Coca-Cola Stock Plunge: Smart Dip-Buying Opportunity or Value Trap?

Coca-Cola shares hit turbulence as investors flee traditional consumer staples. The iconic beverage giant's stock dipped sharply this week—raising eyebrows across both Wall Street and crypto circles.

WHY THE SELL-OFF MATTERS

Traditional finance veterans see Coca-Cola as a defensive play. Dividend hunters love its consistent payout. But crypto-native investors recognize something deeper: capital rotation into digital assets accelerates when legacy giants stumble.

THE DIP-BUYING CALCULUS

Warren Buffett disciples will preach 'buy when there's blood in the streets.' Yet modern portfolio managers increasingly allocate to tokenized assets instead. Coca-Cola's 130-year history versus Bitcoin's 16-year track record tells a story of shifting paradigms.

BEYOND THE CARBONATED BUBBLE

While analysts debate P/E ratios and dividend yields, decentralized finance protocols quietly generate yields that make traditional stocks look like savings accounts. Another reminder that 'safe' investments sometimes carry the highest opportunity costs.

The real question isn't whether to buy Coca-Cola's dip—it's whether you should be buying any pre-blockchain era assets at all.

What does Coca-Cola do?

Coca-Cola, with its $285 billion in market capitalization, is the world's most important nonalcoholic beverage company. That places the drinks giant squarely in the consumer staples sector. Consumer staples stocks tend to be consistent businesses because they sell largely necessity products that are purchased on a regular basis, and that generally get sold at modest, if not low, prices relative to their benefit.

Image source: Getty Images.

While it WOULD be hard to suggest that a Coke is a necessity, drinking liquids is a life necessity. And a Coke is an affordable luxury that many people are more than happy to pay up for as they look to quench their thirst.

Meanwhile, Coca-Cola's production, distribution, marketing, and innovation prowess is on par with any food maker. Its size also allows it the ability to act as an industry consolidator, bringing in new brands to help keep its brand portfolio in line with consumer trends. The company is a Dividend King -- a group of companies that has increased dividends for more than 50 years -- for a reason.

But even great businesses go through hard times. The hard time right now, however, is more about the big picture. There has been a shift in mood, as consumers have been opting for food that is viewed as more healthy. That's left Wall Street leery of companies like Coca-Cola, which are perceived as making products that aren't so healthy.

That said, Coca-Cola has shifted with the times before, and it is highly likely to do so again, so this probably isn't as big a headwind as investors seem to fear.

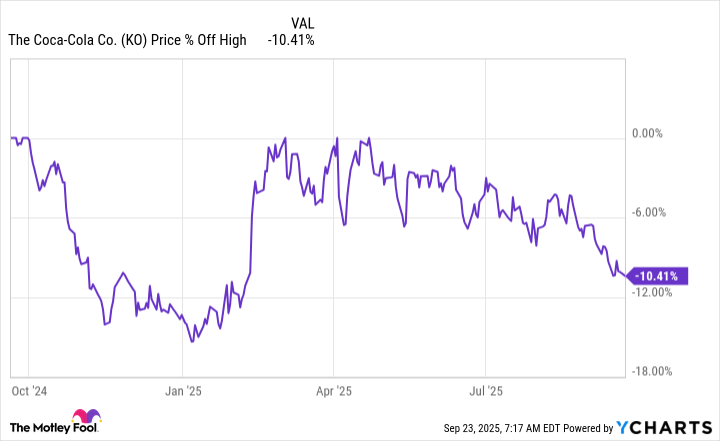

KO data by YCharts

Coca-Cola is worth a buying on the dip

The interesting thing about Coca-Cola's 10% or so drawdown is that the business is actually performing relatively well right now. For example, key peer(PEP -1.55%) saw organic sales growth of 2.1% in the second quarter. Coca-Cola's organic sales ROSE 5%. Clearly, Coca-Cola is doing fairly well compared to the competition.

And yet, investors have pushed down the stock to the point where its price-to-sales, price-to-earnings, and price-to-book value ratios are all below their five-year averages. To be fair, PepsiCo's valuation metrics make it look even cheaper, which will likely appeal more to value investors. However, that's because PepsiCo isn't doing as well as Coca-Cola as a business. So, if you take a growth at a reasonable price (GARP) approach, Coca-Cola will probably be a much more appealing choice for your portfolio right now.

But Coca-Cola isn't perfect. For example, the company may be looking to sell the Costa coffee business it bought in 2018. If this does happen, Coca-Cola will probably end up taking a one-time charge to write down the value of that investment.

As it turns out, operating a chain of coffee stores isn't the same as selling soft drinks. But, overall, Coca-Cola is still executing well in its most important businesses.

Buy and hold, just like Warren Buffett

Perhaps the most famous shareholder of Coca-Cola is Warren Buffett, who has owned the shares withinfor decades. If you buy Coca-Cola like Buffett, you should own it the same way Buffett has -- as a long-term investment. Indeed, Buffett has benefited from the long-term growth of Coca-Cola's business. And today's price pullback could be your opportunity to do so, too, if you think in decades, like Buffett does.