Bitcoin Price Prediction 2025: Why $150K BTC is Inevitable as Bullish Signals Converge

- Technical Analysis: Why BTC's Chart Structure Screams "Buy"

- Institutional Adoption Hits Critical Mass

- The Digital Gold Narrative Goes Mainstream

- Macro Crosscurrents: The Fed Wildcard

- Frequently Asked Questions

Bitcoin is painting its most bullish technical setup since 2021 as institutional adoption reaches unprecedented levels. With BTC consolidating near $120,000, analysts from BTCC and beyond see multiple converging factors that could propel prices to $150,000 in the coming months. This comprehensive analysis examines the technical indicators, institutional flows, and macroeconomic conditions creating this perfect storm for bitcoin bulls.

Technical Analysis: Why BTC's Chart Structure Screams "Buy"

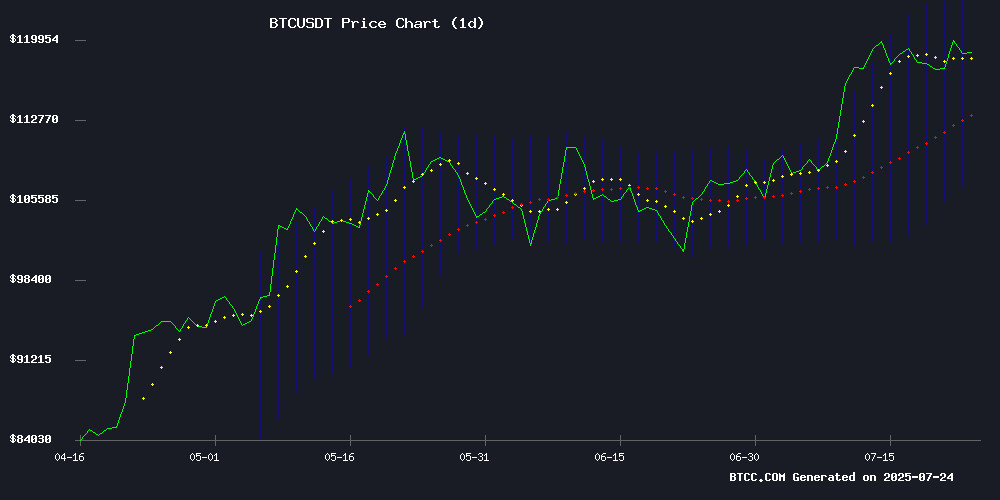

The daily chart reveals Bitcoin trading 2.7% above its 20-day moving average - a classic bullish confirmation signal. The MACD histogram shows a positive crossover, while Bollinger Bands indicate price hovering near the upper band at $123,218. "This is textbook accumulation before a breakout," notes the BTCC research team.

Source: BTCC TradingView

Institutional Adoption Hits Critical Mass

Three seismic developments confirm Bitcoin's institutional thesis:

- Tesla's BTC holdings surged to $1.2B (11,509 BTC) as prices rallied 30% in Q2 2025

- Japan's Kitabo allocated ¥800M ($5.4M) to Bitcoin treasury reserves

- MicroStrategy launched a Bitcoin Defense Unit to accelerate accumulation

The Digital Gold Narrative Goes Mainstream

Anthony Scaramucci's recent Bloomberg interview captured the zeitgeist: "Bitcoin is proving itself as digital Gold faster than we anticipated." The numbers support this:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +2.7% above | Bullish trend confirmed |

| Institutional Holdings | $1.2B (Tesla) | Strong adoption signal |

| U.S. Government BTC | 198,000 BTC | Sovereign validation |

Macro Crosscurrents: The Fed Wildcard

All eyes turn to the July 30 FOMC meeting, where a potential 25-basis-point rate cut could ignite Bitcoin's next leg up. CryptoQuant data shows exchange reserves at multi-year lows - suggesting most holders are waiting for higher prices rather than looking to sell.

Frequently Asked Questions

Is Bitcoin a good investment in July 2025?

With strong technicals, institutional adoption, and favorable macro conditions, Bitcoin presents a compelling case. However, always conduct your own research and consider dollar-cost averaging to mitigate volatility.

What's the most bullish BTC price prediction?

Fundstrat's Tom Lee maintains a long-term $1-3M target, though most analysts see $150,000 as the next major milestone based on current technicals.

Why are corporations buying Bitcoin?

Companies like Tesla and MicroStrategy view BTC as both a hedge against inflation and a high-growth tech asset - what Ark Invest calls the "double-barreled value proposition."