Bitcoin Plunges 14% - Mirroring 2022 Bottom But With a Bullish Twist

Bitcoin's sudden 14% nosedive has traders flashing back to 2022's brutal bear market bottom—but this time, the script's flipped entirely.

The Ghost of Cycles Past

That gut-wrenching drop sent shivers through crypto Twitter, triggering instant PTSD from the 2022 carnage. Charts are printing near-identical patterns, technical indicators screaming 'deja vu' across every trading screen.

Why This Ain't 2022 Redux

Here's where it gets interesting: institutional money's flooding in while retail panics. BlackRock's Bitcoin ETF just recorded its third-largest inflow day as the price tanked—smart money buying when blood's in the streets.

Meanwhile, Bitcoin's hash rate hit another all-time high during the selloff. Miners are doubling down when weak hands bail? That's not bear market behavior.

The Real Story Behind the Plunge

Leverage liquidation cascades wiped out $800 million in long positions. German government selling seized BTC added fuel to the fire. But fundamentals? Stronger than ever.

Network activity's surging, Lightning Network capacity just broke records, and we're months away from the next halving. This smells like a classic shakeout before the next leg up.

Wall Street analysts would call this 'technical consolidation' while charging 2% management fees for the insight. Bitcoin doesn't care about their spreadsheets—it's busy building the future of money during their lunch breaks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

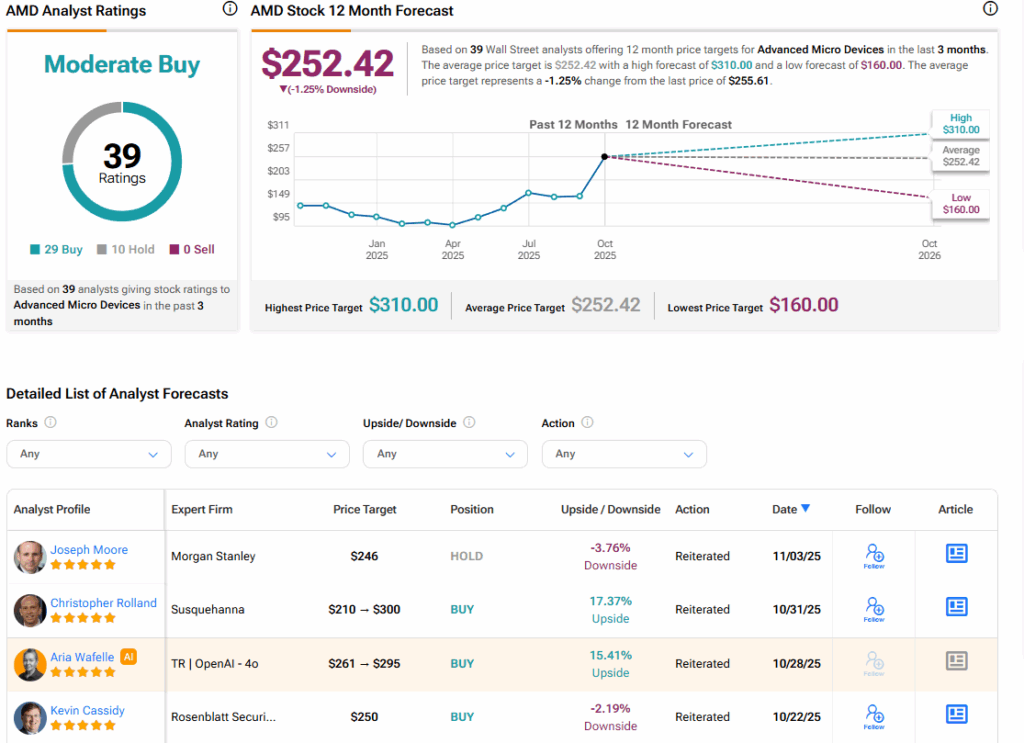

AMD shareholders will note that Moore’s coverage of the company’s stock comes ahead of its earnings report later today. AMD is set to report results for the third quarter of 2025 after markets close today. While the Morgan Stanley analyst expects AMD to perform well in its earnings report, he doesn’t anticipate near-term upside for GPU growth. This is important as AMD wants to expand its position in the AI GPU sector with the launch of its MI450 card next year.

Investors awaiting the AMD earnings report later today should prepare with the latest estimates. Wall Street expects the company to report adjusted earnings per share of $1.17 alongside revenue of $8.76 billion. AMD is likely to match or beat these estimates, based on its earnings history over the past eight quarters. It has beaten EPS estimates six of those times and revenue estimates seven of them.

AMD Stock Movement Today

AMD stock was down 1.62% on Tuesday but was still up 111.47% year-to-date. The stock has also increased 83.29% over the past 12 months. Increased demand during the AI boom has been a significant benefit to AMD stock in 2025.

Is AMD Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for AMD is Moderate Buy, based on 29 Buy and 10 Hold ratings over the past three months. With that comes an average AMD stock price target of $252.42, representing a potential 1.25% downside for the shares.