XRP Price Prediction 2025: Can XRP Hit $4 as Bullish Signals Align with Strong Fundamentals?

- What's Driving XRP's Current Bull Run?

- How Strong Are XRP's Technical Indicators?

- What Fundamental Factors Are Supporting XRP's Price?

- What Are the Key Resistance and Support Levels?

- What Do Analysts Predict for XRP's Future Price?

- What Risks Should XRP Investors Consider?

- Frequently Asked Questions About XRP's Price Movement

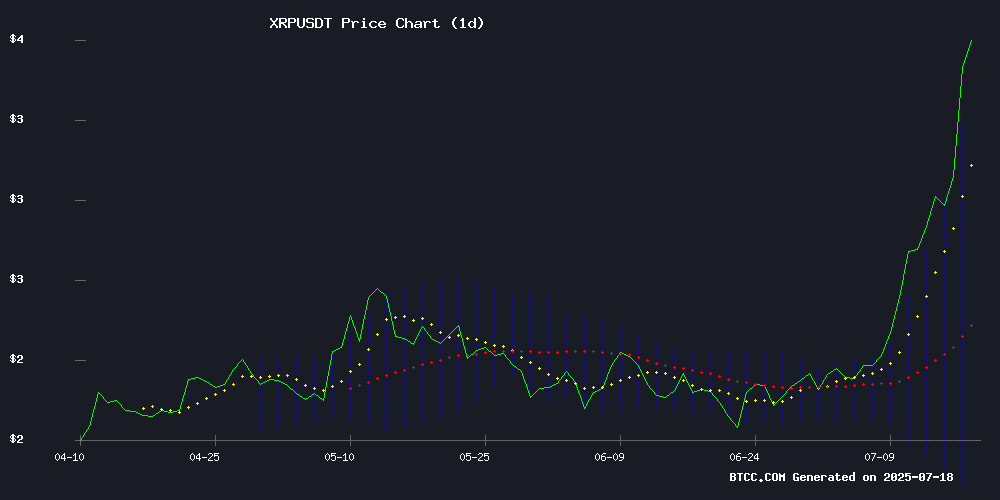

XRP is currently riding a massive wave of bullish momentum, with technical indicators and fundamental developments converging to create what analysts are calling a "perfect storm" for price appreciation. As of July 2025, XRP has shattered multiple resistance levels and is now eyeing the psychologically important $4 mark. The cryptocurrency's recent performance has been nothing short of spectacular - up 500% year-over-year and showing no signs of slowing down. This comprehensive analysis dives DEEP into the technical setup, market sentiment, and fundamental drivers that could propel XRP to new heights in the coming months.

What's Driving XRP's Current Bull Run?

The current XRP rally is being fueled by a powerful combination of technical breakouts and fundamental tailwinds. On the technical side, XRP is trading well above its key moving averages ($3.62 vs. 20-day MA of $2.58), with Bollinger Bands showing sustained upper-band hugging - typically a sign of strong buying pressure. The MACD, while still slightly negative at -0.1726, shows narrowing bearish divergence suggesting weakening downward momentum.

Source: BTCC Trading Platform

Fundamentally, the landscape has never looked better for XRP. Recent regulatory clarity in the U.S. banking sector, expansion into European markets, and Ripple's pursuit of a banking license have all contributed to growing institutional confidence. "We're seeing what happens when years of regulatory uncertainty finally start to clear up," notes a BTCC market analyst. "The market is pricing in XRP's potential to become a major player in institutional cross-border payments."

How Strong Are XRP's Technical Indicators?

Let's break down the technical picture in detail:

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $3.624 | Testing all-time highs |

| 20-day MA | $2.5838 | Strong bullish separation |

| Bollinger Upper Band | $3.4428 | Price hugging upper band |

| MACD Histogram | -0.1726 | Bearish but converging |

| RSI (14-day) | 68 | Approaching overbought |

The technical structure suggests XRP is in a powerful uptrend, though the approaching overbought conditions on the RSI (currently at 68) suggest we might see some consolidation before the next leg up. Key levels to watch include the recent high of $3.66 as immediate resistance, with support now established around $3.30.

