Why Is Crypto Crashing Today? BOJ Rate Hike Sparks BTC, ETH Price Drop

Crypto markets are in the red. The Bank of Japan's long-awaited policy shift has sent shockwaves through global risk assets, and digital currencies are taking the hit.

The Trigger: A Central Bank Breaks Ranks

Forget the Fed for a moment. The real action is in Tokyo. The BOJ's decision to hike rates—ending an era of ultra-loose policy—is a stark reminder that cheap money isn't a permanent global fixture. It's a classic liquidity squeeze: as one major central bank tightens, the speculative fuel for high-risk assets like crypto gets a little thinner.

Market Mechanics: A Flight to (Perceived) Safety

Bitcoin and Ethereum aren't crashing in a vacuum. The move triggered a classic risk-off rotation. Traders are scrambling to price in a new macro reality where Japanese capital might not be as freely sloshing around the system. It's a brutal lesson in interconnectedness—a policy shift aimed at domestic inflation is kneecapping a decentralized, borderless asset class. Go figure.

The Bigger Picture: Volatility Is the Price of Admission

Let's be clear: this isn't a crypto-specific failure. It's a market-wide recalibration. These sharp, news-driven downdrafts are the flip side of the explosive rallies the space is known for. For every moon mission funded by loose policy, there's a gravity check waiting when that policy changes. It's the ultimate proof that crypto, for all its disruptive potential, still dances to the tune of traditional finance's fiddlers—at least for now.

So, is this the end? Hardly. It's just another stress test. The infrastructure holds, the networks keep running, and the long-term thesis remains untouchable by any single central bank. Consider it a fire drill for the next phase of adoption, where real utility, not just cheap money, will dictate value. After all, if your investment thesis evaporates with one rate hike, you were probably just betting on liquidity—a game Wall Street perfected and always wins.

Why Is Crypto Crashing Today? Main Reasons for the Decline

One of the primary reasons for the crash of crypto market today is due to fear related to interest rate decisions by the Bank of Japan. A former board member of the BOJ, Makoto Sakurai, claimed that Japan could increase its core interest rate to 1.0% by mid-2026.

In this case, it leads to an appreciation of the yen and makes liquidity tighter in the global market. Risk assets like cryptocurrency generally react negatively to money policy tightening signals from central banks around the world.

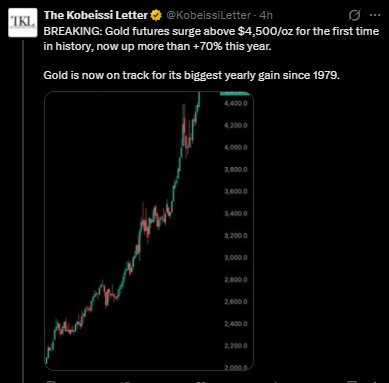

Another reason for the decline in the value of cryptos at present is the record-breaking increase in Gold prices. According to The Kobeissi Letter, the gold futures have broken the all-time high of $4,500 an ounce. Gold has risen by more than 70% so far this year. This year's growth makes it gold’s best performance since 1979.

This is an indicator that investors are redeploying funds towards less-risky physical commodities. When fear escalates, funds usually migrate from risk-sensitive commodities like cryptocurrency to other SAFE havens like gold.

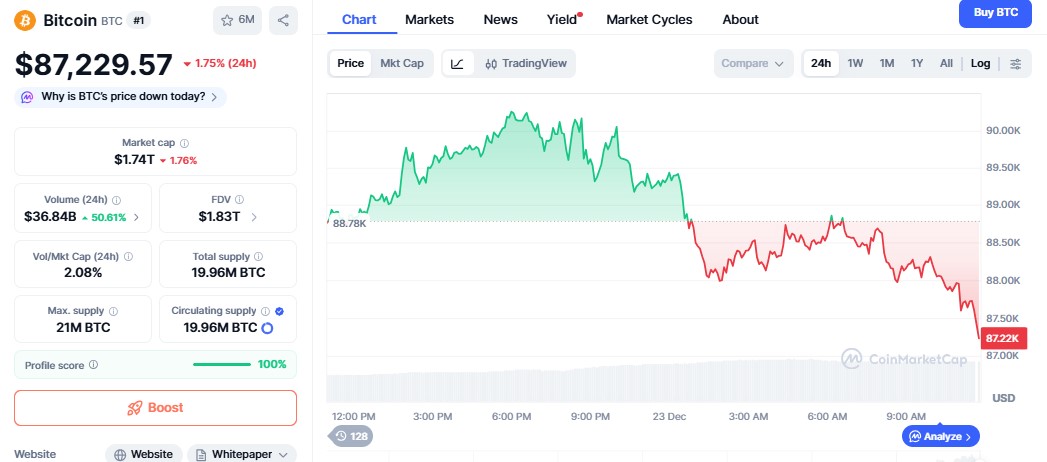

The effect of volatility is reflected in the prices as well. The price crash of Bitcoin affected the prices of this cryptocurrency, making it fall by 1.75% in a day to reach $87,224.28, while its market cap is $1.74 trillion. The decrease in the price of ethereum was even steeper, declining by 2.50% to reach $2,953.32.

Smaller tokens suffered deeper losses. Audiera (BEAT) dropped 16%, Midnight (NIGHT) fell 10%, and Pump.fun (PUMP) slid 9%.

Whale activity added fear. Lookonchain reported that Whale 0xa339 sold 5,306 ETH worth $15.76 million and withdrew another 24,700 ETH from Aave. Another whale sold PUMP at a 62% loss, increasing panic selling.

What Next for Crypto: Santa Rally 2025 Hope Still Alive?

While whales are selling, large players are accumulating. According to Lookonchain, Tom Lee’s Bitmine bought 29,462 ETH worth $88.1 million. AAVE founder Stani Kulechov purchased 32,660 AAVE at $158, despite sitting on unrealized losses.

Trump Media also added 451 BTC worth $40.3 million and now holds over $1.04 billion in Bitcoin. This is a demonstration of strong long-term confidence.

Conclusion

The question of Why is crypto crashing is all about fear, liquidity flows, and short-term market reaction. But institutional buying trends clearly point to this being a reset and not a dead end if market moods turn around. Even then, a “Santa rally 2025” or a “New Year” bounce is possible.

Note that this article does not qualify as an investment advice. Investments in cryptocurrencies are fraught with risks of volatility. Thus, it can be beneficial to do research on the topic before investing.