U.S. Steel (NISTF) Bets Big: $11B American Reinvestment Plan Through 2028

Steel giant goes all-in on domestic infrastructure—Wall Street yawns.

U.S. Steel just signaled a full-throttle commitment to American manufacturing, pledging a staggering $11 billion investment into its operations by 2028. The move comes as legacy industries scramble to stay relevant in an era of tech-driven capital flows—because nothing says 'innovation' like doubling down on 19th-century infrastructure.

Key details:

- No new plants announced—just 'modernization' buzzwords

- Timeline suspiciously aligns with next presidential election cycle

- Zero mention of blockchain integration (obviously)

While Main Street might cheer the jobs promise, crypto natives know the real action remains in decentralized finance. After all, $11B could've bought a lot of Bitcoin ETFs.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The billion-dollar investment is part of a new multiyear growth strategy that includes modernizing the century-old steelmaker’s U.S. facilities. The investment comes five months after Nippon Steel finalized its takeover of the Pittsburgh-based steelmaker in a deal worth $15 billion.

In approving the acquisition of U.S. Steel, the administration of U.S. President Donald TRUMP negotiated a a “golden share” clause that gives the federal government in Washington, D.C. the power to appoint a board member and a say in some operational decisions.

Improvements

The combination of Nippon Steel and U.S. Steel creates the world’s fourth-largest steelmaker. In a news release, Nippon said the $11 billion investment to upgrade U.S. Steel’s aging American facilities will unlock $2.5 billion in savings from capital investments and another $500 million from operational efficiencies.

U.S. Steel said it has identified more than 200 initiatives that will help it save money across all business segments. The company is modernizing and expanding its manufacturing operations and expanding its research and development (R&D) unit as it aims to make higher value, lower emission steel products.

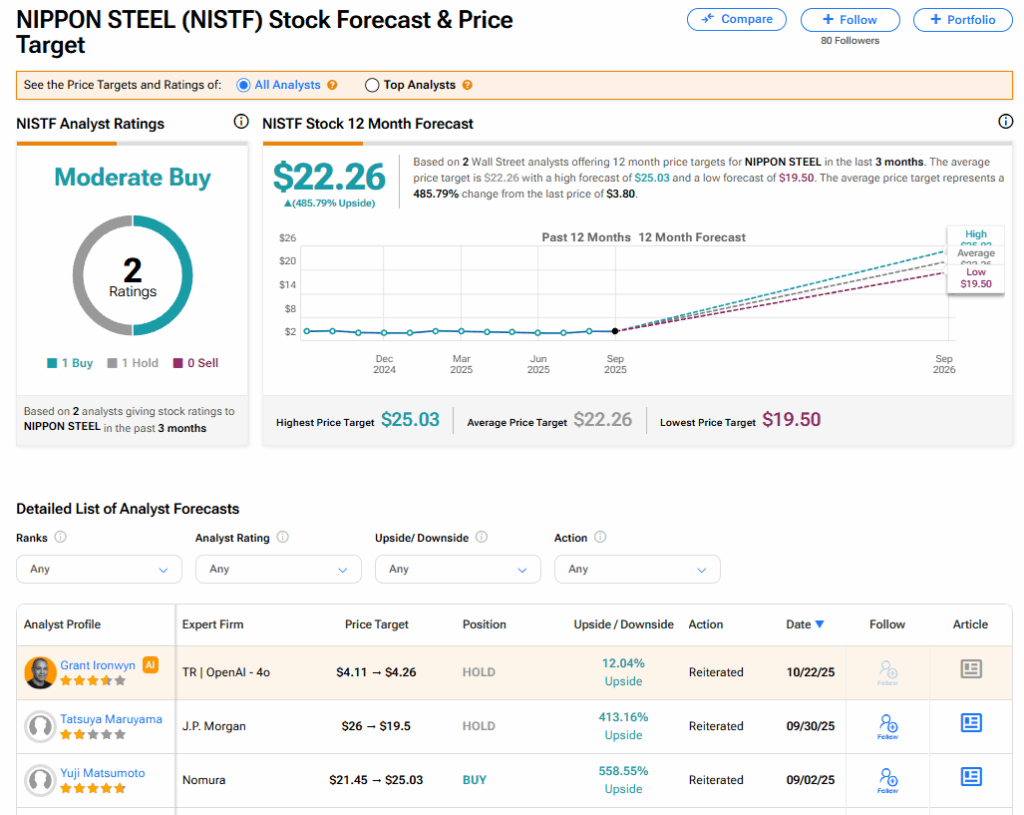

Is NISTF Stock a Buy?

Nippon Steel has a consensus Moderate Buy rating among two Wall Street analysts. That rating is based on one Buy and one Hold recommendations issued in the last three months. The average NISTF price target of $22.26 implies 485% upside from current levels.