CVX, XOM, SHEL Surge as Oil Prices Post Biggest Weekly Gain in Three Months

Black gold's back with a vengeance—crude just delivered its most explosive weekly performance since June.

The Triple Threat Rally

Energy heavyweights Chevron, ExxonMobil, and Shell are riding the wave as oil markets wake from their summer slumber. Three months of sideways action shattered in just five trading days.

What's Fueling the Fire

Geopolitical tensions meeting supply constraints creates the perfect storm. Refiners can't keep up with demand despite what the spreadsheet jockeys predicted.

The New Reality

Traditional energy plays proving they've still got legs while crypto continues eating their lunch long-term. Sometimes the old guard reminds everyone why they became giants in the first place.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Prices for crude oil are on track for a more than 4% weekly increase after Ukraine’s attacks on Russia’s energy infrastructure prompted government officials in Moscow to reduce the country’s fuel exports. Brent crude oil, the international standard, is up 0.63% on Sept. 26 and trading at $69.86 a barrel.

West Texas Intermediate (WTI) crude oil has gained 0.77% to trade at $65.48 a barrel. Both oil benchmarks are pacing for their biggest weekly increases since mid-June of this year. The current rise comes after Russia announced that it will ban diesel exports until the end of the year and extend an existing ban on gasoline exports following Ukraine’s attacks.

Other Factors

Citing a drop in refining capacity, Russia’s government said certain regions of its country are now facing fuel shortages, further ratcheting up demand for crude and supporting prices. Separately, the U.S. Energy Information Administration (EIA) said in recent days that crude inventory levels in the U.S. fell by 607,000 barrels in the week ended Sept. 19.

The U.S. inventory decline surprised analysts who had forecast a build-up of 800,000 barrels of crude. The EIA said the drawdown in American crude oil reflects strong refinery runs and firmer demand for retail gasoline at the pumps. The rise in oil prices is good news for the stocks of leading oil majors such as Chevron (CVX), ExxonMobil (XOM), and Shell (SHEL).

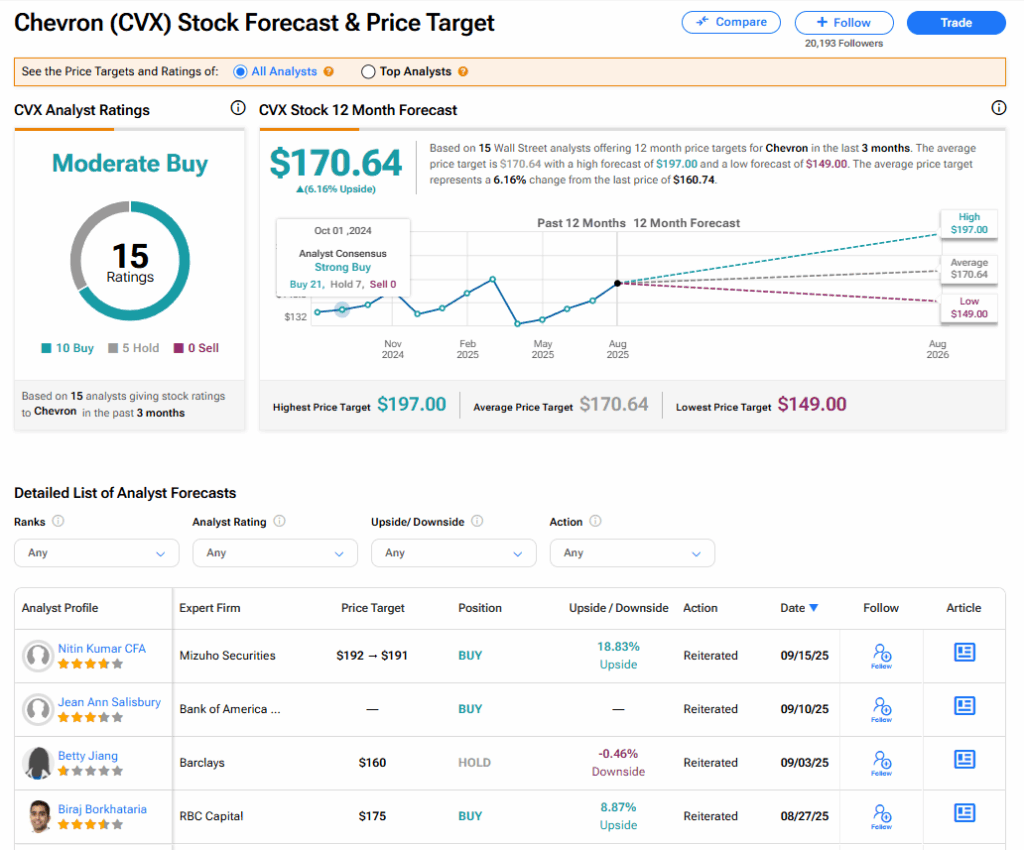

Is CVX Stock a Buy?

The stock of Chevron has a consensus Moderate Buy rating among 15 Wall Street analysts. That rating is based on 10 Buy and five Hold recommendations issued in the last three months. The average CVX price target of $170.64 implies 6.16% upside from current levels.