Cipher Stock (CIFR) Rockets on Google’s 10-Year AI Hosting Megadeal - Here’s Why It Matters

Cipher Stock just caught the AI wave—and investors are riding the volatility.

The Catalyst

Google locks in a decade-long AI hosting partnership that sent CIFR shares swinging wildly. The tech giant's commitment signals massive confidence in Cipher's infrastructure capabilities.

Market Reaction

Traders piled in as news broke, creating the kind of price action that separates day traders from long-term holders. The 10-year timeframe suggests this isn't just another flash-in-the-pan tech deal.

AI Infrastructure Gold Rush

With every company suddenly needing AI capabilities, hosting providers like Cipher become the picks-and-shovels play in the digital gold rush. Google's bet acknowledges that the real money isn't in building AI—it's in housing it.

Wall Street's usual suspects will probably claim they saw this coming—right after they finish downgrading their price targets. The stock might be volatile now, but a 10-year deal in tech? That's basically a marriage.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For context, Cipher is a bitcoin (BTC) mining company that builds and operates large-scale data centers to produce new Bitcoin and support the blockchain network. Meanwhile, Fluidstack provides cloud-based high-performance computing and infrastructure services.

More Details About the Deal

As part of this deal, Google will acquire warrants for about 24 million Cipher shares, giving it roughly 5.4% ownership in the company, valued at $3 billion. Under the agreement, Google will cover $1.4 billion in lease obligations for Fluidstack, helping Cipher secure financing for the project.

The contract could grow to $7 billion if two optional five-year extensions are exercised. Meanwhile, Cipher plans to provide 168 megawatts of data-center capacity at its Lake Barber site in Colorado City, Texas, by September 2026, and will keep full ownership while raising extra funds from the capital markets if needed.

Overall, the deal positions Cipher as more than a Bitcoin miner, offering investors exposure to both AI and crypto growth.

Is Cipher Mining a Good Stock to Buy?

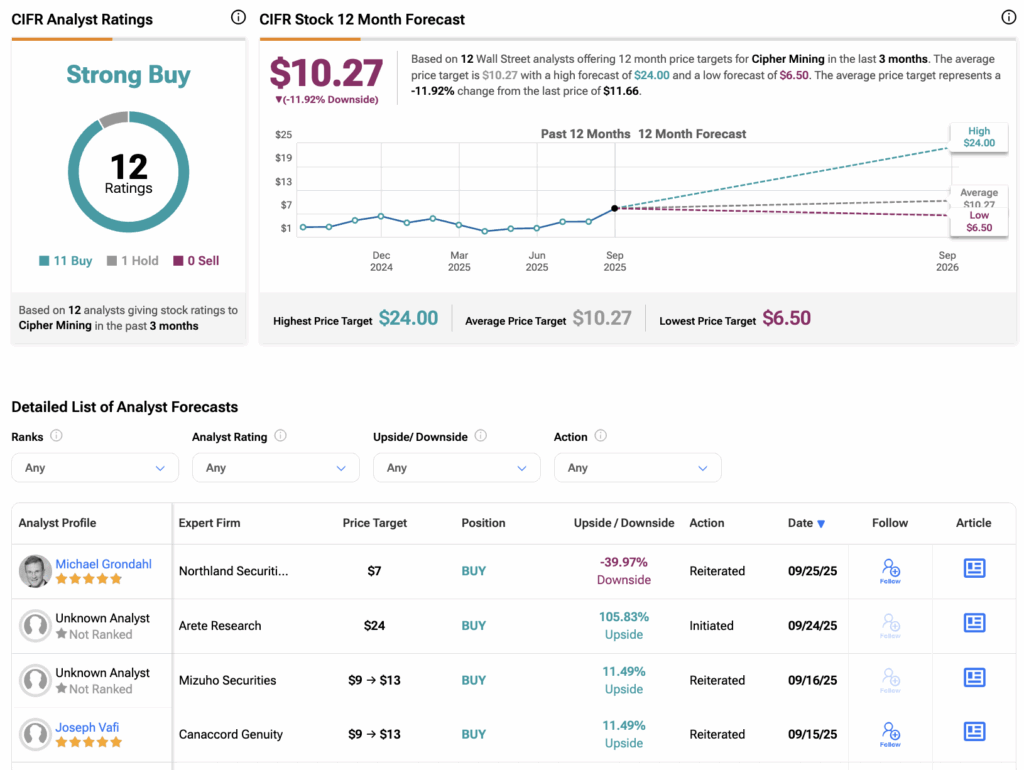

Turning to Wall Street, analysts have a Strong Buy consensus rating on CIFR stock based on 11 Buys and one Hold assigned in the past three months. Furthermore, the average Cipher Mining’s stock price target of $10.27 per share implies 12% downside risk.