Billionaires Are Loading Up On This AI Stock That Could Skyrocket to $10 Trillion Market Cap

Wall Street's elite are placing massive bets on artificial intelligence's next trillion-dollar winner.

The AI Gold Rush Heats Up

While retail investors chase meme stocks, billionaires are quietly accumulating positions in what could become the world's first $10 trillion company. The smart money sees AI as more than just hype—they're betting it will reshape entire industries.

Numbers Don't Lie

$10 trillion represents nearly 40% of the entire S&P 500's current value. That's not just ambitious—it's revolutionary. Yet somehow traditional analysts still call crypto valuations 'unrealistic.'

This isn't just another tech play—it's a fundamental shift in how value gets created in the digital age. The billionaires got it right with Amazon and Tesla. Now they're doubling down on AI's transformative potential.

Image source: Getty Images.

Why follow the billionaires?

So, first, a quick note on why we're interested in a stock that's popular with billionaires. The answer is simple. These investors have proven their ability to identify winning stocks over many years, and that means it's reasonable to take a look at their latest moves. Some of these investment decisions might not be right for all of us -- for example, if you're a cautious investor, you may not want to follow a billionaire into a risky recovery story. But, if the billionaire's choice suits your investment style, then you might want to give the particular stock a try.

Now, let's consider the latest moves of Tepper, Platt, and Laffont. You may know Tepper best as the owner of the National Football League's Carolina Panthers, but as founder of Appaloosa, he also oversees $6.4 billion in 13F securities across industries. Platt, at the head of BlueCrest, Europe's third-largest hedge fund, manages $2.6 billion. And Coatue's Laffont, who heavily invests in technology, oversees $35 billion in 13F securities. (Investors of more than $100 million must report trades in these securities on a quarterly basis to the Securities and Exchange Commission on FORM 13F.)

From $4 trillion in market value to $10 trillion

Each of these investors bought shares in AI chip giant,(NVDA -0.31%), in the recent quarter -- a company that soared past the market value of $4 trillion this year to become the world's biggest company, and my prediction is it may be on its way to $10 trillion by the end of the decade.

- Tepper increased his position in Nvidia by 483% to 1,750,000 shares, and it now makes up 4.2% of his portfolio.

- Platt opened a position in the chipmaker and now holds 649,956 shares -- that's 3.9% of his portfolio.

- Laffont increased his Nvidia holding by 34% in the quarter and now owns 11,488,529. That's 5% of his portfolio.

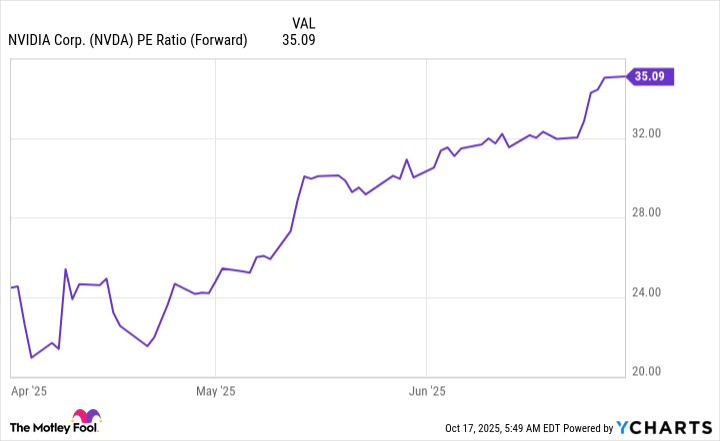

These investors may have taken advantage of Nvidia's dip in valuation in the second quarter of the year. At certain points during that period, the stock traded for less than 24x forward earnings estimates -- a dirt cheap level for a company at the heart of the AI growth story.

NVDA PE Ratio (Forward) data by YCharts

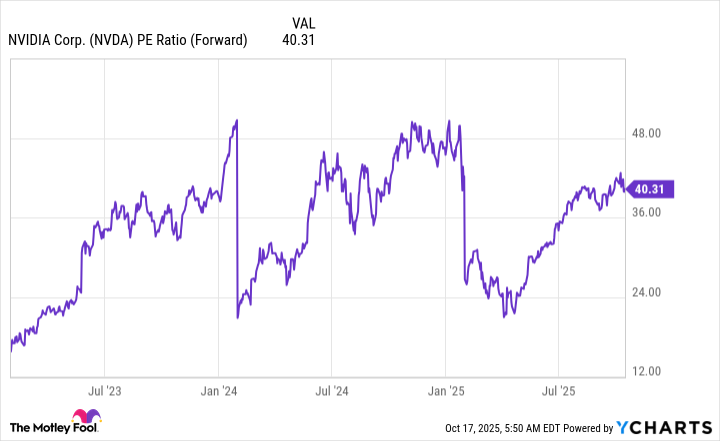

Since that time, Nvidia's valuation has climbed quite a bit -- it now trades for 40x forward earnings estimates, so it's not as much of a bargain, though it is cheaper than it was a year ago.

NVDA PE Ratio (Forward) data by YCharts

Is this the right stock for you?

So, should you follow the billionaires into Nvidia today? It's true that this spring was a fantastic time to get in on this growth story on the dip, but this doesn't mean it's now too late to invest. It's important to remember that Nvidia's well-positioned to gain amid the AI infrastructure scale up happening now through the end of the decade. As customers need compute, they turn to Nvidia's top graphics processing units (GPUs) -- the chips powering AI tasks.

And, in investing, it's key to select companies that offer potential for gains over the long term so that you can buy and hold on for at least five years. Considering Nvidia's prospects in the AI market, even a purchase of the stock at today's price could result in great rewards for you over time. Since Nvidia is an established player generating significant earnings growth, it makes a solid investment for both cautious and aggressive investors, as long as it's part of a well-diversified portfolio.

All of this means that it's a great idea to follow the billionaires into this company that could be worth $10 trillion just a few years down the road.