Starbucks Stock (SBUX) Tanks as Market Realizes Coffee Experience is Overrated

Wall Street wakes up smelling the burnt coffee.

Starbucks shares took a nosedive today as investors finally acknowledged what crypto traders have known for years—brand loyalty doesn't scale like blockchain protocols. The coffee giant's market cap evaporated faster than a meme coin's liquidity pool.

Subheader: The Frappuccino Fade

Analysts noted declining foot traffic as consumers prioritize digital asset portfolios over pumpkin spice lattes. 'Turns out people care more about their Bitcoin self-custody than barista small talk,' quipped one fund manager while adjusting his ledger wallet.

Subheader: Web3 Brews Competition

Decentralized alternatives are gaining steam, with crypto-native coffee DAOs offering tokenized rewards that actually appreciate in value—unlike those gold stars on your loyalty app that get devalued every fiscal quarter.

The bitter truth? In an age of digital primacy, even $7 artisanal cold brew can't compete with the dopamine hit of watching your altcoin positions 10x. Maybe they should accept Lightning payments.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The news is almost as terrible as it was good, amazingly enough. Starbucks revealed that its coffee delivery business recently passed the billion-dollar mark, and that business actually grew by 30% in the quarter. That is objectively great news. But it comes with a massive inherent problem: Brian Niccol’s entire plan to turn around Starbucks depends on the exact opposite of the part of the business that is seeing some of the largest growth numbers.

Starbucks got its start in being a thoroughly cosmopolitan operation. The coffeehouse feel, the aesthetic, the sound of Norah Jones music playing everywhere…all of this was part of that essential coffeehouse vibe. It worked for years. For decades, even; coffeehouses became cultural centers where people bought overpriced coffee and listened to poetry charitably described as experimental. But then, something hit; whether that something was mobile ordering, changing customer tastes, or whatever, people wanted to get their coffee and go.

Back to the Table

Regardless of where Starbucks customers actually drink their coffees and the like, someone still has to make them. A small portion of that workforce is union, and its contract with Starbucks has not been an easy thing to put together. In fact, elements of the government are calling on Starbucks to return to the bargaining table and make a deal happen.

The numbers are starting to climb: 26 senators and 82 House representatives have all sent letters to Starbucks, calling on CEO Brian Niccol to get back to negotiating with the union workers. One such letter featured the phrase, “We have heard of a troubling return to union busting.”

Is Starbucks Stock a Good Buy?

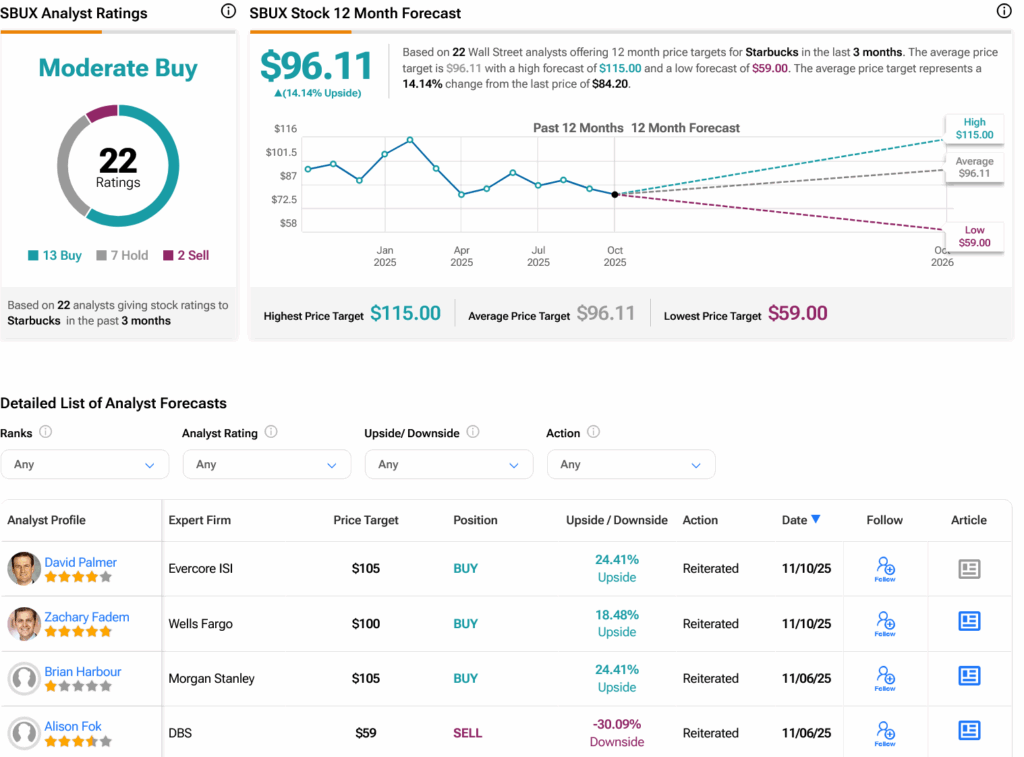

Turning to Wall Street, analysts have a Moderate Buy consensus rating on SBUX stock based on 13 Buys, seven Holds and two Sells assigned in the past three months, as indicated by the graphic below. After a 14.69% loss in its share price over the past year, the average SBUX price target of $96.11 per share implies 14.14% upside potential.

Disclosure