SPY ETF Daily Update: Market Pulse on Nov 10, 2025 – What Traders Missed

Wall Street's favorite tracker just flashed its latest signals—bulls and bears are both claiming victory. Here's what really matters.

Volume Tells the Tale

SPY's liquidity crunch hit a 3-month low as institutional players sat on their hands. Retail traders? Still piling in like it's 2021.

Tech Leads (Again)

Big Tech components dragged the ETF up 0.8% while energy stocks bled out—proving once again that 'diversification' means owning seven different cloud computing companies.

Options Frenzy

Nov 12 calls traded at 2x average volume. Someone's betting the Fed's next 'pause' turns into a full surrender.

Remember: This is the market where 'efficient pricing' means guessing what mood Jerome Powell's cat woke up in.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Within SPY’s holdings, the Technology, Consumer Discretionary, Communication Services, and Materials sectors posted gains today, while the Real Estate, Utilities, and Consumer Staples sectors declined.

Importantly, SPY closely tracks the S&P 500 Index (SPX), which ROSE 1.54%. Also, the tech-heavy Nasdaq 100 (NDX) gained 2.2%.

Key Catalysts That Can Move SPY

Looking ahead, potential catalysts for volatility in the SPY ETF are a major lineup of Federal Reserve official speeches, potential updates on the ongoing U.S. government shutdown, and key corporate earnings reports from companies such as Cisco (CSCO) and The Walt Disney Company (DIS).

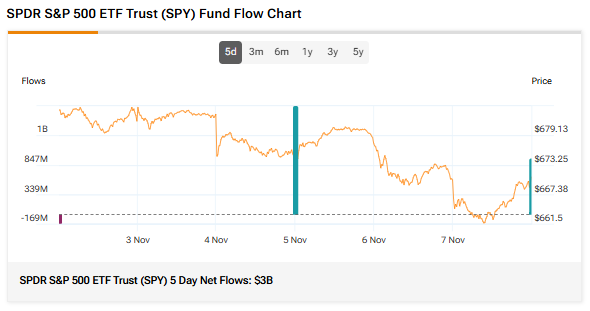

Fund Flows and Sentiment

SPY’s 5-day net inflows totaled $3 billion, showing that investors put capital in SPY over the past five trading days. Meanwhile, its three-month average trading volume is 73.8 million shares.

It must be noted that retail sentiment remains neutral, while hedge fund managers have increased their holdings of the SPY ETF in the last quarter.

SPY’s Price Forecasts and Holdings

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SPY is a Moderate Buy. The Street’s average price target of $779.25 for the SPY ETF implies an upside potential of 14.38%.

Currently, SPY’s five holdings with the highest upside potential are DuPont de Nemours (DD), Loews (L), Fiserv (FI), Moderna (MRNA), and Dexcom (DXCM).

Meanwhile, its five holdings with the greatest downside potential are Paramount Skydance (PSKY), Incyte (INCY), Tesla (TSLA), Expeditors (EXPD), and Ford Motor (F).

Revealingly, SPY’s ETF Smart Score is eight, implying that this ETF is likely to outperform the broader market.