Barrick Gold (B) Shocks Market With 25% Dividend Surge—Miners Printing Cash

Gold heavyweight Barrick just flexed its balance sheet—announcing a 25% dividend hike that'll make income investors drool.

Golden showers (the financial kind)

While crypto bros stare at volatile charts, old-school miners are quietly stacking cash. Barrick's move signals confidence in sustained high gold prices—or maybe just a shareholder pacification program.

Inflation hedge pays dividends—literally

With central banks still playing catch-up on monetary policy, gold's traditional appeal gets a modern twist: cold hard cash payouts. Take that, Bitcoin maximalists.

One cynical take? This reeks of 'peak gold' signaling—when miners start showering investors with dividends instead of reinvesting, it often precedes commodity downturns. Enjoy the yield while it lasts.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Barrick continues to benefit from strong gold prices, which hit an all-time high of just over $4,300 an ounce in recent months. As such, the Toronto-based company reported earnings per share (EPS) of $0.58, which beat analysts’ average expectation of $0.57.

Revenue for the quarter ended Sept. 30 was $4.15 billion, up from $3.37 billion a year earlier. However, the Q3 sales figure fell short of the $4.40 billion forecast on Wall Street. Still, Barrick’s Q3 gold production rose 4% from this year’s second quarter and totaled 829,000 ounces. This helped the company report record quarterly operating cash FLOW and free cash flow of $2.4 billion and $1.5 billion, respectively.

Dividend and Share Repurchase

Barrick is using the record cash Flow to hike its distribution to shareholders. Moving forward, the company will pay a quarterly dividend of $0.125 per share, up 25% from the previous amount. Barrick also said it plans to pay a special, one-time dividend of $0.05 per share, bringing its total payout for the current quarter to $0.175 a share.

Additionally, Barrick’s board of directors has approved a a $500 million increase to the existing share repurchase program. The company has bought back a total of $1 billion shares year to date. The $500 million expansion brings the remaining amount on the current share repurchase program to $1.5 billion. B stock is up 5% on Nov. 10 on news of the dividend and share repurchase increases.

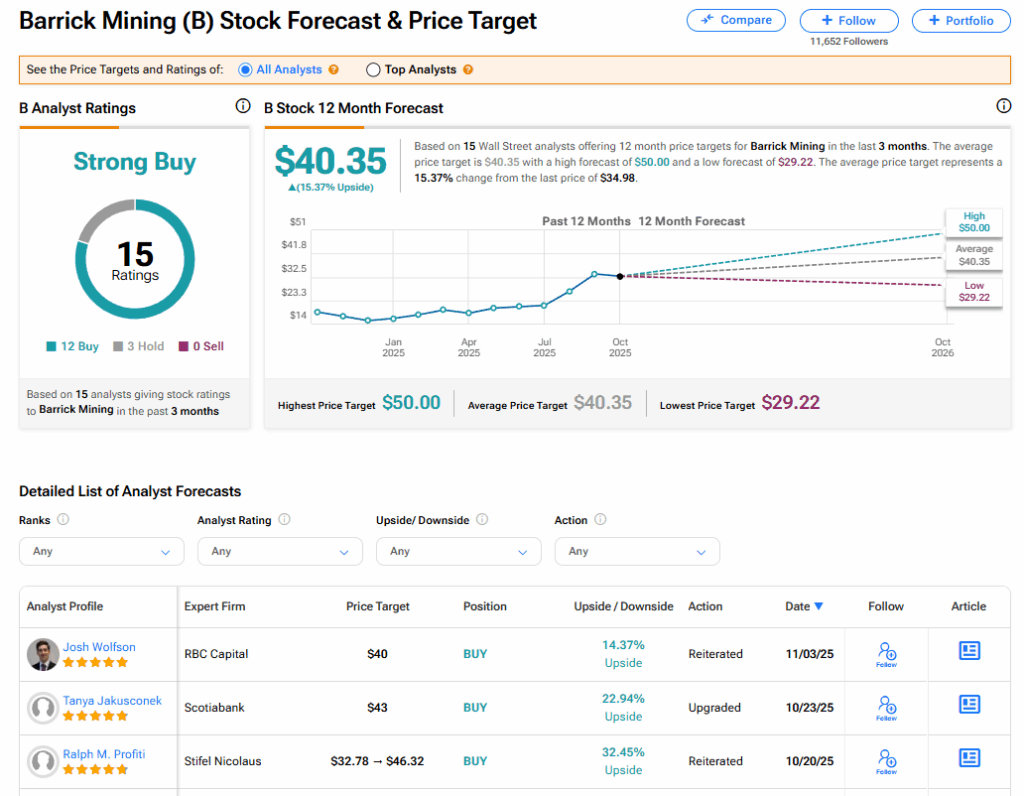

Is B Stock a Buy?

Barrick Mining’s stock has a consensus Strong Buy rating among 15 Wall Street analysts. That rating is based on 12 Buy and three Hold recommendations issued in the last three months. The average B price target of $40.35 implies 14.37% upside from current levels.