Bitcoin (BTC) Price Prediction 2025–2030: What to Expect and How to Prepare

If you think it’s “too late” to buy Bitcoin, think again. Every halving cycle tells a similar story: skepticism, correction, accumulation… and then a new all-time high.

By 2025, we’ll likely be entering a new growth phase powered by:

• Institutional demand through Bitcoin ETFs

• Global inflation pushing investors toward scarce assets

• Reduced Bitcoin supply after the 2024 halving

• Broader acceptance of Bitcoin as “digital gold”

This six-year window (2025–2030) could define the next major wave of crypto adoption — and it’s exactly where smart, patient investors focus.

/ You can claim a welcome reward of up to 10,055 USDT🎁\

What is Bitcoin (BTC)?

Bitcoin was the first and is still the largest cryptocurrency in terms of market capitalization. Transactions in a worldwide P2P network are verified using a proof-of-work mechanism. U.S. and international authorities are among the few that recognize Bitcoin as a truly decentralized cryptocurrency.

Bitcoin is mostly employed as a medium of exchange. It can be used for both personal money transfers and purchases made online or at an increasing number of retail outlets’ point of sale terminals. Bitcoin is becoming more accepted as a method of payment by merchants worldwide. It is also utilized to transfer funds internationally without the need to incur the costs associated with a currency exchange or international transaction.

Mining is the method by which Bitcoin transactions are verified and new Bitcoin are created. There are a lot of publicly traded Bitcoin mining companies because it’s a lucrative sector.

| Cryptocurrency | Bitcoin |

| Token | BTC |

| Price | $ 78728.4200 |

| Rank | 2 |

| Market Cap | $ 0 |

| 24H Trading Volume | $ 97.5B |

| All-time High | $ 126025.0000 |

| All-time Low | $ 0.0500 |

| 24 High | $ 84260.5200 |

| 24 Low | $ 77039.9500 |

| Cycle High | $ 79214.5000 / 2026-01-31 23:24:57 |

| Cycle Low | $ 76020.0000 / 2026-01-31 18:43:58 |

| Update Time | 2026-01-31 23:59:01 |

Authoritative Data Sources Behind This Forecast

To avoid speculation, we rely only on verified institutional and data-driven models:

| Source | Year | BTC Price Range (USD) | Forecast Type |

|---|---|---|---|

| CoinCodex | 2025 | 112,739 – 144,758 | Algorithmic model based on historical cycles |

| CoinCodex | 2030 | 265,000 – 308,000 | Long-term trend projection |

| ARK Invest | 2030 | 250K (bear) – 1.5M (bull) | Institutional thesis factoring ETF inflows |

| Unchained Research | 2025 | ≈250K | Institutional accumulation model |

| Flitpay | 2030 | 467K – 734K | Industry average forecast |

Data verified from CoinCodex, ARK Invest, Unchained, Flitpay, CoinDesk, and CoinMarketCap (as of October 2025).

[TRADE_PLUGIN]BTCUSDT,BTCUSDT[/TRADE_PLUGIN]

Bitcoin’s Long-Term Logic — Explained for Beginners

Supply & Halving Cycles

Bitcoin’s supply is capped at 21 million coins. Every four years, the block reward halves — reducing new supply and historically triggering major rallies 12–18 months later.

Institutional Adoption

From ETFs to corporate treasuries, institutions are now major players. As this capital flows in, volatility tends to decline while long-term demand increases.

Inflation & Macro Factors

With persistent inflation and weakening fiat currencies, investors are turning to Bitcoin as a hedge — much like gold in previous decades.

Network and Ecosystem Growth

Bitcoin’s ecosystem keeps expanding: Lightning Network, layer-2 scalability, and increasing real-world utility make BTC more than just a speculative asset.

