BYND Earnings Shock: Beyond Meat Plunges 15% After Disastrous Q3 Report

Plant-based pain: Beyond Meat's stock tanks as earnings miss burns investors.

Revenue shrivels like week-old lettuce

Another 'growth story' running on hopium—analysts slash price targets amid mounting losses. Meme stock magic wearing thin?

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Looking forward, management now expects revenue for Q4 2025 to be in the range of $60 million to $65 million. For reference, analysts were expecting $70.3 million in revenue.

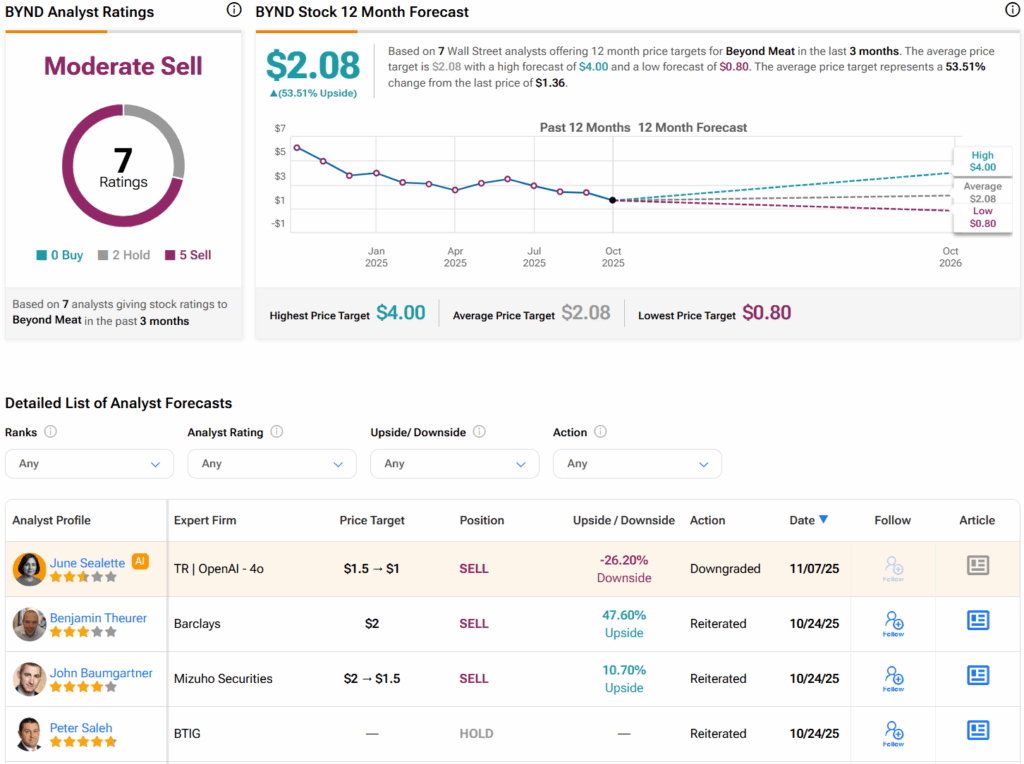

Is BYND Stock a Good Buy?

Turning to Wall Street, analysts have a Moderate Sell consensus rating on BYND stock based on two Holds and five Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average BYND price target of $2.08 per share implies 53.5% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.