Bitcoin Price Forecast 2025-2040: Will BTC Shatter $123K and Reach $1.5 Million?

- What Do the Charts Say About Bitcoin's Current Trajectory?

- How Are Institutional Players Shaping Bitcoin's Future?

- What On-Chain Metrics Reveal About Market Sentiment?

- How Are Governments Impacting Bitcoin's Trajectory?

- Why Is Bitcoin DeFi (BTCFi) Exploding?

- Bitcoin Price Predictions: 2025-2040 Outlook

- Frequently Asked Questions

As Bitcoin continues its volatile journey, analysts are looking beyond the current $120K price range to predict where the world's leading cryptocurrency might be headed in the coming decades. This comprehensive analysis examines technical indicators, institutional adoption trends, and macroeconomic factors that could propel Bitcoin to $123K in the near term and potentially $1.5 million by 2040. We'll break down the key drivers including Matador Technologies' ambitious accumulation strategy, changing whale behavior, government Bitcoin policies, and the explosive growth of Bitcoin DeFi.

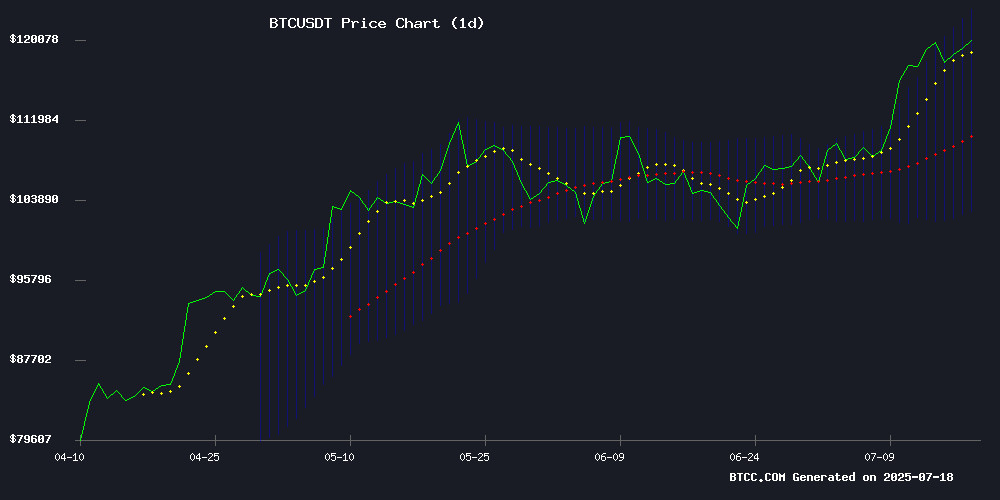

What Do the Charts Say About Bitcoin's Current Trajectory?

Bitcoin is currently trading at $120,355.41, comfortably above its 20-day moving average of $112,961.60 according to TradingView data. The MACD indicator, while still negative at -5,706.53, shows signs of convergence as the signal line (-4,353.22) narrows the gap with the MACD line - a classic sign of weakening downward momentum.

The price is testing the upper Bollinger Band at $123,185.15, which often acts as resistance. A decisive break above this level could trigger a new bullish phase. The middle band at $112,961.60 now serves as strong support, with the lower band at $102,738.05 representing a potential buying zone should a pullback occur.

How Are Institutional Players Shaping Bitcoin's Future?

Matador Technologies' Bold 1% Supply Grab

Canadian firm Matador Technologies has filed a CA$900 million shelf prospectus to fuel its ambitious plan to acquire 6,000 BTC by 2027. Currently holding just 77.4 BTC (~$9 million), this WOULD give them control of approximately 1% of Bitcoin's fixed supply - enough to rank among the top 20 corporate holders globally.

CEO Deven Soni describes their "flywheel" strategy combining direct BTC accumulation, synthetic mining, and DeFi-linked revenue streams. "Our business is structured around bitcoin as a core asset," Soni emphasized in a recent statement.

