AI Stock Showdown: Nebius Group vs. CoreWeave - Which Cloud Giant Wins?

Cloud computing's AI arms race heats up as two infrastructure titans battle for dominance.

The GPU Gold Rush

Nebius Group's European stronghold faces off against CoreWeave's specialized AI infrastructure - both betting big that the artificial intelligence boom will fuel unprecedented demand for high-performance computing. Their data centers are packed with the latest chips, positioned to capitalize on the generative AI explosion that's reshaping entire industries overnight.

Market Positioning Play

While traditional cloud providers scramble to adapt, these specialists built their entire stack around AI workloads from day one. They're not just renting compute power - they're selling rocket fuel to companies racing to deploy large language models and computer vision systems at scale.

The Bottom Line

Investors chasing AI returns face a classic growth versus specialization dilemma. One offers geographic diversification, the other pure-play AI exposure - because nothing says 'smart investment' like betting on which company can sell more virtual math coprocessors to other companies selling virtual services.

Image source: Getty Images.

CoreWeave's astounding AI ascent

CoreWeave was once focused on cryptocurrency mining. Consequently, it accumulated computing capacity before the company decided to pivot into charging for use of its AI-optimized infrastructure.

The prescient MOVE transformed CoreWeave. With organizations rushing to acquire more AI processing power, the company's second-quarter sales skyrocketed to $1.2 billion from $395.4 million last year.

Among the businesses gobbling up CoreWeave's services is OpenAI, which expanded its previous $11.9 billion commitment to $22.4 billion in September. Other marquee businesses buying up CoreWeave computing capacity includeand.

Its success led CoreWeave to forecast full-year sales between $5.2 billion and $5.4 billion. This outlook is a jaw-dropping increase from the $1.9 billion generated in 2024.

Even so, sales could rise higher. The company's remaining performance obligations as of Q2 were $30.1 billion, nearly double the $16.2 billion it had a year ago.

However, this success comes at a cost. To meet the enormous AI demand, CoreWeave invested in expanding its footprint of data centers. This resulted in operating expenses of $1.2 billion in Q2, up from $317.7 million in the previous year.

To finance its costly expansion, CoreWeave accumulated massive debt. It exited Q2 with more than $10 billion in debt on its balance sheet.

The company then added to this sum in July, when it closed a $1.8 billion senior notes offering, as well as a $2.6 billion secured debt financing facility. All of this indebtedness makes CoreWeave look like a house of cards that could collapse if it can't keep up its sales growth.

Nebius Group's AI success

Like CoreWeave, Nebius Group is a provider of high-performance cloud computing infrastructure for AI systems. So it's not surprising Nebius is experiencing a similar financial outcome to its competitor.

The company's Q2 sales soared 625% year over year to $105.1 million. Nebius is poised for further sales growth in the near future. In September, it signed a multiyear deal with Microsoft to deliver dedicated computing capacity starting this year.

And like CoreWeave, Nebius is rushing to expand its data centers. As a result, its capital expenditures ROSE 49% year over year to $91.5 million in Q2.

Nebius turned to debt to finance this expansion. It exited Q2 with nearly $1 billion in debt, a dramatic increase from a mere $6.1 million at the end of 2024. In addition, last month it closed a senior notes offering and issued more stock for a combined $4.2 billion in gross proceeds.

At this point, the company's financial position is starting to look similar to CoreWeave's. Nebius is increasing its debt load to fuel business expansion.

This volatile mix could reach a tipping point if sales slow, although given the stupendous growth the AI market is experiencing, that may not come to pass for a few years.

Weighing an investment in CoreWeave or Nebius Group stock

The current AI Gold rush has created unprecedented revenue opportunities for Nebius and CoreWeave. In the coming years, the AI industry is projected to grow from $255 billion in 2025 to an astonishing $1.7 trillion by 2031.

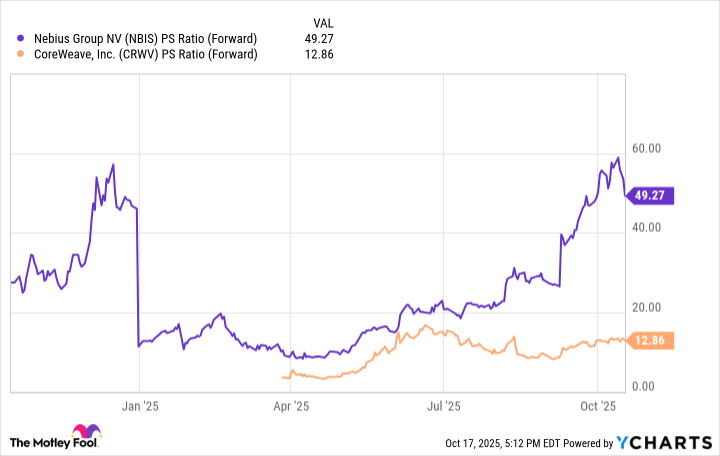

But between the two, CoreWeave looks like the better investment right now. One key factor here is share price valuation. A good way to assess this is to look at each company's forward price-to-sales (P/S) ratio.

This metric measures how much investors are prepared to pay for every dollar of projected revenue over the next 12 months. Given the impending income from Nebius' deal with Microsoft, understanding how these future sales might impact stock value is particularly insightful.

Data by YCharts.

The chart reveals CoreWeave has a substantially lower P/S multiple, indicating it is the better value. That said, neither stock is cheap.

Moreover, since both are piling up on debt to fuel sales growth, this risky situation means CoreWeave stock isn't for the faint of heart. Consider an investment only if you have a high risk tolerance, and ideally, after the stock price dips.