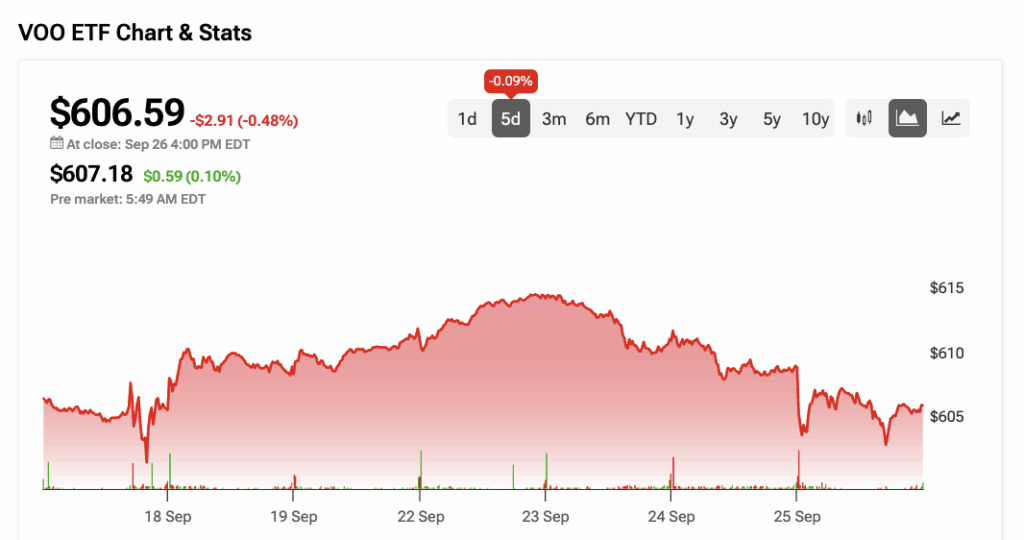

VOO ETF News, 9/26/2025

Vanguard's Flagship ETF Shows TradFi Still Has Pulse

Market Movements

While crypto continues eating traditional finance's lunch, VOO proves legacy assets still have some fight left. The S&P 500 tracker quietly outperforms expectations—almost like it remembered people still use dollars for things.

Institutional Flows

Big money keeps flowing into the vanilla ETF, bypassing more exciting digital alternatives. Because nothing says 'innovation' like betting on the same 500 companies your grandfather invested in.

The Bottom Line

VOO's steady gains highlight the boring beauty of traditional finance—where 'disruption' means adding a new expense ratio footnote. Sometimes the safest bet is the one that puts you to sleep.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to TipRanks’ unique ETF analyst consensus, determined based on a weighted average of analyst ratings on its holdings, VOO is a Moderate Buy. The Street’s average price target of $683.74 implies an upside of 12.72%.

Currently, VOO’s five holdings with the highest upside potential are Loews (L), Moderna (MRNA), The Trade Desk (TTD), Chipotle (CMG), and CarMax (KMX).

Meanwhile, its five holdings with the greatest downside potential are Paramount Skydance (PSKY), Warner Bros. Discovery (WBD), Intel (INTC), Tesla (TSLA), and Garmin (GRMN).

Revealingly, VOO ETF’s Smart Score is eight, implying that this ETF will likely outperform the market.

Does VOO Pay Dividends?

Yes, VOO pays dividends, offering investors a source of regular income. The ETF distributes these payments every quarter to shareholders. They come from the dividends paid by the companies in the S&P 500 (). Since company payouts change over time, the dividend amount from VOO also varies each quarter.

VOO’s yield as of today is 1.14%.