Breaking: IBIT ETF Makes Waves on November 11, 2025 – What You Need to Know

IBIT ETF shatters expectations as institutional money floods crypto markets.

Wall Street's latest darling—the IBIT Bitcoin ETF—just hit another milestone. While traditional finance scrambles to keep up, digital asset vehicles prove they're here to stay.

Key takeaways:

- Record inflows signal growing institutional confidence

- TradFi dinosaurs still can't decide if this is a 'fad' or the future

- Crypto markets shrug off regulatory theater with bullish momentum

Funny how the same banks that called Bitcoin 'rat poison' now charge 2% fees to hold it for you. The revolution will be tokenized—and heavily monetized.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

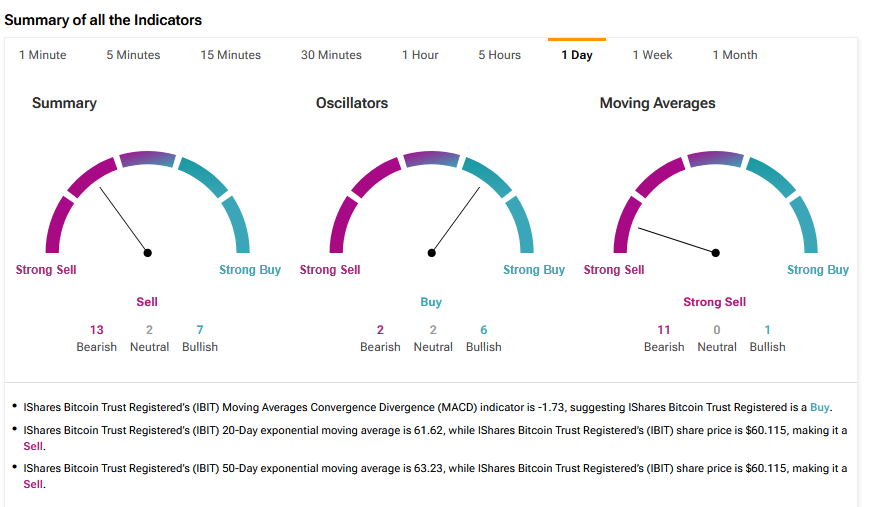

According to TipRanks’ technical analysis, the IBIT is now at a Strong Sell consensus based on 13 Bearish, 2 Neutral and 7 Bullish ratings.

Based on the activity of 827,325 investors in the recent quarter, it has scored sector-average neutral sentiment. Those investors aged between 35 and 55 have been the most active buyers.

In total, 1.9% of all portfolios hold IBIT.

Today’s IBIT Performance

Today, the IBIT was up 2.14% at $60.17 The main driver was the price of Bitcoin, which ROSE 1.19% to $105,936.34.

It was boosted by Strategy (MSTR) which revealed that during the period from November 3 to November 9, 2025, it sold shares of various securities, generating net proceeds of $50 million. The proceeds from these sales were used to acquire 487 bitcoins, increasing the company’s aggregate bitcoin holdings to 641,692.

Strive also announced that between October 28, 2025, and November 9, 2025, it purchased approximately 1,567.2 bitcoin at an average price of $103,315.46 per bitcoin, totaling $161,912,220. As a result, Strive’s total bitcoin holdings increased to approximately 7,525 bitcoin, positioning the company as one of the top corporate holders of bitcoin.