What Fundamental Factors Are Supporting XRP's Price?

The fundamental case for XRP has strengthened dramatically in recent months:

- Regulatory Clarity: The U.S. banking regulators (Fed, FDIC, OCC) have issued unified guidance allowing banks to custody digital assets like XRP, removing years of uncertainty.

- European Expansion: Ripple Payments has launched in Europe, accelerating institutional adoption across the continent.

- Banking License Pursuit: Ripple's bid for a national banking charter could revolutionize its business model if approved.

- Institutional Products: The launch of the ProShares Ultra XRP ETF has brought new institutional money into the market.

- Market Recognition: Ripple was named among the world's top fintech companies for the third consecutive year.

These developments have created what market participants are calling a "fundamental floor" for XRP's price. Unlike previous rallies that were purely speculative, the current MOVE has tangible business developments supporting it.

What Are the Key Resistance and Support Levels?

Based on recent price action and technical analysis, here are the critical levels to watch:

- $3.66 (Recent high)

- $3.75 (Psychological barrier)

- $4.00 (Major psychological level)

- $4.80 (Projected target from breakout patterns)

- $3.45 (Recent breakout point)

- $3.30 (Previous resistance now support)

- $3.00 (Major psychological support)

- $2.58 (20-day moving average)

The $3.30 level deserves special attention - it was previously a formidable resistance zone that has now flipped to support. This classic technical pattern often precedes strong continuation moves.

What Do Analysts Predict for XRP's Future Price?

Market analysts have become increasingly bullish on XRP's prospects. Here's a compilation of price predictions from various technical and fundamental perspectives:

| Timeframe | Price Target | Key Drivers |

|---|---|---|

| 2025 | $4.00-$5.50 | Banking license progress, institutional adoption |

| 2030 | $8.00-$12.00 | Mainstream payment adoption, potential ETF approval |

| 2035 | $15.00-$25.00 | Full regulatory clarity, possible central bank adoption |

| 2040 | $30.00-$50.00 | Mature market position, global settlement network |

It's worth noting that these projections assume continued favorable developments in both technology adoption and regulatory environments. cryptocurrency markets remain highly volatile, and investors should approach long-term predictions with appropriate caution.

What Risks Should XRP Investors Consider?

While the current outlook appears bullish, several risk factors warrant consideration:

- Regulatory Setbacks: Any reversal in the current favorable regulatory trends could impact XRP's price.

- Profit-taking: After such a strong run, short-term traders may look to take profits, creating volatility.

- Macroeconomic Factors: Broader financial market conditions could affect crypto markets generally.

- Competition: Other blockchain payment solutions continue to evolve and compete with Ripple's technology.

- Technical Overextension: The current overbought conditions could lead to a corrective pullback.

As always in cryptocurrency investing, proper risk management is essential. The BTCC analyst team recommends: "Never invest more than you can afford to lose, and consider dollar-cost averaging as a strategy to mitigate volatility risk."

Frequently Asked Questions About XRP's Price Movement

How high can XRP go in 2025?

Based on current technical patterns and fundamental developments, analysts project XRP could reach between $4.00 and $5.50 by the end of 2025. The $4 level appears particularly achievable given current momentum.

Is XRP a good investment right now?

While XRP has shown strong performance recently, all cryptocurrency investments carry significant risk. The current technical and fundamental setup appears favorable, but investors should conduct their own research and consider their risk tolerance before investing.

What's driving XRP's price increase?

The rally is being driven by a combination of technical breakouts, regulatory clarity in the banking sector, European expansion, institutional product launches, and growing mainstream adoption of Ripple's payment technology.

Could XRP hit $10?

While $10 seems unlikely in the immediate future, some analysts project XRP could reach $8-$12 by 2030 if current adoption trends continue and the cryptocurrency establishes itself as a mainstream payment solution.

Should I buy XRP now or wait for a dip?

Market timing is extremely difficult. Some technical indicators suggest XRP may be overbought in the short term, which could present a buying opportunity on any pullback. However, trying to time the market perfectly often leads to missed opportunities.