Strategy USD Reserve Soars to $2.19B as Bitcoin Price Languishes: A Bullish Contrarian Signal?

While Bitcoin's price action looks like a sleepy Sunday morning, one key metric is screaming a different story. The Strategy USD Reserve just blasted past $2.19 billion—a number that should make any serious crypto investor sit up straight.

The Quiet Accumulation Play

Forget the doom-scrolling on price charts. Major players aren't watching; they're buying. That swelling reserve isn't magic—it's capital being strategically parked, waiting for the next move. It's the institutional equivalent of loading the cannon while everyone else debates the weather.

Decoding the Divergence

Price weakness amid massive reserve growth creates a classic tension. History loves these setups. It signals that deep-pocketed conviction is building precisely when retail sentiment is shaky. They're not betting on today's noise; they're positioning for tomorrow's trend.

The Finance World's Ironic Twist

Here's the cynical jab: traditional finance spends millions on research to often be late. In crypto, the multi-billion dollar signal is on-chain for anyone to see—yet most still prefer their narratives served by talking heads on TV.

Weak price? Maybe. But with $2.19B strategically deployed, the smart money is already looking past the current fog. The reserve isn't just a number; it's a loaded spring.

Strategy USD Reserve Grows While BTC Buying Pauses

Michael Saylor’s firm is known for its conviction in the largest cryptocurrency and buying frequently, no matter the price. This time, the company took a brief break in accumulating the crypto asset as prices fell sharply.

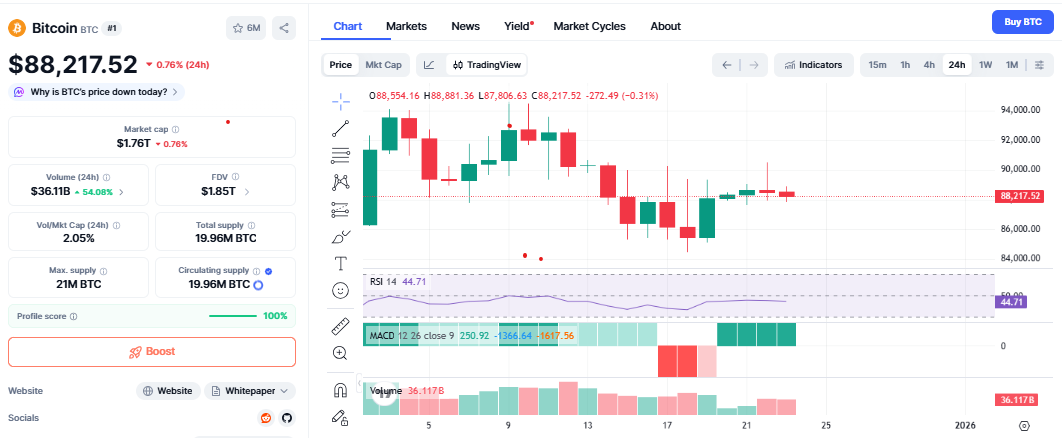

As per the Coinmarketcap, the currency is now trading NEAR $88,000, down almost 30% from its recent high. During this fall, the organisation did not sell any amount of the cryptocurrency. It went on to increase the USD Reserve, strengthening the overall balance sheet.

Source: CMC

This then shows that the cash reserve is put in place for a safety buffer. In essence, the company wants to have enough cash to pay dividends against its preferred stock and interest costs without having to sell coins in a weak market.

How much Bitcoin does Strategy still hold?

The company is holding an immense stash even after halting purchases. The company holds 671,268 BTC worth close to $60 billion at current prices.

This makes them the world's largest corporate holder. So, while for some quarters the cash build-up reflects caution, others see it as smart planning.

BTC maximalists hailed the move, stating this shows long-term confidence. Critics, among them Peter Schiff questioned Strategy why chose dollars instead of gold. Most analysts still believe liquidity is essential during such uncertain times.

Bitcoin Price Today: Why Is BTC Still Under Pressure?

The digital asset is down 0.63% in the last 24 hours and has continued a broader decline seen for the past two months.

New money entering in this cryptocurrency has slowed down.

Strong selling pressure around the $93,000 level

Investors remain cautious, despite long-term interest in ETFs

Technical signals are mixed, pointing at a struggling market, which might see further selling if prices fall below $86,000.

BlackRock Still Supports BTC Long Term

Even with short-term weakness, big institutions have not turned their backs. BlackRock recently highlighted bitcoin as a key investment theme for 2025.

Source: X (formerly Twitter)

Its BTC ETF, the IBIT, still maintains more than 777,000 BTC, indicating large investors still believe in it's future, even if they're cautious for the time being.

Bitcoin Price Prediction: What Comes Next?

Bullish: If it remains above $86,000, it could slowly recover toward a range of $92,000–$93,000.

Bearish: If it falls below that support level, it might force prices closer to $81,000.

Thus, in this uncertain phase, the Strategy USD Reserve gives flexibility to the company to wait, stay calm, and buy this digital currency again when it may feel the time is right.

Conclusion

The increased Strategy USD Reserve to $2.19 billion does not mean that Michael Saylor’s firm is stepping away from the digital asset; rather, it shows balance. With large cash reserves and a huge BTC treasury, the organisation is preparing for both the near-term pressure and long-term opportunity. In a volatile market, that might just turn out to be its biggest strength.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing in crypto markets.