MSTR Stock Tumbles as Bitcoin Stumbles: Peter Schiff Predicts ’Brutal Bear Market’ Ahead

MicroStrategy's high-wire act hits turbulence as Bitcoin weakness sends the corporate Bitcoin proxy into a tailspin.

The Bitcoin Barometer Breaks

MSTR shares are getting crushed—trading like a leveraged crypto ETF rather than a traditional software company. The stock's violent swings mirror Bitcoin's price action with terrifying precision, proving Michael Saylor's big bet remains a double-edged sword.

Gold Bug's I-Told-You-So Moment

Peter Schiff pounces on the weakness, warning this is just the beginning of a 'brutal bear market' for digital assets. The perennial crypto critic's timing looks prescient as institutional investors reassess their digital asset allocations.

Corporate Treasury Experiment Under Fire

The selloff raises fresh questions about using company balance sheets as speculative crypto vehicles. Turns out accounting rules weren't designed for volatile digital assets—who could've predicted that?

As traditional finance veterans nod knowingly, crypto true believers see another buying opportunity. Because nothing says 'sound investment strategy' like doubling down on assets that can drop 20% before lunch.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

MSTR Stock Under Pressure

Strategy, earlier known as MicroStrategy, claims to be the largest Bitcoin treasury company. It also offers artificial intelligence (AI)-powered enterprise analytics software. Strategy accumulates Bitcoin by using proceeds from equity and debt financings, as well as cash flows from its operations.

In the September 15-21 period, MSTR sold 173,834 shares of its 10.00% series A perpetual preferred STRF shares for $19.4 million in net proceeds. The company purchased 850 BTC for $99.7 million in this timeframe. As of September 21, 2025, MSTR held 639,835 Bitcoin. MSTR stock reacted negatively to the news of additional bitcoin purchase, as it was funded by an at-the-money (ATM) stock offering, yet again raising concerns about shareholder dilution.

MSTR is viewed as a Leveraged bet on Bitcoin, as it generally rises more than BTC during bull runs and falls more than the largest cryptocurrency during downturns. The stock has declined more than the drop in Bitcoin since the Federal Reserve’s recent interest rate cut.

On Thursday, Bitcoin and MSTR critic Peter Schiff warned of a “brutal bear market” for Bitcoin treasury companies. He stated that while so many companies have been busy replicating Michael Saylor’s (founder and Chairman of Strategy) “harebrained” business strategy, few have noticed that MSTR stock is down 45% from its November 2024 high. “I’m not sure if any, including MSTR, will survive it,” cautioned Schiff.

Is MSTR Stock a Good Buy?

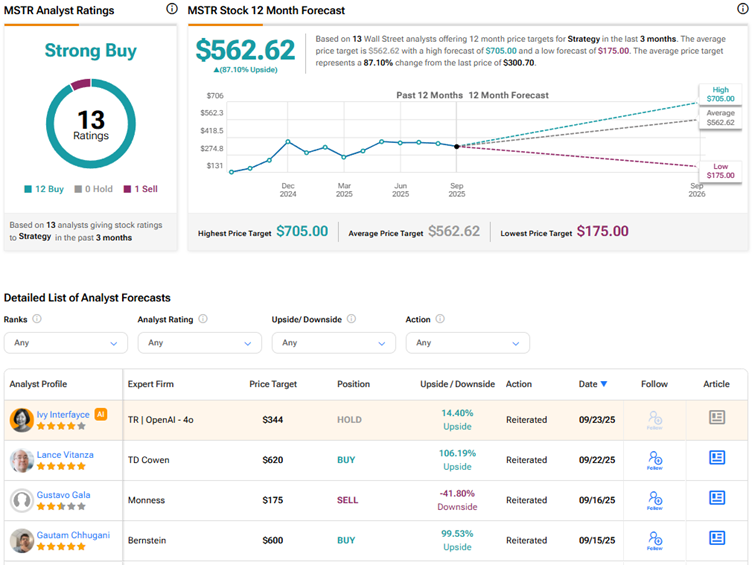

Currently, Wall Street has a Strong Buy consensus rating on Strategy stock based on 12 Buys and one Sell recommendation. The average MSTR stock price target of $562.62 indicates 87.1% upside potential from current levels.