Coinbase Stock (COIN) Surges on Dual Partnerships with Citi and Apollo — Market Disruption Ahead?

Wall Street giants just placed their biggest bet yet on crypto infrastructure.

The Citi Connection: Banking Goes Blockchain

Traditional finance meets digital assets as Citi brings institutional credibility to Coinbase's platform—proving even the old guard can't ignore the crypto revolution.The Apollo Factor: Institutional Money Floodgates Open

Apollo's involvement signals deep-pocketed investors are finally ready to move beyond Bitcoin ETFs and into actual crypto infrastructure plays.Market Impact: More Than Just a Stock Pop

This isn't just about COIN's price surge—it's about validation. When names like Citi and Apollo jump in, they're not testing waters; they're building bridges for the entire financial system to cross over.The Bottom Line: Traditional Finance Finally Gets It

After years of skepticism, Wall Street's embrace feels less like adoption and more like surrender—turns out even billion-dollar institutions eventually follow the money.Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Coinbase and Citi Eye Fiat-to-Crypto Transfers

With Citi, Coinbase’s partnership is focused on building digital asset payment pipelines to simplify and expand the process for Citi’s institutional clients. For a start, both companies WOULD work on supporting the client’s ability to deposit and withdraw fiat currencies through Coinbase’s platform.

Over the coming months, both organizations will provide more details on additional initiatives to be developed under the partnership. At the same time, they plan to collaborate on stablecoins to create an alternative payment method for moving fiat currencies into the blockchain.

Wall Street Deepens Crypto Ties

Coinbase’s partnership with Citi comes as Wall Street continues to embrace digital assets, integrating the technology further into the traditional lending system.

This month, reports have emerged that Morgan Stanley (MS) is working to pave the way for its wealth-management clients to invest in cryptocurrency funds, while JPMorgan (JPM), the largest U.S. commercial bank, is working to enable its institutional clients to obtain loans using leading digital assets, Bitcoin and Ether, as collateral.

Apollo Backs Coinbase’s Private Credit Push

Meanwhile, Coinbase Asset Management (CBAM), the crypto exchange’s wholly-owned subsidiary, has also tapped Apollo to “bring Coinbase stablecoin credit strategies to market.”

The goal in this regard is to provide loans against over-collateralized digital assets such as Bitcoin to traditional and digital-native borrowers. Examples of such borrowers include stablecoin issuers, payment service providers, neobanks, and financial technology companies.

Both organizations will also seek to provide investors with exposure to credit strategies managed by Apollo using Coinbase’s tokenization technology. Coinbase added that they are looking to deliver these credit investment products by next year.

Anthony Bassili, CBAM’s president, pointed out that Coinbase wants to unlock opportunities not available in traditional private credit markets but accessible through the stablecoin ecosystem.

Is COIN a Good Stock to Buy?

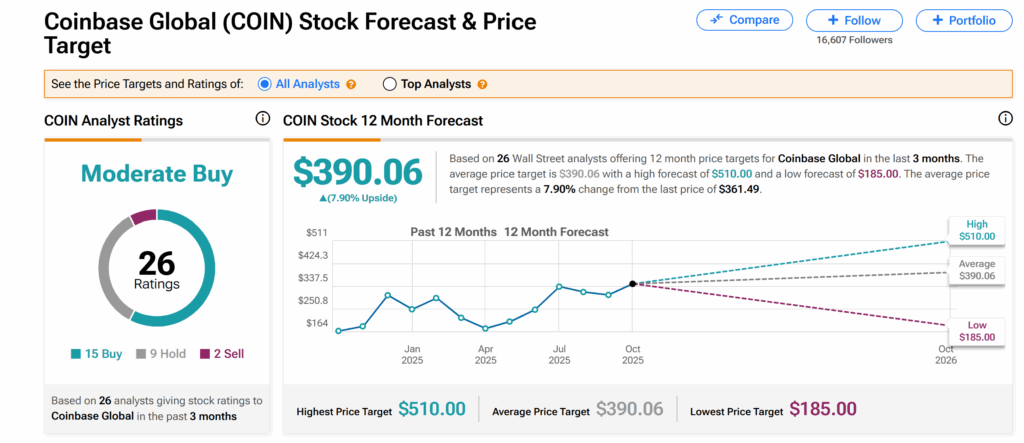

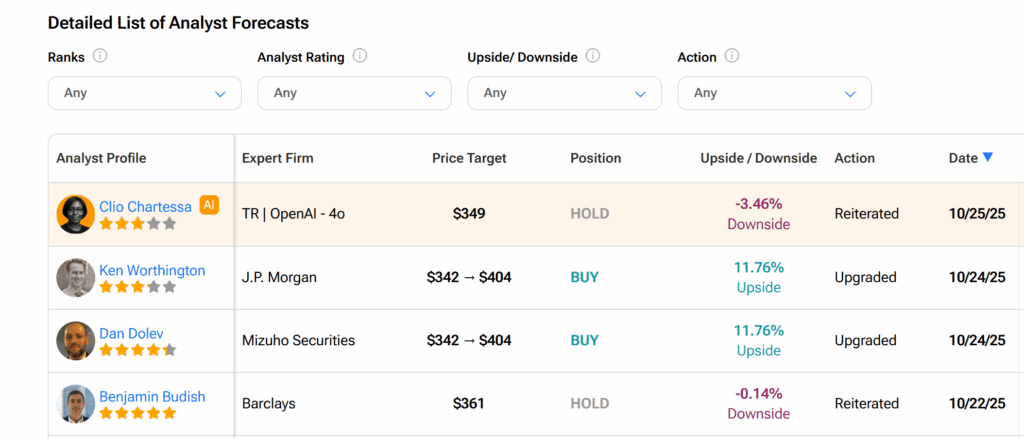

Turning to Wall Street, Coinbase’s shares currently have a Moderate Buy consensus rating, as seen on TipRanks. This is based on 15 buys, nine Holds, and two Sells issued by 26 analysts over the past three months.

However, the average COIN price target of $390.06 indicates almost 8% upswing potential from the current level.