Crypto Bloodbath: Bitcoin & Ethereum Plunge Amid Market Sell-Off Frenzy

Digital assets hemorrhage value as market panic triggers massive liquidations.

MAJOR CRYPTO COLLAPSE

Bitcoin tumbles below critical support levels while Ethereum follows suit—both assets shedding billions in market capitalization within hours. The sell-off accelerates as leveraged positions get wiped out across exchanges.

WHEN FEEDBACK LOOPS TURN VICIOUS

Price drops trigger margin calls, forcing liquidations that push prices lower—creating the perfect storm for cascade selling. Trading volumes spike 300% as panic spreads through derivatives markets.

THE SILVER LINING PLAYBOOK

History shows these violent corrections often create generational buying opportunities. Smart money accumulates during fear—while weak hands capitulate at the worst possible moments.

Remember when traditional finance said crypto was too volatile? At least we're not charging 2% management fees to lose money slowly.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

While the latest filing with the U.S. Securities and Exchange Commission (SEC) is getting lots of attention for the big bets Burry has made against high-flying technology stocks Palantir (PLTR) and Nvidia (NVDA), the disclosure document also shows that the investor held just four securities in the portfolio of his hedge fund Scion Asset Management at the end of the third quarter.

Those four stocks are health insurance provider Molina Healthcare (MOH), athletic apparel retailer Lululemon Athletica (LULU), private student loan provider SLM Corp. (SLM), which is often referred to as “Sallie Mae,” and the preferred stock of Bruker Corp. (BRKR), which makes scientific instruments used in laboratories and for research. All of the positions held by Burry are new except for LULU stock.

Pessimistic View

Lululemon’s stock is the only one that Burry held onto from the previous quarter. During Q3, he doubled his position in LULU stock to 100,000 shares valued at $16.3 million based on the current share price. Burry sold all of his other previous holdings, including bets on insurer UnitedHealth Group (UNH) and cosmetics giant Estee Lauder (EL).

It’s not unusual for Burry, who came to prominence for his short bet on the U.S. housing market prior to the 2008 financial crisis, to completely overhaul his portfolio from one quarter to the next. In addition to disclosing his new holdings and short bets, Burry has also returned to social media after being absent for more than a year.

Burry is warning of a market bubble, writing on X / Twitter at the end of October: “Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning MOVE is not to play.”

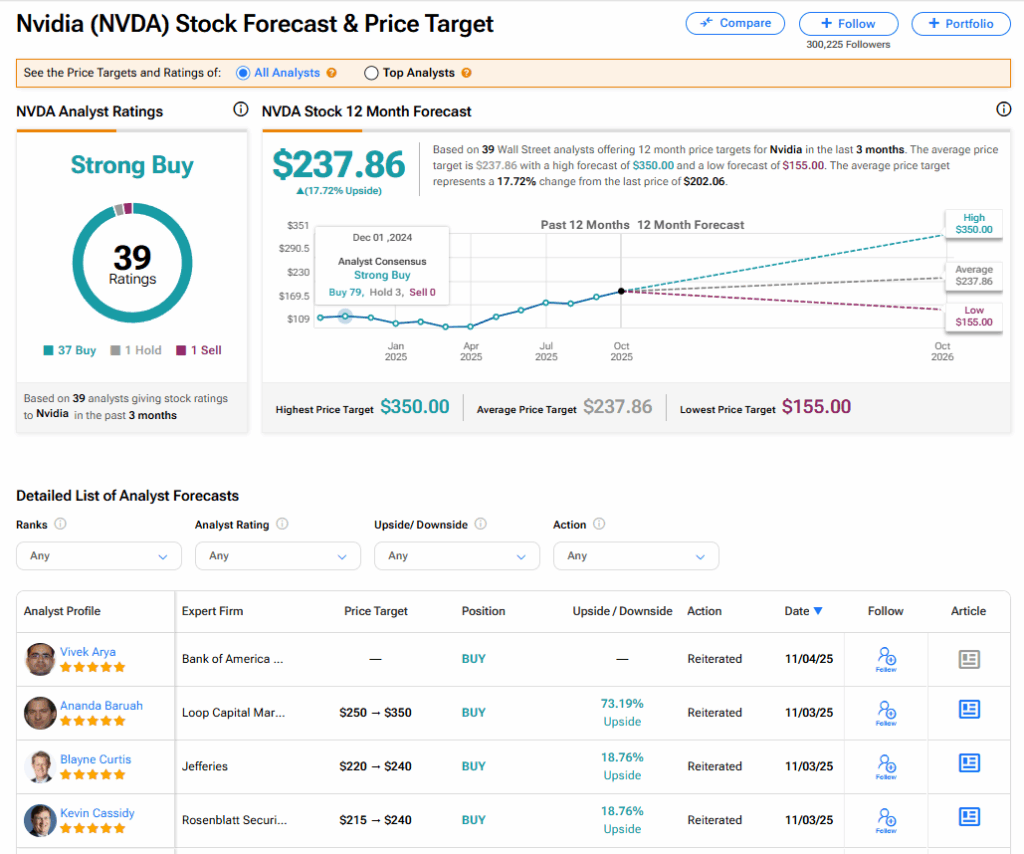

Is NVDA Stock a Buy?

The stock of Nvidia has a consensus Strong Buy rating among 39 Wall Street analysts. That rating is based on 37 Buy, one Hold, and one Sell recommendations issued in the past three months. The average NVDA price target of $237.86 implies 17.72% upside from current levels.