Ethereum-Focused Altcoin Economic Revolution: Buybacks and Burns Set to Ignite Market!

Digital assets are rewriting the economic rulebook—and Ethereum's ecosystem is leading the charge.

The Deflationary Engine Awakens

Protocols built on Ethereum are deploying aggressive tokenomics strategies that could reshape entire market dynamics. Buyback programs and token burns are no longer theoretical concepts—they're becoming operational realities.

Smart contracts now automate what traditional finance struggles to implement efficiently. These mechanisms systematically remove tokens from circulation while creating permanent value appreciation pressure.

Market Impact Unleashed

The combination of reduced supply and increased demand creates a perfect storm for price discovery. Unlike stock buybacks that often benefit executives more than shareholders, blockchain-based burns are transparent and verifiable by anyone.

Traditional economists might dismiss this as digital alchemy, but the numbers don't lie—and neither does the blockchain. While Wall Street debates stock repurchase accounting, decentralized networks are executing economic transformations in real-time. Because nothing says financial innovation like watching bankers scramble to explain why burning digital assets creates more value than their complex derivatives ever could.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Toronto-based company, which owns the Reuters newswire, announced earnings per share (EPS) of $0.85, which was above the $0.83 that was expected on Wall Street. Revenue for the quarter totaled $1.78 billion, in-line with consensus expectations. Sales were up 3% from a year earlier.

Management attributed the results largely to rising demand for its artificial intelligence (AI) products. Thomson Reuters also benefitted from 3% growth in its recurring revenues, which comprise 83% of the total, and 12% growth in its transactions revenue.

Buyback and Dividend

Thomson Reuters has been developing a number of agentic AI products that are proving to be popular with its clients. These include AI software that helps with taxes, audits, and general accounting. Many of its AI products are used by law firms and accountants.

Along with the Q3 print, Thomson Reuters announced a new $1 billion share repurchase program that goes into effect immediately and is made possible by an improving 2026 profitability outlook. The company also declared a quarterly dividend of $0.595 per share that is payable on Dec. 10 to shareholders of record as of Nov. 18. The dividend is unchanged from the previous quarter.

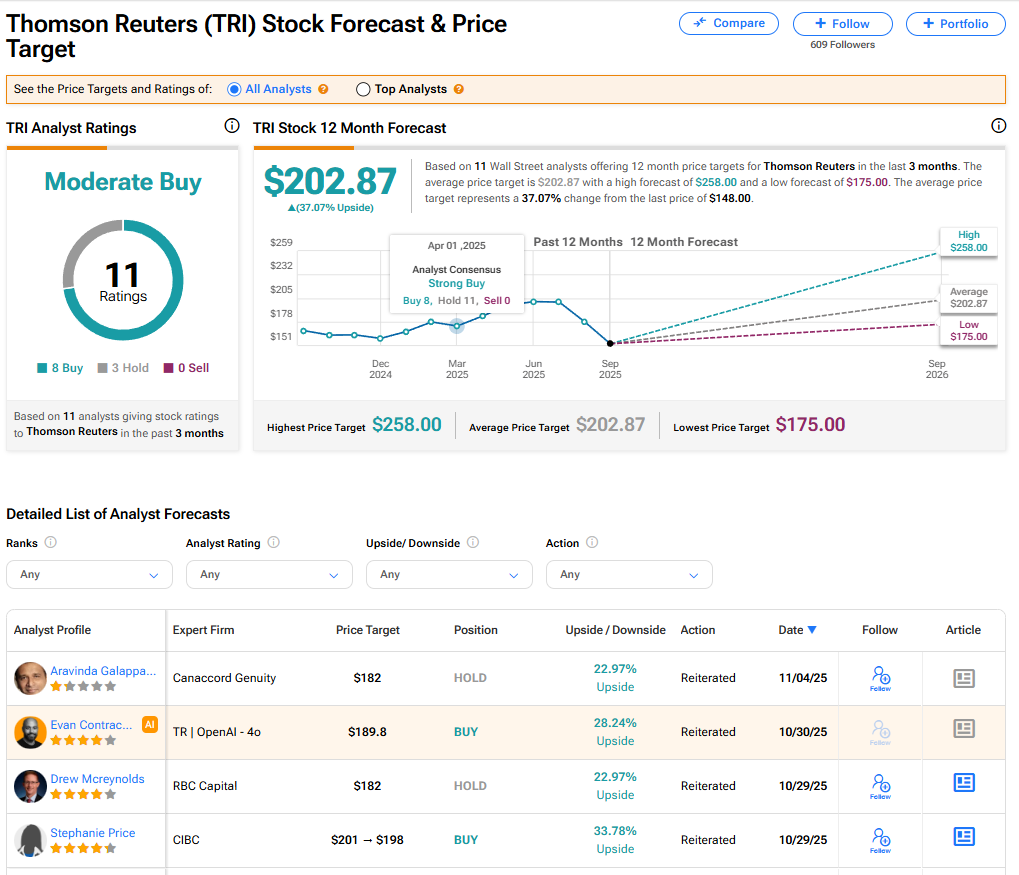

Is TRI Stock a Buy?

The stock of Thomson Reuters has a consensus Moderate Buy rating among 11 Wall Street analysts. That rating is based on eight Buy and three Hold recommendations issued in the last three months. The average TRI price target of $202.87 implies 37.07% upside from current levels. These ratings could change after the company’s financial results.