Bitcoin’s New Era: Institutions and Whales Dominate as Retail Investors Sit This Cycle Out!

The landscape has shifted dramatically—this isn't your 2017 crypto market anymore.

Power Play in Digital Gold

Corporate treasuries and deep-pocketed whales are calling the shots now, accumulating positions that dwarf typical retail investments. While mom-and-pop investors watch from the sidelines, institutional money floods into Bitcoin ETFs and direct holdings.

The Numbers Don't Lie

Recent blockchain analytics reveal whale wallets controlling unprecedented percentages of circulating supply. Meanwhile, retail exchange inflows have stagnated—proving once again that when Wall Street finally embraces an asset class, they don't just join the game, they buy the entire casino.

Market Realities

Volatility patterns have changed, liquidity pools have deepened, and the typical retail FOMO cycles have been replaced by calculated institutional accumulation strategies. The days of quick 10x returns from random altcoins appear to be fading into crypto nostalgia.

So while traditional finance finally figures out what 'HODL' means, the little guy gets to enjoy the show from the cheap seats—watching the professionals turn digital scarcity into their personal playground.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to the suit, two passengers initially survived the impact but were unable to escape as the car caught fire, allegedly trapped by malfunctioning electronic doors.

The lawsuit accuses the automaker of negligence and highlights a “foreseeable risk” tied to Tesla’s flush-mounted door handles and post-crash fire hazards. It also claims Tesla has long been aware of similar complaints involving battery fires and door malfunctions but failed to take corrective action.

Tesla’s Door Handle Design Under Scrutiny

Tesla’s door handle design has come under increasing scrutiny in recent years. The flush-mounted handles rely on electronic mechanisms to open, which can malfunction during or after a crash.

While Tesla includes mechanical overrides, many passengers are unaware of their location or how to use them in an emergency.

The National Highway Traffic Safety Administration (NHTSA) is currently investigating whether Tesla’s door systems are defective, citing cases where children and other passengers were trapped inside.

Following multiple complaints, the NHTSA recently widened the probe to include other vehicles, such as the 2017–2022 Model 3 sedans and 2020–2022 Model Y SUVs.

What Is the Prediction for Tesla Stock?

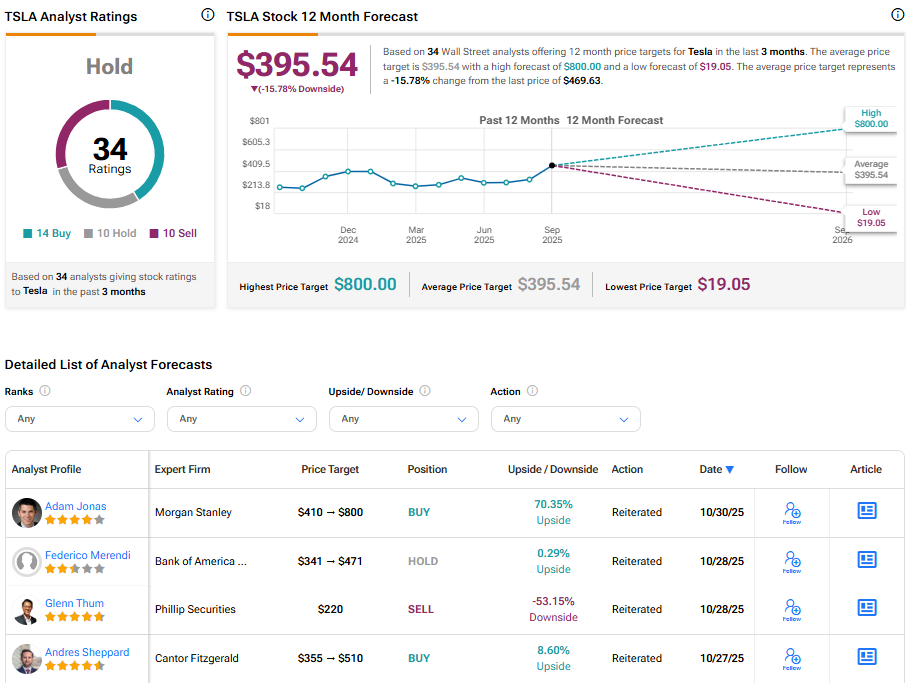

Turning to Wall Street, TSLA stock has a Hold consensus rating based on 14 Buys, 10 Holds, and 10 Sells assigned in the last three months. At $395.54, the average Tesla price target implies a 15.66% downside risk. The stock has gained 62.9% over the past six months.