Adam Back's $3.5B Bitcoin Treasury Venture

Bitcoin pioneer Adam Back is partnering with Cantor Fitzgerald to launch the Bitcoin Standard Treasury Company (BSTR), set to go public via SPAC merger. The firm will debut with over 30,000 BTC ($3.5 billion at current prices), potentially making it the fourth-largest public BTC holder behind MicroStrategy, MARA Holdings, and Tesla.

What On-Chain Metrics Reveal About Market Sentiment?

Glassnode data shows an interesting shift - Bitcoin's rally past $123,000 appears driven largely by new investors rather than institutional whales. First-time buyers accumulated 140,000 BTC in just two weeks, boosting their holdings from 4.77 million to nearly 5 million BTC.

Meanwhile, Binance has seen whale deposits drop by $2.25 billion over 30 days to $4.5 billion. This reduction in exchange inflows typically signals decreased selling pressure, creating a more stable price environment.

How Are Governments Impacting Bitcoin's Trajectory?

U.S. Government's Controversial Bitcoin Sales

Senator Cynthia Lummis has raised alarms after FOIA requests revealed the U.S. Marshals Service currently holds just 28,988 BTC - down from an estimated 198,012 BTC previously under federal control. "This is a total strategic blunder," Lummis declared, warning this could disadvantage the U.S. in the global crypto race.

Potential Tax Exemptions for Small BTC Transactions

The WHITE House is considering a de minimis tax exemption for Bitcoin transactions under $600 to facilitate everyday crypto use. Senator Lummis has proposed even more aggressive reforms, advocating for a $300 threshold and revised taxation of mined assets.

Why Is Bitcoin DeFi (BTCFi) Exploding?

The total value locked (TVL) in Bitcoin-based DeFi has surged from $304.66 million in January 2024 to over $7.117 billion according to DefiLlama. Platforms like Stacks are reporting rapid adoption of Bitcoin-backed assets like sBTC that enable DeFi transactions.

"When everyday users see BTC hit new all-time highs, it creates an opportunity for a second step—Bitcoin DeFi," noted Rena Shah, COO of Trust Machines.

Bitcoin Price Predictions: 2025-2040 Outlook

| Year | Price Target | Key Drivers |

|---|---|---|

| 2025 | $123,000-$150,000 | ETF inflows, halving effects, institutional adoption |

| 2030 | $250,000-$400,000 | Mainstream adoption as collateral, store-of-value status |

| 2035 | $600,000-$1,000,000 | Network effects, possible scarcity premium |

| 2040 | $1,500,000+ | Full monetization, potential global reserve asset status |

These projections assume continued network growth, no catastrophic regulatory changes, and Bitcoin maintaining its dominance in the crypto ecosystem. The $123K resistance remains the key near-term level to watch.

Frequently Asked Questions

What's driving Bitcoin's current price momentum?

The current rally appears fueled by a combination of institutional accumulation (like Matador Technologies' plans), decreased whale selling pressure, and an influx of new retail investors entering the market.

How reliable are long-term Bitcoin price predictions?

While technical analysis can identify trends, long-term predictions remain speculative. Factors like regulatory changes, technological developments, and macroeconomic conditions can dramatically alter Bitcoin's trajectory.

What risks could derail Bitcoin's growth?

Potential risks include regulatory crackdowns, security vulnerabilities, competition from other cryptocurrencies, and macroeconomic factors like interest rate hikes that reduce risk appetite.

Is now a good time to invest in Bitcoin?

This article does not constitute investment advice. Investors should consider their risk tolerance, conduct thorough research, and potentially consult a financial advisor before making cryptocurrency investments.

How does Bitcoin DeFi differ from Ethereum DeFi?

Bitcoin DeFi (BTCFi) leverages Bitcoin's security and liquidity but faces different technical challenges. Solutions like Stacks and sBTC aim to bring DeFi functionality to Bitcoin while maintaining its Core properties.