BTCC Crypto Daily (7.23)|US-Japan Trade Deal Sealed; Ethereum ETF Net Inflows Rank Third Highest in History

1.Overview

- US and Japan reach a trade agreement, lowering reciprocal tariffs to 15%

- Trump: Interest rates should be cut by 3 percentage points to 1% or even lower

- Ethereum spot ETFs saw a net inflow of $534 million yesterday, the third highest in history

2.Macro & Policy Outlook

Key Events Today

- Eurozone July Consumer Confidence Index to be released today, previous value: -15.3

- Trump to speak at an event titled “Winning the AI Race”

- US EIA Gasoline Inventory Change for the week ending July 18 (in 10,000 barrels), previous: 339.9

- Japanese Prime Minister Shigeru Ishiba to meet with EU Commission President Ursula von der Leyen and host the annual summit

Global Macro Developments

1. US-Japan Trade Deal Reached, Tariffs Cut from 25% to 15%

On July 22 (local time), US President Trump announced a trade agreement with Japan. The reciprocal tariffs originally set at 25% will be lowered to 15%. Japan also pledged to invest $550 billion in the US and open up markets such as rice and other agricultural products. Trump stated the agreement would create hundreds of thousands of jobs, and that the two countries also plan to establish an LNG joint venture in Alaska. Japanese Prime Minister Shigeru Ishiba said he would review the agreement details and meet with Trump if necessary, but will not make any personal decisions for now.

2. Powell Makes No Policy Comments During Fed Quiet Period

Fed Chair Jerome Powell gave a welcome speech at a regulatory conference today but did not comment on monetary policy or pressure from the Trump administration. His short remarks provided no signals on interest rates or the economy, as expected, due to the Fed’s blackout period ahead of the July 29–30 FOMC meeting. Powell said he welcomed feedback on banking regulation and capital frameworks.

3. Trump: Rates Should Be Cut by 3 Points to 1% or Lower

Trump criticized Powell for keeping interest rates “too high,” which he says has hurt the housing market. He called for a rate cut of 3 percentage points, ideally down to 1%, and added that Powell would be “out soon.” Treasury Secretary Besant also supported rate cuts, blaming the Fed’s “mission creep” for excessive government spending.

4. Goldman Sachs: Tariffs May Rise to 15%, Critical Minerals Up to 50%

Goldman Sachs Chief US Economist David Mericle forecast that the Trump administration will raise the base “reciprocal” tariff rate from 10% to 15%, with copper and key mineral tariffs reaching 50%. This could intensify inflation and suppress growth. As a result, Goldman adjusted its US macro forecasts: Core inflation: 2025 lowered from 3.4% to 3.3%, 2026 raised from 2.6% to 2.7%, 2027 from 2.0% to 2.4%;

GDP growth: 2025 cut to 1%; tariffs may cumulatively raise core prices by 1.7% over 2–3 years, reducing GDP by 1.0, 0.4, and 0.3 percentage points in 2025, 2026, and 2027 respectively.

5. US Treasury: Tariff Revenue May Reach $300 Billion Annually

Treasury Secretary Besant said tariff revenues are “huge,” possibly accounting for 1% of GDP, and may reach $300 billion annually. Over the next decade, cumulative tariff revenue could total $2.8 trillion. He projected that GDP growth could exceed 3% by Q1 2026. Previously, the Treasury reported tariff revenues surpassed $100 billion in the first seven months of 2025.

6. Korea’s Regulator Limits ETFs’ Holdings in Crypto Stocks

Korea’s Financial Supervisory Service issued verbal guidance to domestic asset managers, prohibiting increased ETF holdings in crypto-related stocks like Coinbase and MicroStrategy. Regulators emphasized that the 2017 “Emergency Measures on Virtual Currencies” remain effective, prohibiting traditional financial institutions from holding crypto directly, obtaining related collateral, or engaging in equity investments. Some Korean ETFs already allocate over 10% to crypto assets, with the “ACE US Top Stocks ETF” holding 14.59% in Coinbase.

Traditional Asset Correlation

- Nasdaq fell 0.39%, S&P 500 dropped 0.06%%, Dow dropped 0.40%

- Spot gold fell 0.20%, to $3,423.99 per ounce.

- WTI crude oil (USOIL) declined 0.06%, to $65.27 per barrel.

