signals vs. Resistance Walls

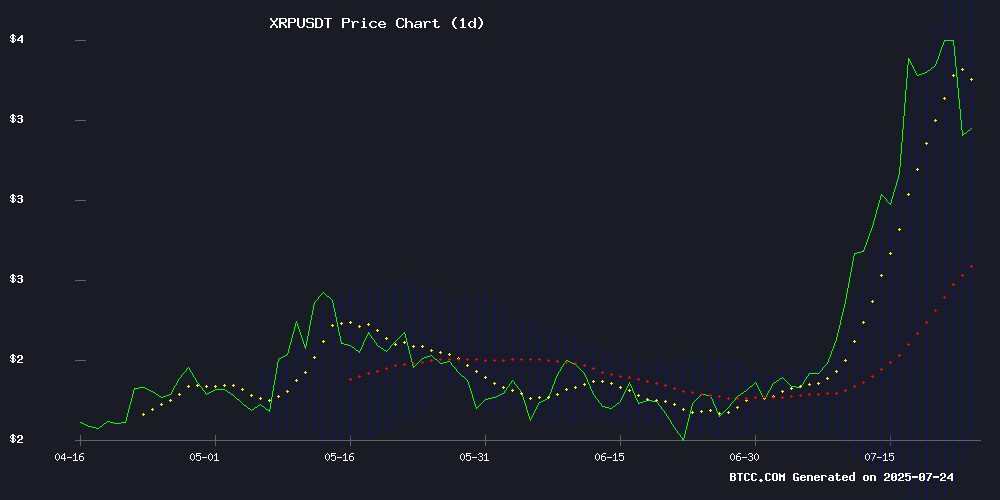

As of July 24, 2025, XRP sits at $3.2158 - comfortably above its 20-day moving average of $2.9259 but facing resistance NEAR $3.8479. The Bollinger Bands ($2.0038-$3.8479) show tightening volatility, typically preceding significant breakouts. "This setup suggests accumulation before potential upward movement," notes the BTCC research team. The MACD histogram shows narrowing bearish momentum (-0.0978), while the RSI at 45 avoids overbought territory.

Institutional Adoption: The $20M Vote of Confidence

Nature's Miracle, a California agrotech firm, announced plans to establish a $20 million XRP treasury reserve through an SEC-approved S-1 registration. CEO James Li stated, "XRP's cross-border efficiency aligns perfectly with our international supply chain needs." The news propelled the company's stock price 150% in a single session, demonstrating market enthusiasm for corporate XRP adoption.

This follows similar moves by VivoPower International ($121M commitment) and Wellgistics Health ($50M crypto treasury). Singapore's Trident Digital leads with plans for a $500 million XRP reserve, signaling growing institutional acceptance.

Regulatory Developments: The GENIUS Act Catalyst

The recently enacted GENIUS Act provides regulatory clarity that's boosting XRP adoption. Legal expert Bill Morgan highlights how Ripple's escrow strategy (reducing holdings from 55B to 35B XRP since 2017) has stabilized prices: "Monthly unlocks are frequently relocked, preventing market oversupply." Meanwhile, ProShares launched the first XRP futures ETF, though the SEC unexpectedly blocked Bitwise's altcoin ETF proposal.

On-Chain Red Flags vs. Bullish Indicators

Conflicting signals emerge from chain data:

- Bearish: Binance exchange reserves hit a YTD high of 2.98M XRP

- Bullish: ChatGPT analysis identifies a Golden Cross formation (50-day MA crossing 200-day MA)

The taker buy/sell ratio below 1 since July 10 suggests short-term caution, but institutional positioning indicates strategic accumulation. "We're seeing healthy correction, not trend reversal," observes market analyst Olivia.

Price Targets: Realistic or Overly Optimistic?

Analysts present divergent outlooks:

| Scenario | Price Target | Timeframe |

|---|---|---|

| Conservative | $5.32 | Q3 2025 |

| Bullish | $15 | 2026 |

| Speculative | $2,000 | 2026 |

Digital Ascension Group's Jake Claver argues macroeconomic shifts could fuel an improbable $2,000 target, while technical analysts focus on the $3.50-$3.85 resistance zone as the immediate battleground.

Scam Alert: Rising Threats Amid Price Volatility

Ripple CEO Brad Garlinghouse warns of sophisticated impersonation scams using AI deepfakes. "If someone promises doubled XRP, it's absolutely fraudulent," he emphasizes. The company is actively reporting fake YouTube channels but urges community vigilance.

Cloud Mining Innovation: GENIUS-Compliant Options

Topnotch Crypto launched the first regulatory-compliant XRP cloud mining contracts featuring:

- 1.2%-1.8% daily yields

- 1-50 day flexible terms

- Multi-signature cold wallet security

This development bridges decentralized finance with regulatory requirements under the GENIUS Act.

XRP Price Prediction FAQs

What is the current XRP price and key technical levels?

As of July 24, 2025, XRP trades at $3.2158. Key levels include support at the 20-day MA ($2.9259) and resistance at $3.8479 (upper Bollinger Band).

What institutional developments support XRP's price?

Major developments include Nature's Miracle's $20M treasury plan, VivoPower's $121M commitment, and Trident Digital's proposed $500M reserve - all signaling growing corporate adoption.

How does Ripple's escrow strategy affect XRP's price?

Ripple has reduced escrow holdings from 55B to 35B XRP since 2017, with monthly unlocks often relocked to prevent oversupply. This disciplined approach supports price stability.

What are the main risks to XRP's price rally?

Key risks include rising exchange reserves (indicating selling pressure), SEC regulatory actions, and the broader crypto market sentiment. Technical resistance at $3.85 also poses a near-term challenge.

Is the $15 XRP price target realistic?

While ambitious, the $15 target WOULD require breaking multiple resistance levels and sustained institutional adoption. More conservative analysts focus on the $5.32 Fibonacci level as the next major milestone.