OpenAI Eyes Healthcare Disruption: The Next Frontier for AI Giants

Silicon Valley's AI powerhouse is making moves—healthcare's trillion-dollar inefficiencies just became target practice.

Why hospitals? Because nothing screams 'low-hanging fruit' like an industry drowning in paperwork, legacy tech, and billing labyrinths. OpenAI's algorithms could slice through prior auth delays like a scalpel through red tape.

Wall Street's already salivating. 'Finally, a sector where AI can monetize human suffering at scale,' quipped one hedge fund manager, adjusting his position in EHR stocks.

But here's the twist: healthcare eats disruptors for breakfast. IBM Watson Health flatlined. Google Health got discharged. Now OpenAI's betting its language models can out-diagnose the hype cycle.

One thing's certain—if this works, it'll make crypto's healthcare plays look like Web3 band-aids on a gunshot wound.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Interestingly, recent hires show just how serious OpenAI is about healthcare. In June, it brought in Nate Gross, cofounder of Doximity (DOCS), to lead its healthcare strategy. It also hired Ashley Alexander from Instagram as its Vice President of Health Products. Experts say that OpenAI might finally solve the long-standing “personal health record” problem, where medical data is scattered across different doctors and systems. It’s worth noting that previous attempts by Apple (AAPL), Google, and Microsoft failed mainly because users had to manually upload data, or hospitals were slow to share records.

However, a recent U.S. rule banning “information blocking” is starting to change that, and companies like Health Gorilla and Particle Health now act as intermediaries that can help aggregate medical data for AI systems like OpenAI’s. Nevertheless, for now, OpenAI isn’t asking users to share personal medical records and is sticking to general health information in ChatGPT. In addition, company leaders say that they plan to collaborate with healthcare partners rather than store or manage sensitive data themselves.

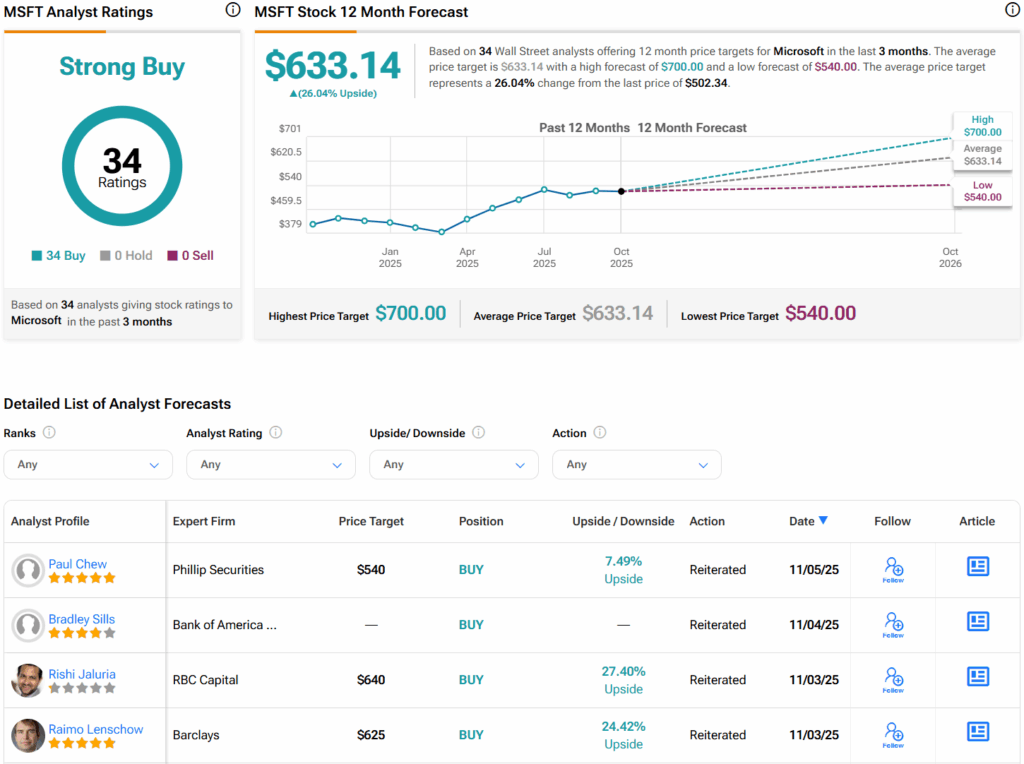

Is MSFT Stock a Good Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 34 Buys assigned in the last three months. Furthermore, the average MSFT price target of $633.14 per share implies 26% upside potential.