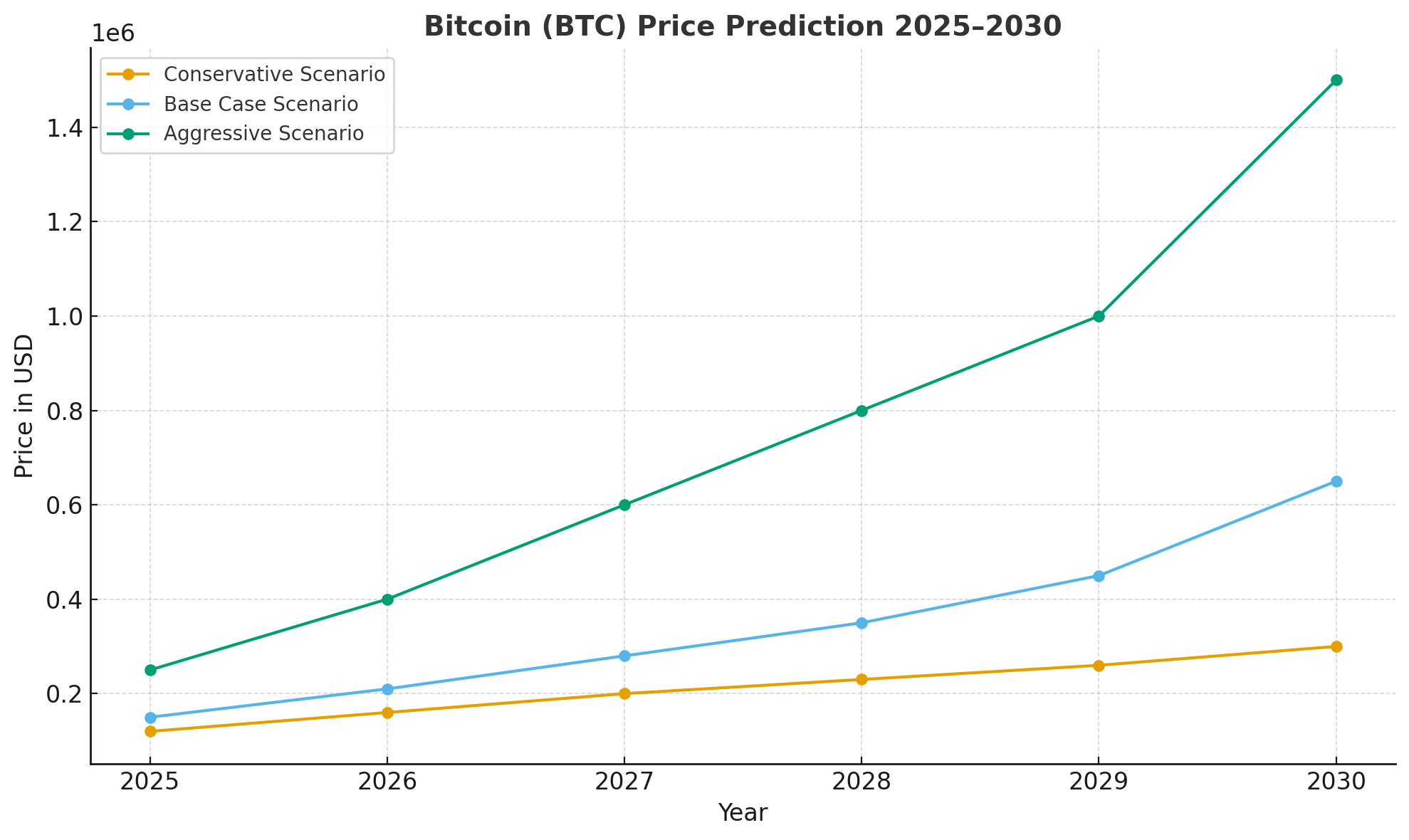

Bitcoin Price Prediction 2025–2030: Three Possible Scenarios

Note: These scenarios combine data from ARK Invest, CoinCodex, and Unchained, serving as educational projections — not investment advice.

| Scenario | 2025 Target | 2030 Target | Suggested Strategy |

|---|---|---|---|

| Conservative | $100K – $140K | $250K – $300K | Dollar-cost averaging (DCA); build positions slowly |

| Base Case | $150K – $200K | $400K – $700K | Moderate accumulation; use stop-loss and take-profit levels |

| Aggressive | $250K+ | $1M+ | Small, long-term holdings; high risk, high reward |

Insight:

Most analysts expect Bitcoin to maintain an upward trajectory, with consolidation phases between rallies.

The exact pace will depend on institutional adoption speed and global monetary conditions.