3.Crypto Market Snapshot

1. Spot Performance of Major Cryptocurrencies

(as of July 23, 2025, 14:00 HKT)

2.Futures Capital Flow Analysis

According to Coinglass on July 23, ETH, SOL, DOGE, XRP, 100PEPE, and SUI showed the largest net outflows in derivatives trading over the past 24 hours — possibly indicating trade opportunities.

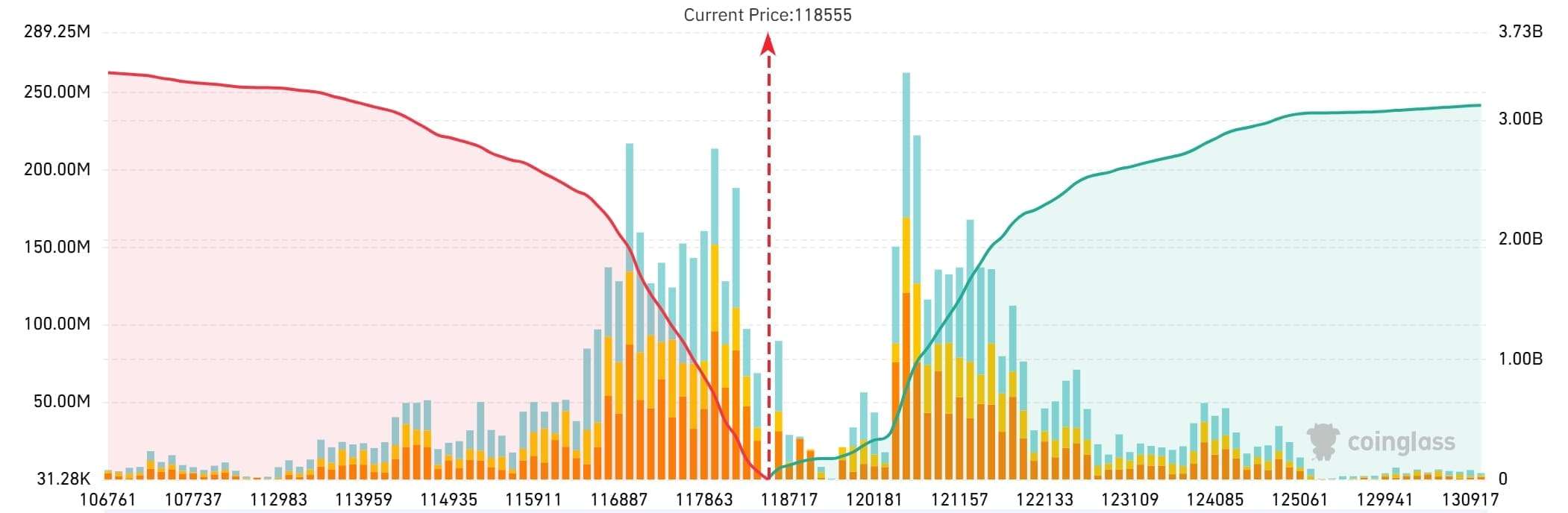

3. Bitcoin Liquidation Map

As of July 23, Coinglass data shows that if BTC falls below $117,000, long liquidations across major CEXs could total $1.936 billion. Conversely, if BTC breaks $122,000, short liquidations could reach $1.942 billion. Leverage should be managed prudently to avoid mass liquidations during price swings.

