Lighter Token Sets Jan 28 Deadline for LIT Staking in Liquidity Pool

Stake now or miss the boat—Lighter Token just dropped a hard deadline for its LIT liquidity pool rewards.

The Countdown Is On

January 28. That's the final date to lock your LIT tokens into the designated liquidity pool and start earning staking yields. The project is pushing for deeper liquidity, and this deadline is the carrot—or perhaps the stick—to get holders moving.

How the Pool Works

Users provide LIT tokens to the pool, supporting trading pairs and market stability. In return, they harvest rewards directly from protocol fees. It's a classic DeFi play: provide capital, earn a slice of the revenue. The mechanics are straightforward, but the timing is everything.

The Rush for Rewards

Deadlines have a funny way of focusing the mind—and the wallet. Expect a last-minute scramble as passive holders convert into active stakers, chasing those promised APY percentages before the window slams shut. It's the financial equivalent of a midnight oil sale, just with more blockchain.

The Fine Print

Always read the smart contract. Pool participation typically involves locking periods and impermanent loss risks. The rewards are real, but so is the volatility. This isn't your grandfather's savings account—unless your grandfather traded memecoins.

Lighter Token is making a calculated move to boost its ecosystem liquidity by a fixed date. Whether this creates sustainable depth or just a temporary spike is the real question. In crypto, a deadline often generates more action than a roadmap ever could. After all, nothing motivates like a little FOMO—the oldest financial incentive in the book, now running on a blockchain.

Lighter Mandates: Staking to access the Liquidity Pool.

Decentralized Perpetuals Exchange Adds New Use of Native Token.

Decentralized perpetual contracts exchange has officially introduced its Lighter token staking feature, which means that stakes are compulsory condition for users who wish to contribute to the Lighter Liquidity Pool (LLP).

This update makes $LIT a utility asset and is a major change in the liquidity access framework on the platform.

The announcement was also included in the most recent LIT staking news and was confirmed on January 15, 2026.

Source: Official X

LIT Stake on LLP deposits is now mandatory.

In the new system, users will be required to stake tokens to get access to deposits in the LLP. The staking-to-deposit ratio is 1:10.

This rule is already active for new users. Anyone providing liquidations for the first time must complete taking before depositing funds.

For existing LLP depositors, the network has introduced a two-week transition period. During this window, users can keep their funds in the pool without staking. But in or after January 28, 2026, unstaked deposits will not be permitted to stay in the liquidity pool.

Reason for Introducing LIT Staking.

The network states that the new system will make the holders more aligned with liquid providers. This correlation is likely to enhance the risk-adjusted returns and enhance the long-term value.

The LLP is an important part of the Lighter crypto ecosystem. It assists in the production of yields and forms a cushion during liquidations, which assists in stabilizing trading during turbulent market times.

The network also assured that the same staking models can be generalized to other public pools, which supports its mission of democratizing on-chain hedge fund-style models.

Source: X

Additional Benefits for LIT Stakers

Beyond liquidity access, Lighter token staking provides added incentives:

Zero withdrawal and transfer fees for users stakes 100 tokens or more

Yield rewards for stakers (APR to be announced)

Fee discounts for market makers and high-frequency trading firms based on stake levels

Continued zero-fee trading for retail users

The stake feature will also be available on mobile shortly, following the recent launch of the Lighter mobile app.

LIT Tokens Rapid Growth and Market Position

Last month, the protocol released its native token, 50% of the total supply is assigned to ecosystem growth, including incentives and programs associated with the Lighter Token airdrop and future programs after the release.

It also initiated buybacks on January 5, which is in line with its previously stated Lighter Tokenomics model.

This crypto has been expanding fast since it was publicly introduced on its mainnet in October. The platform has recorded more than $200 billion in trading volume each month in December, beating some of the largest competitors. The protocol recently raised $68M at a valuation of $1.5 billion, with Founders Fund and Ribbit Capital leading.

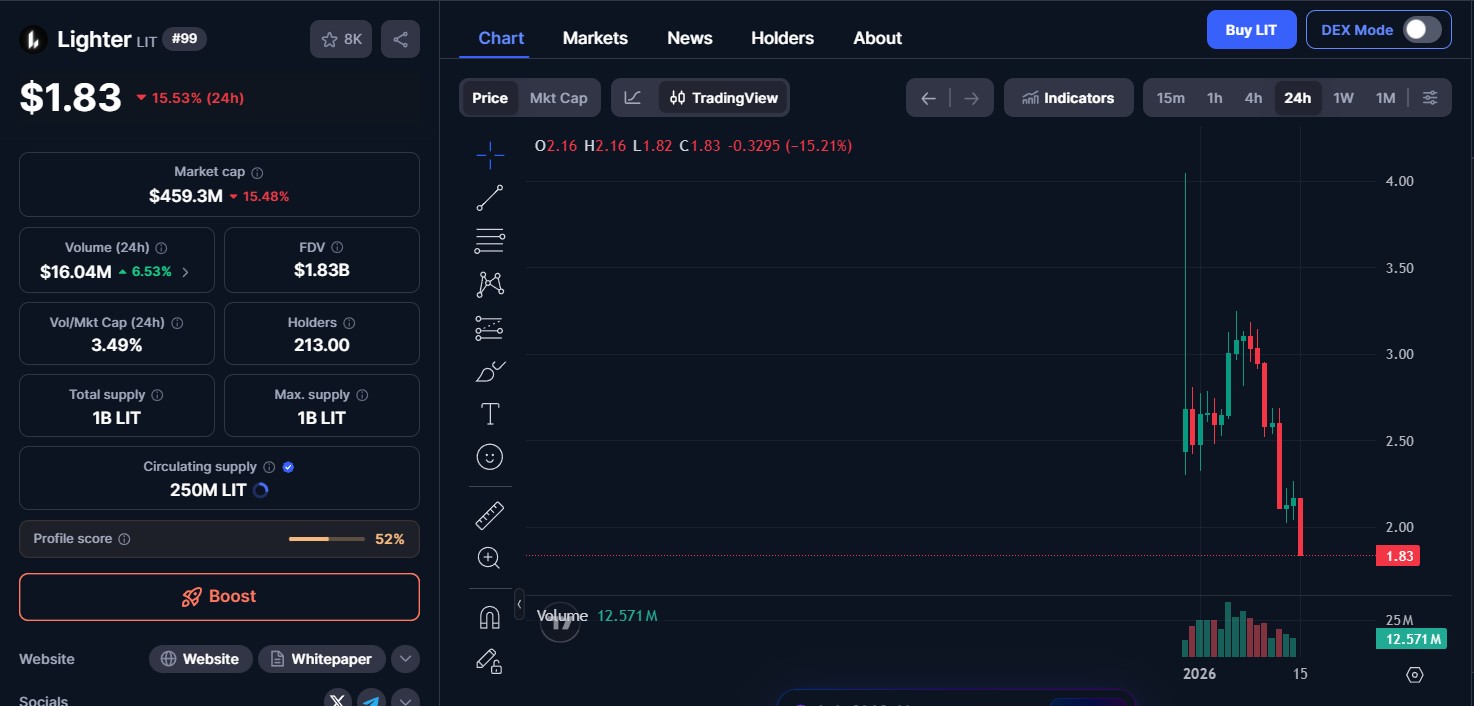

According to the most recent update, the token is trading at around $1.83, down by 15.23%, which is a short-term Lighter coin price movement since the rollout.

Source: coinmarketcap

Conclusion

The transition increases the utility of Tokens, incentives, and the position of the platform in the long-term of the decentralized perpetual trading market.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile, and you can lose your entire investment.