BREAKING: Ethereum Earthquake - Major Corporation Dumps Massive ETH Holdings!

Market tremors ripple through crypto as institutional whale executes staggering Ethereum sell-off.

The Great Unloading

A corporate titan just liquidated mountains of ETH—sending shockwaves across decentralized finance. Exact figures remain classified, but insiders confirm the move represents one of the largest single-entity disposals this quarter.

Chain Reaction

Smart money never sleeps—while retail investors chase memecoins, institutions play chess with nine-figure positions. The timing couldn't be more provocative, landing right before major protocol upgrades.

Another day, another 'strategic reallocation'—Wall Street's favorite euphemism for 'we saw the exit signs first.'

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The layoffs follow AMZN’s massive job-cut initiative between late 2022 and 2023, in which 27,000 positions were shed. These layoffs reflect ongoing efforts to compensate for overhiring during the pandemic boom.

The latest round targets roles across divisions, including human resources, devices and services, and operations, among others. Further, Reuters reported that managers of affected teams received training on Monday on how to communicate with employees, as email notifications are set to roll out tomorrow morning.

AI Reshaping the Workforce

Earlier this year, CEO Andy Jassy noted that Amazon’s growing investment in AI is driving the need to restructure. As AI automates more tasks, traditional roles are being phased out, while new opportunities emerge in robotics, machine learning, and cloud infrastructure.

Further, the layoffs coincide with reports that Amazon is aggressively investing in automation and AI. A New York Times report, released last week, stated that Amazon’s robotics division is working toward automating up to 75% of its fulfillment and logistics processes.

The initiative involves using advanced robots for tasks such as packaging, sorting, and moving goods, which is expected to increase efficiency and reduce costs. This move can drastically reduce the need for manual labor across warehouses and delivery networks, leading to job cuts.

AMZN to Report Q3 Earnings on October 30

The job cut reports come as Amazon prepares to report its third-quarter earnings later this week.

Currently, analysts expect AMZN to post revenue of $177.89 billion in Q3, up from $158.88 billion in the year-ago quarter. Further, the company is expected to report earnings of $1.57 per share, compared with earnings of $1.43 in the prior-year quarter.

Is Amazon a Buy, Hold, or Sell?

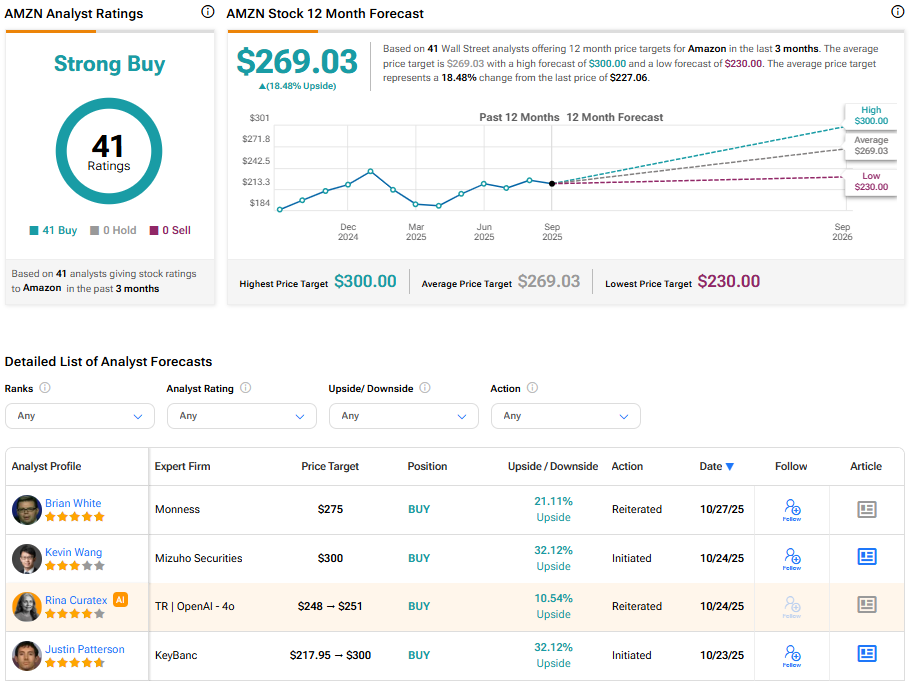

Turning to Wall Street, AMZN stock has a Strong Buy consensus rating based on 41 Buy ratings assigned in the last three months. At $269.03, the average Amazon stock price target implies an 18.52% upside potential.