How to Build a Bitcoin Portfolio on BTCC (Step-by-Step for Beginners)

This section is written by BTCC editors — real traders who simplify crypto investing for first-timers.

Step 1: Create and Verify Your BTCC Account

Head to the BTCC registration page → sign up with your email or phone → complete KYC verification (usually takes under 10 minutes).

Step 2: Deposit Funds

BTCC supports fiat and crypto deposits. You can start small and move funds to your “Spot Wallet.”

Step 3: Plan Your Long-Term Entry

Example plan (for a $5,000 total investment):

• Buy 30% when BTC hits $120K

• Add 20% if price dips 10%

• Hold the rest for a breakout above $180K

Step 4: Protect Your Position

Suggested stop-loss: 10–15% below entry price.

Ready to invest for the next Bitcoin cycle? Sign up on BTCC today to claim your Welcome Trading Bonus and start your BTC journey for beginners.

Final Thoughts: The Bitcoin Decade Is Just Beginning

Bitcoin’s journey from a few dollars to over $100,000 is already historic — but it’s not the end.

From 2025 to 2030, with ETFs, institutional adoption, and global economic shifts, Bitcoin could enter a true mainstream phase.

If you’re new, don’t rush. Learn, plan, and execute with discipline.

And when you’re ready to take that first step — BTCC is here to guide you from beginner to confident investor.

Frequently Asked Questions (FAQ)

Q1: Is it too late to buy Bitcoin?

Not at all. Despite previous rallies, on-chain data shows long-term holders are still accumulating. Bitcoin remains early in adoption compared to traditional assets.

Q2: Why do forecasts vary so widely?

Each model uses different assumptions. ARK Invest factors in ETF inflows, while CoinCodex relies on algorithmic cycle analysis.

Q3: Should I invest all at once or gradually?

Gradual investment (DCA) is safer. BTCC allows you to automate recurring purchases.

Q4: Do I need to monitor the market daily?

No. For long-term investors, it’s better to focus on fundamentals and rebalance quarterly rather than chasing daily volatility.

BTCC Guide:

- How to Trade Crypto Futures Contracts on BTCC

- BTCC Guide-How to Deposit Crypto on BTCC?

- What is Crypto Futures Trading – Beginner’s Guide

- What is Leverage in Cryptocurrency? How Can I Trade at 100X Leverage?

- BTCC Review 2025: Best Crypto Futures Exchange

How to Trade Bitcoin Futures on BTCC?

Now you can trade BTC on BTCC. BTCC supports a diverse selection of cryptocurrencies for trading. This includes popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and others. BTCC also offers products such as crypto, gold, and tokenized stocks to help investors rationally allocate their assets.

1. Register an Account

Join BTCC now and get up to 10,055 USDT when you deposit and trade. Click the button below to sign up now.

2. Deposit Funds

Once your account is set up, you’ll need to deposit funds into your BTCC account. BTCC may offer various deposit methods such as bank transfers, cryptocurrency deposits, or other payment options. Choose the method that works best for you and follow the instructions provided to deposit funds into your account. BTCC mainly offers USDT margin and future trading. Therefore, you need to buy USDT before trading.

3.How to Trade BTC?

Here are the steps to trade BTC on BTCC

1) First, tap “Futures” on the website homepage

2) Select a product you would like to trade from the list here. BTCC currently offers daily and perpetual futures

3) Check time to settlement. The settlement time of these futures type is different, you can check the time for settlement for each product here.

4) After choosing product, you can decide whther you would like to buy or sell it. You only need to own USDT to trade USDT-margined futures. That is to say you can sell BTCUSDT futures without owing any BTC Coin.

5) Then select your order type, and choose your leverage.

If you choose Limit or SL/TP order, you will need to enter your order price here.

Enter the quantity or choose the percentage under the quantity field.

You can also set up stop loss or take profit targets to limit losses or maximise earnings.

6)After everything is set up, Buy or Sell to play your order. A confirmation window will show up, check if all info is correct and click [Confirm] to open the position.

Please be aware that all investments involve risk, including the potential loss of part or all of your invested capital. Past performance is not indicative of future results. You should ensure that you fully understand the risks involved and consider seeking independent professional advice suited to your individual circumstances before making any decision.

For any inquiries or feedback regarding this article, please contact us at: [email protected]