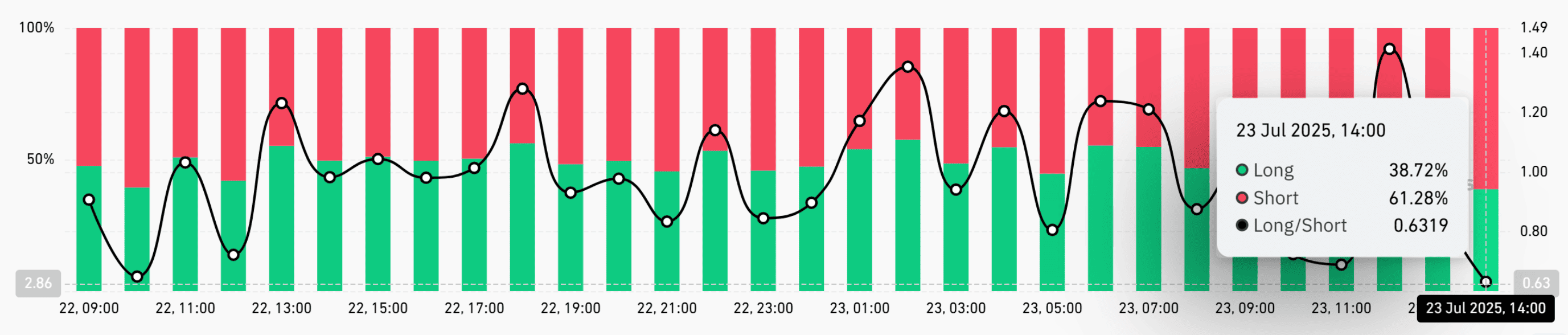

4. Bitcoin Long/Short Ratio

As of 14:00 HKT on July 23, the BTC long/short ratio is 0.6319: long positions account for 38.72%, short for 61.28%.

5. On-Chain Monitoring

- According to on-chain analyst @ai_9684xtpa, a user nicknamed “Set 10 Big Goals” opened a short position of 1,817.69 BTC ($217M), with $36.2M in margin at an entry price of $119,425. The liquidation price is around $133,678.

- @EmberCN: In the past 24 hours, the PENGU deployer address transferred 226.6 million PENGU tokens ($9.05M) to CEXs. Since July 12, it has transferred 1.81 billion PENGU ($54.61M) in total.

- Lookonchain: Three wallets — likely belonging to the same whale — just moved 10,606 BTC ($126M) after 3–5 years of dormancy. All received BTC on December 13, 2020, when BTC was $18,807.

4.Blockchain Headlines

- Korean blockchain infra provider DSRV completes ~$11.6M Series B funding

- Public company MEI Pharma raises $100M in private placement, for Litecoin reserves

- 519,000 ETH queued for exit from Ethereum PoS network

- Ethereum spot ETF net inflows hit $534M yesterday, third highest in history

- Bitcoin spot ETF saw net outflows of $67.93M yesterday; only Grayscale’s GBTC had net inflows

- SpaceX transferred 1,308 BTC ($150M) on Tuesday

- Dan Tapiero launches $500M crypto fund, rebrands firms under new name “50T”

- US SEC approves conversion of Bitwise 10 Crypto Index Fund into an ETF

- PNC, the 8th largest US bank, partners with Coinbase to offer crypto services

- HKMA: Will issue only a few stablecoin licenses initially to avoid excessive speculation

- Citadel Securities urges SEC not to exempt tokenized stocks from securities laws

- “Pudgy Penguins” NFT series turns 4, with ROI on single units reaching 94,780%

- FTX hearing: Creditors in restricted jurisdictions may transfer claims to unrestricted ones

- Six ETF issuers submit amended crypto ETF redemption proposals

5.Institutional Insights · Daily Picks

- CZ: Although uncertain about the accuracy of the Altcoin Season Index on CoinMarketCap, it is trending upward. “FOMO season is coming.”

- Matrixport: Wall Street’s crypto IPO boom and related stock surges could extend the BTC bull cycle.

- Greeks.live: Market sentiment remains bearish, with volatility surprisingly low during sharp price swings.

6.BTCC Exclusive Market Analysis

Bitcoin is currently consolidating around the $118,000 level. After a previous upward breakout, price entered a horizontal range within the Bollinger Bands, with candlesticks oscillating near the mid-band as bulls and bears test strength. The MACD shows a golden cross forming, with rising red bars indicating weakening bearish momentum and initial bullish recovery. However, the golden cross is still shallow — sustained strength will require growing momentum. The CCI is hovering in a neutral-to-low range, showing neither overbought nor oversold conditions, suggesting a period of sideways digestion.

Short-term traders: Watch for Bollinger Band breakout signals.Breakout above the upper band (~$119,713) may justify a light long position.Breakdown below the lower band (~$117,083) with MACD death cross could signal a short opportunity; use mid-band as stop-loss.

Mid-term traders: Wait for clear moving average divergence, MACD golden cross with strong histogram, and watch for breakout of the $117K–$119.7K range. Employ strict risk control.

The US-Japan trade deal reduces bilateral trade barriers and may support economic stability — a factor that could enhance overall risk appetite. While the direct impact on crypto is limited, a more stable macro backdrop could encourage capital flow into diversified assets including Bitcoin.

