Cathie Wood’s Bold Pivot: Dumping Roku and Roblox to Supercharge Arcturus Holdings

ARK Invest's chief makes power moves as portfolio strategy shifts dramatically.

Portfolio Reshuffle

Wood slashes exposure to streaming giant Roku and metaverse darling Roblox—trimming positions that once dominated ARK's flagship funds. The sell-off signals cooling sentiment toward pandemic-era darlings as growth projections normalize.

Betting Big on Biotech

Arcturus Holdings gets massive capital injection as Wood doubles down on genetic medicine. The biotech firm's mRNA platform now represents one of ARK's largest concentrated bets—a classic Cathie Wood moonshot play.

Wall Street's reaction? Typical skepticism from analysts who still don't get disruptive innovation. But when has Wood ever cared about short-term noise? Her track record of spotting paradigm shifts speaks for itself.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Notably, these trades were smaller in dollar terms than Wood’s usual bets. Her portfolio shuffle reflects a cautious stance amid recent market swings, particularly in tech stocks which have been driving volatility.

Wood Trims ROKU, RBLX Stakes

The largest trade of the day was the sale of 21,592 Roku shares worth $2.12 million by the ARK Innovation ETF (ARKK). This move is consistent with Wood’s ongoing strategy of booking profits on Roku after a NEAR 32% price rally this year. Following these sales, ROKU now ranks as the third-largest holding across ARK’s combined portfolios, with a 4.66% weighting.

Similarly, Wood reduced exposure to the gaming platform Roblox, selling 10,667 shares for $1.42 million through the ARKK ETF. Wood also sold RBLX shares worth $2.71 million earlier this week, despite Roblox’s impressive 128% gain so far in 2025.

Wood could be scaling back on these stocks as the fund is reallocating shares toward sectors with perceived higher growth potential, such as biotech, AI, and the crypto sector.

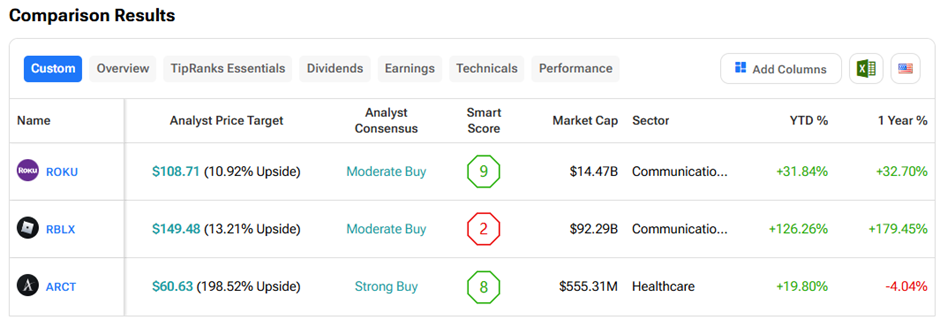

Wall Street’s Take on ROKU, RBLX, and ARCT Stocks

Wall Street’s view of Arcturus aligns with Wood’s recent purchases. Analysts have assigned ARCT stock a “Strong Buy” consensus rating, and the average Arcturus price target implies a 198% upside potential over the next 12 months.