Risk Warning: The content above is for informational purposes only and should not be construed as investment advice. Investors should conduct their own due diligence and be aware of the high risks associated with cryptocurrency trading.

How to Trade Crypto on BTCC?

This brief instruction will assist you in registering for and trading on the BTCC exchange.

Step 1: Register an account

The first step is to hit the “Sign Up” button on the BTCC website or app. Your email address and a strong password are all you need. After completing that, look for a verification email in your inbox. To activate your account, click the link in the email.

Step 2: Finish the KYC

The Know Your Customer (KYC) procedure is the next step after your account is operational. The main goal of this stage is to maintain compliance and security. You must upload identification, such as a passport or driver’s license. You’ll receive a confirmation email as soon as your documents are validated, so don’t worry—it’s a quick process.

Step 3. Deposit Funds

After that, adding money to your account is simple. BTCC provides a range of payment options, such as credit cards and bank transfers. To get your money into your trading account, simply choose what works best for you, enter the amount, and then follow the instructions.

Fiat Deposit. Buy USDT using Visa/Mastercard (KYC required).

Crypto Deposit. Transfer crypto from another platform or wallet.

Step 4. Start Trading

If you wish to follow profitable traders, you might go for copy trading, futures, or spot trading. After choosing your order type and the cryptocurrency you wish to trade, press the buy or sell button. Managing your portfolio and keeping track of your trades is made simple by the user-friendly interface.

Look more for details: How to Trade Crypto Futures Contracts on BTCC

BTCC FAQs

Is BTCC safe?

Based on its track record since 2011, BTCC has established itself as a secure cryptocurrency exchange. There have been no reports of fraudulent activity involving user accounts or the platform’s infrastructure. By enforcing mandatory know-your-customer (KYC) and anti-money laundering (AML) procedures, the cryptocurrency trading platform gives consumers greater security. For operations like withdrawals, it also provides extra security features like two-factor authentication (2FA).

Is KYC Necessary for BTCC?

Indeed. Before using BTCC goods, users must finish the Know Your Customer (KYC) process. A facial recognition scan and legitimate identification documents must be submitted for this process. Usually, it is finished in a few minutes. This procedure has the benefit of strengthening the security of the exchange and satisfying legal requirements.

Because their accounts will have a lower daily withdrawal limit, those who do not finish their KYC are unable to make deposits. It should be noted that those who present a legitimate ID without a facial recognition scan will likewise have restricted withdrawal options.

Is There a Mobile App for BTCC?

Indeed. For users of iOS and Android, BTCC has a mobile app. The exchange’s website offers the mobile app for download. Since both the web version and the mobile app have the same features and capabilities, they are comparable.

Will I Have to Pay BTCC Trading Fees?

Indeed. BTCC levies a fee for trade, just like a lot of other centralised exchanges. Each user’s VIP level, which is unlocked according to their available money, determines the different costs. The BTCC website provides information on the charge rates.

Can I Access BTCC From the U.S?

You can, indeed. According to its website, BTCC has obtained a crypto license from the US Financial Crimes Enforcement Network (FinCEN), which enables the cryptocurrency exchange to provide its services to investors who are headquartered in the US.

According to BTCC’s User Agreement document, its goods are not allowed to be used in nations and organisations that have been sanctioned by the United States or other nations where it has a licence.

BTCC Guide:

How to Trade Crypto Futures Contracts on BTCC

BTCC Guide-How to Deposit Crypto on BTCC?

What is Crypto Futures Trading – Beginner’s Guide

What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

BTCC Review 2024: Best Crypto Futures Exchange

Crypto Buying Guides:

Crypto Prediction:

Ethereum (ETH) Price Prediction 2024, 2025, 2030 — Will ETH Reach $10,000?

Ethereum Price Prediction 2024, 2025, 2030: How High Can ETH Go in 2024?

Bitcoin (BTC) Price Prediction 2024, 2025, 2030 — Is BTC a Good Investment?

Ripple (XRP) Price Prediction 2024, 2025, 2030 — Will XRP Reach $1 After SEC Lawsuit?

Pi Coin Price Prediction 2024,2025,2030 — Is Pi Coin a Good Buy?

Pepe (PEPE) Price Prediction 2024, 2025, 2030 – Will PEPE Reach $1

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]